Homepage / Buying Guides: Silver Guide

Silver Bullion Buying Guide

with a list of Reputable

Silver Bullion

Dealers

Silver's Two Purposes

in the Monetary Markets

Silver's primary role in the monetary market is as a store of value as an safe haven metal.

As a monetary metal, silver shares the same asset principles that gold possesses.

Gold and Silver are 'de-centralized' forms of money, they have no liabilities and they will never be worth zero.

This is the greatest monetary reason individuals should purchase precious metals because they protect wealth, great and small.

Silver's other monetary role is as an investment asset.

All investor's invest in an asset to receive the greatest return and it is for this reason alone that silver bullion is a greater investment asset than gold, platinum, or palladium bullion.

Silver possesses this investment power because of its value, and it has the potential to rapidly move higher by percentage points than the other precious metals.

It is this investment property that allures many investors who are willing to brave the risk to receive the reward.

The rest of this page will help you learn more about how silver serves as an investment asset.

In addition, this link to this guide's Gold Buying Guide page will help you understand how gold and silver serves, its primary role, as monetary insurance a.k.a. Safe Haven Asset.

Free Shipping on Orders $199+ | 5.0 star Customer Reviews

Understanding the

Gold to Silver Ratio

Silver is known as the "Poor Man's Gold", but for many of those who invest in physical silver bullion, they consider Silver to be the "Smart Investors Gold."

The reasons behind silver's 'Poor Man's' label is this simple truth; Silver is priced less than gold and other precious metals.

This fact doesn't devalue silver's relationship to other precious metals, it simply states the obvious, that silver is more affordable.

For those who want to invest in silver to receive the greatest return, want to watch the Gold to Silver Ratio.

When the Gold to Silver ratio is above 65, silver has the greatest possibility of multiplying in price.

A reading of '65' in the Gold to Silver ratio means that it takes 65 ounces of Silver to be equal in price to 1 ounce of Gold.

In monetary comparison, from 1100 A.D. (12th Century) to 1700 A.D. (18th Century), the Gold to Silver Ratio was as low as 12 to 1.

The 2014 mining ratio of the Gold to Silver ratio - measures to be about 8.3 to 1. (8.3 oz. of silver mined to 1 oz. of gold mined)

If the 12 to 1 ratio were true today, the price of silver would be over $100.00 an ounce, or if silver traded near the mined gold to mined silver ratio, silver's price would be between $120 to $150.00 a troy ounce.

A few other reasons behind silver's

capacity to multiply have to do with the size of the physical silver

market, it is extremely small in comparison to other investments.

In physical terms, each year, nearly one billion ounces of silver are mined and traded.

That makes the physical silver market equal in size to just One Large-Cap Stock. (Over $10 Billion in market capitalization)

On the other hand, silver's paper market is much larger, in 2014, Bloomberg valued the paper market of Silver around $5 trillion (see article here).

Furthermore, Silver's paper to physical silver ratio sits around 250 to 1, meaning that for every ounce of physical silver, there are 250 ounces of paper silver. (paper silver = silver futures contracts)

"If the price of silver were based directly on the real physical silver market, silver’s price should be at $5,000 an ounce." - Gold Broker

SD Bullion - 4.8 star Customer Reviews

Silver's Volatile Market

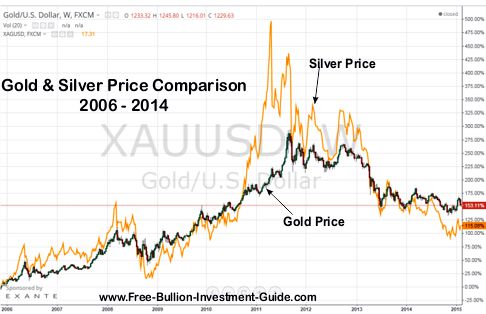

The chart below offers you a glimpse of silver's volatile market, in relation to the gold market.

