Homepage / Bullion Coins: Austrian Coins

Last Updated on 10/25/2025

The Austrian Mint &

Austrian Bullion Coins

The History of the Austrian Mint

Austria's First Silver Coins

The Austrian Mint was established in 1194 when an Austrian Duke was paid half of a ransom for an English King's freedom from a German King in the form of 75,000 silver marks (50,000 pounds of silver).

The story goes like this, King Richard I of England, known as Richard the Lionheart, and Duke Leopold V of Austria, whose armies had taken part in battle together a few years earlier in the Siege of Acre during the Third Crusade, had a falling out and a ransom was put on Richard I.

Shortly after the dispute, Richard I, while on his way home from the Holy Land, had no choice but to travel through Austria to get home, so he disguised himself as a pilgrim to keep from getting recognized by Austrian authorities.

Unfortunately for Richard, he was recognized (supposedly because of his signet ring) and detained in the Vienna suburb of Erdberg, not far from where the Austrian Mint is today. Duke Leopold V kept Richard I of England captive in Dürnstein Castle along the Danube River until he handed his hostage over to King Henry VI of Germany, Holy Roman Emperor.

Henry VI (King of Germany) sought a ransom of 150,000 silver marks (100,000 pounds of silver) for Richard's release. When the ransom for Richard I's freedom was paid, half was given to Duke Leopold V, who chose to have a portion minted into silver coins; for this purpose, the first Vienna Mint was built, from which the Austrian Mint emerged 800 years later.

Raising the ransom money was one of the most spectacular monetary undertakings of the 12th century, showcasing England's affluence. Today, the value of this silver is estimated at over 3 billion euros (€).

Changing Locations

Following its founding, the Vienna Mint built several satellite facilities in cities and towns around Austria, including Graz, Krems, Salzburg, Innsbruck, and Villach.

However, since its inception, the Austrian Mint has always had its headquarters in Vienna; it has simply relocated to different parts of the city.

The Vienna Mint's headquarters was originally located near the Hoher Markt; then, in 1371, the Mint moved its headquarters to Wollzeile (left), where it stayed for more than 350 years. (Photo provided by Werner Wunderl)

In 1752, the Vienna Mint moved to Prince Eugene's former winter palace in Himmelpfortgasse; then, in 1834, Emperor Franz I ordered the construction of the mint house on Heumarkt, which remains the Mint's administration and production site to this day.

In 1918, the Vienna Mint closed its satellite mints scattered around the country after the formation of the Republic of Austria, while its headquarters in Vienna became the country's sole Mint.

In 1989, the Mint of the Republic became the Austrian Mint (MÜNZE ÖSTERREICH AG) as a subsidiary of the Oesterreichische National Bank.

History of Minting Techniques

Minting Techniques used by the Austrian Mint over the centuries.

12th century to 16th century

- Hammer minting & Roller minting

17th century

- Pocket minting (a mixture of roller and stamp minting)

18th century

- Spindle press

19th century

- Toggle press

The electric motor replaced water and steam drives in 1907.

The modern minting machines in the early 1960s could produce up to 300 coins per minute, an output that has been increased to 750 per minute on today's high-tech machines. (Roller Minting Machine photo provided courtesy of Mateus2019)

The Austrian Mint's Historic Coins

The Ducat

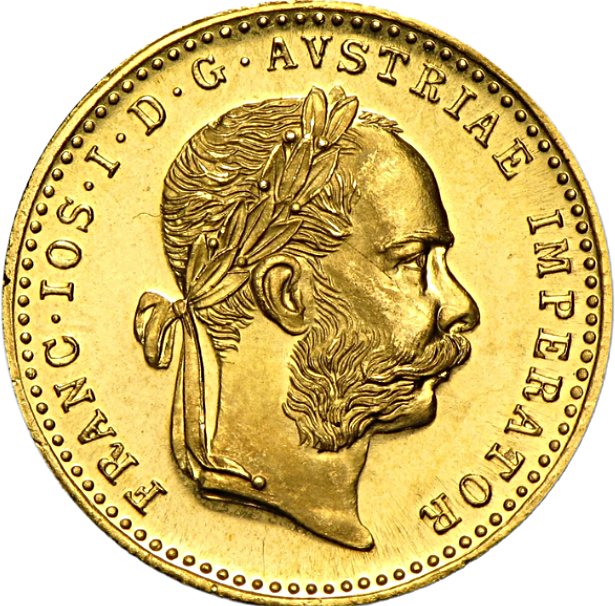

Originating in Italy in the late 13th Century, the Ducat became one of the world’s most widely accepted gold coins. Austria began to mint gold and periodically silver Ducats in the 1500s as legal tender.

The Austrian Ducat lost its legal tender status in 1857, but that didn't stop the Austrian Mint; it continued to mint the gold Ducat for trade through 1915 and continues to mint it for investors and collectors.

The obverse of the 1915 Ducat gold coin features the bust of Emperor Franz Joseph I, who ruled the Austro-Hungarian Empire for 68 years, one of the longest reigns for a monarch in modern history.