The gold and silver markets react to different variables, Gold acts more as a currency than a commodity, in addition, gold is known more as a safe haven currency, than silver.

Silver is also a safe haven, as mentioned above, however, silver has more industrial uses and trades more as an industrial commodity, than it does a safe haven currency, in the markets.

chart photo courtesy of TradingView.com

Violent fluctuations in some markets are unusual, but in the Silver Market, it is the norm.

If you choose to purchase silver as an investment vehicle, the volatility in the Silver Market should be known and expected.

Patience is required if you

choose to invest in silver bullion because the violent swings in price can cause anxiety.

Investors who want to buy silver, should follow the silver market and understand what causes these fluctuations in price.

Bullion Market News is posted daily, on the Guide's homepage, to help you better understand the ups and downs in the silver market.

In addition, the news on the homepage is there to help you decide when to buy, hold or sell precious metals bullion.

List of Reputable

Silver Bullion Dealers

Note: As a suggestion to anyone interested in buying bullion from any one of the sites listed below, Please Read each company's ordering instructions and shipping rules carefully.

(Silver Bullion link)

"BGASC" is a acronym for "Buy Gold And Silver Coins" they are a Precious Metals Dealer based in California, and is one of the largest coin and bullion dealers in the United States.

Buy Gold And Silver Coins.com's goal is to be the kind of dealer they've always wanted to trade with: to be in stock, ship fast, be fair & reasonable, and operate honestly and efficiently.

They are an Official PCGS Dealer, member of the Certified Coin Exchange (CCE), an NGC Collector's Society Member, and a Bulk Purchaser of United States Mint non-bullion coins.

Every single package they ship is sent fully insured for its time in transit. Customers all across the country have quickly come to recognize BGASC as one of the fastest, and most trusted online precious metals suppliers in the U.S.

_______

Free Shipping on Orders $199+

Money Metals Exchange

Stefan Gleason is president of the Money Metals Exchange, which is a national precious metals investment company and news service with over 500,000 readers and 75,000 customers.

Gleason founded the company in 2010 in direct response to the abusive methods of national advertisers of collectible, and numismatic coins.

Money Metals Exchange believes the average investor should never purchase precious metals that are not priced at or near their actual melt value.

Now you can safeguard your assets from financial turmoil and the devaluing dollar – without paying costly middleman mark-ups or fending off high pressure, bait-and-switch sales tactics.

Savvy, self-reliant investors are embracing Money Metals Exchange as their trustworthy resource for gold and silver bullion.

_______

Free Shipping on Orders $199+

BBB - Customer Reviews

SilverGoldBull

SilverGoldBull.com provides you with competitive, up-to-minute pricing and we make sure your precious metals are delivered to your door discreetly and fully insured.

SilverGold Bull's in-house customer service representatives will work to assure your satisfaction in a timely, friendly, and professional manner. Never hesitate to get in touch - building relationships with our clients is our number one priority.

If you would like to learn more about what our customers are saying about our service, please view our customer reviews (below).

SilverGoldBull has tens of thousands of satisfied customers who have taken their financial future into their own hands by investing in gold and silver.

This bullion dealer is based in Canada and offers a wide variety of precious metals bullion for you to choose from, their commitment to you is to provide extraordinary service throughout your bullion buying experience.

_______

Free Shipping on Orders $199+

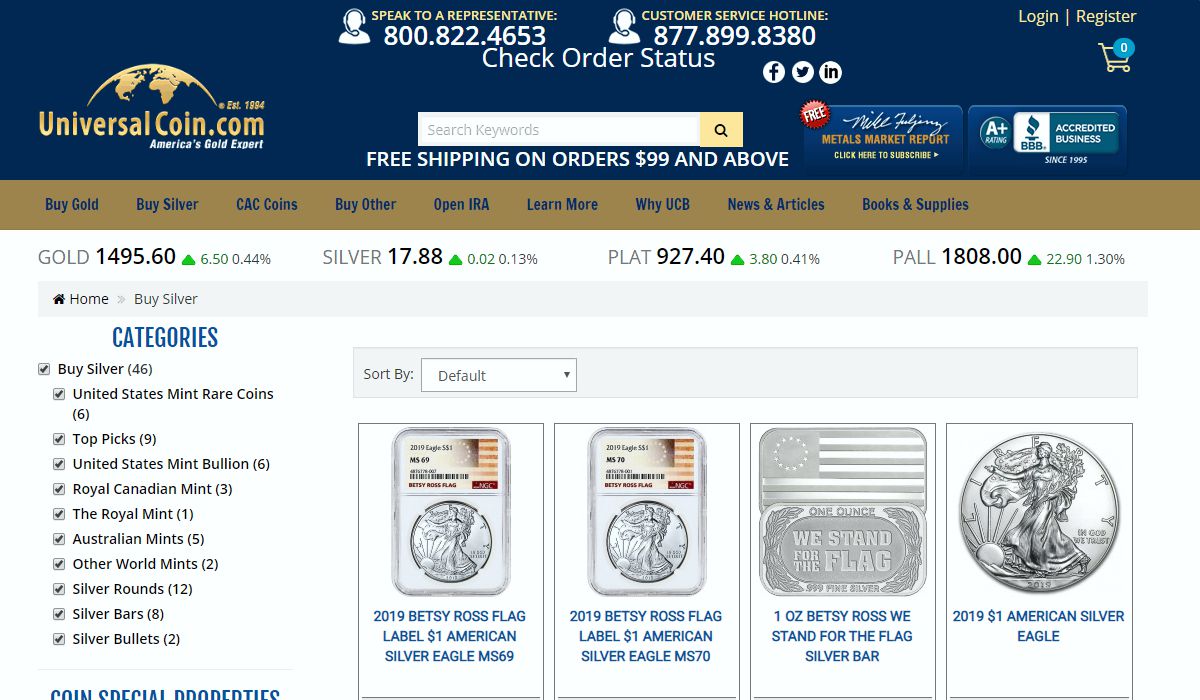

Universal Coin

Universal Coin & Bullion is dedicated to providing clients with outstanding collecting and investment strategies for the rare coin market.

Universal Coin & Bullion specializes in U.S. rare coins, Precious Metal IRAs and Gold, Silver and Platinum American Eagles, their acquisition and Expert Buying Team has been building premium collections and providing appraisal services to clients since 1995.

Universal Coin & Bullion® President, Dr. Michael Fuljenz has won more than 60 prestigious national and regional awards for his consumer education and protection work in rare coins and precious metals.

Universal Coin & Bullion, Better Business Bureau Accredited since 1995.

_______

Silver, Gold, and Platinum

Bullion Broker &

Storage

Bullion Vault

|

BullionVault is the world's largest online bullion investment service taking care of $2 billion for more than 75,000 users. The bullion you own is held in vaults. Bars are stored in professional-market vaults in Zurich, London, Toronto, Singapore or New York. You choose where. Because of their size, you benefit from the low storage costs they've negotiated, which always include insurance. |

with Bullion Vault |

The video below goes into further detail about Bullion Vault's services.

Bullion Vault - Customer Review Links

4.7 star Customer Reviews

Bullion Buying Guides

Other pages you may like...

| br | br |

Silver Bullion Buying Guide page

Visit the Bullion Dealers page

OR

For the Best Bullion Market News...

|

Support this Guide & Paypal Thank You for Your Support |

|

|

| |||||

Free Bullion Investment Guide

Keep this Guide Online

& Paypal

Thank You for

Your Support

Search the Guide

| search engine by freefind | advanced |

Daily

Newsletter

Mintages

for

2024

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

2025

Gold & Silver Chinese Panda

|

Silver Panda |

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

March's

All Articles were Originally Posted on the Homepage

5.0 Customer Reviews

ExpressGoldCash - 4.9 star Customer Reviews