The reverse of the gold Ducat displays the Austrian Coat of Arms above the double-headed imperial eagle.

Today's Austrian Gold Ducats are re-strikes dated 1915, and all Ducats have a gold purity of 98.60%. The Austrian mint produces re-strikes of 4-Ducat gold coins that weigh 13.96 grams and 1-Ducat gold coin weighing 3.49 grams.

The Maria Theresa Thaler (MTT)

|

The Maria Theresa thaler (MTT) is a silver bullion coin and a type of Conventionsthaler that has been used in world trade continuously since it was first minted in 1741. The coin is named after Maria Theresa, who ruled Austria, Hungary, and Bohemia from 1740 to 1780, the year she died. Maria Theresa succeeded her father, Charles VI, as Empress; she

successfully defended her kingdom against the War of Austrian

Succession.

The obverse side of the silver coin features the Empress in her later years, and the reverse side displays Austria's Imperial Crown flanked by a pair of eagle heads above a shield covered in different Austrian Coats of Arms. The Austrian Mint has continuously re-struck Maria Theresa thalers since 1857 with the date of 1780, memorializing the Empress's year of death. |

|

Maria Theresa thalers became the official trading coin in most German-speaking countries and the only currency in some countries during World War II.

The Maria Teresa silver bullion coin is 42mm in diameter, contains 23.39 grams (0.752 troy ounces) of fine silver, and has a total weight of 28.0668 grams. The Maria Teresa bullion coin has a silver content of 833.0 in millesimal fineness or 83.30 percentile fineness with the remnants being of copper.

Under the "Mint Act of 1792," the early United States adopted the Austrian Thaler as the foundation for the silver dollar; in fact, the term "dollar" comes from the German/Austrian word "Thaler."

Today's Austrian Mint

(Münze Österreich)

Today, the mint produces all euro coins for the Republic of Austria.

The Austrian Mint (Münze Österreich) is known internationally for its precious metals refining by providing blanks to many worldwide mints, while offering world-class minting facilities by producing some of the world's best-selling bullion and collector coins.

The Austrian Mint produces Austrian bullion coins, also known as the Austrian Vienna Philharmonic bullion coins. Since their introduction, the Philharmonic Gold bullion coin has become one of the world's bestselling bullion coins.

With more than 800 years of history behind it, the Austrian Mint is nestled in the heart of Vienna. Based on centuries of experience, the Austrian Mint has the technical and commercial expertise for today and tomorrow.

Source: The Austrian Mint

Bullion Coin Values

|

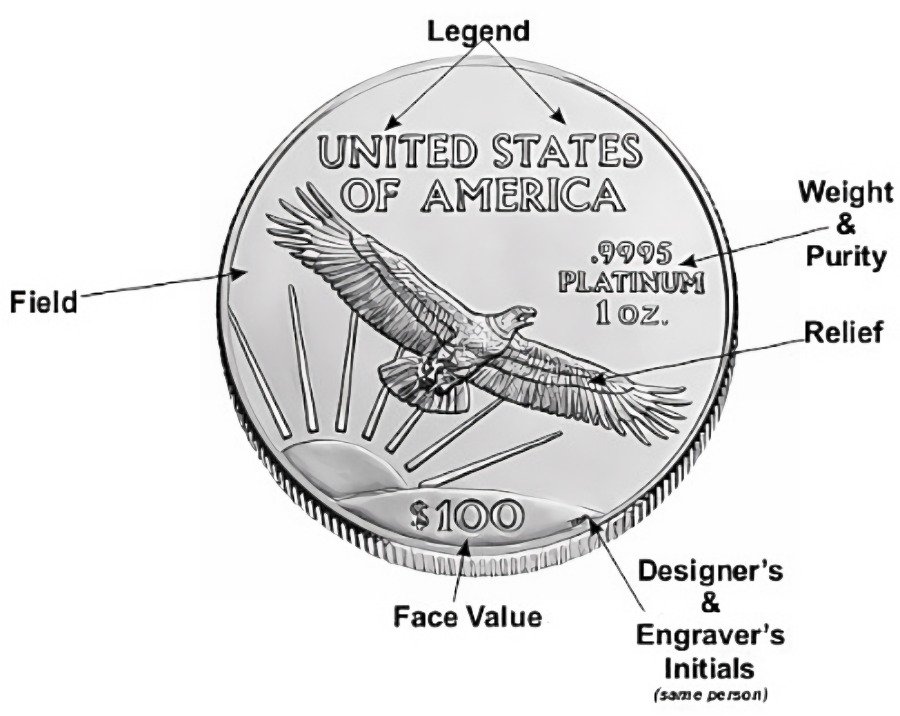

The "Face Value" of a bullion coin does not represent the 'intrinsic value' of coins. For instance, the 'face value' of a 1 oz Vienna Philharmonic silver bullion coin is 1.50 euros (€), whereas the 'intrinsic value' of the coin is the current spot price of silver plus a premium to cover minting, handling, distribution, and marketing costs. Austrian Philharmonic Gold, Silver, and Platinum Bullion coins are known for having one of the lowest premiums among investment bullion coins. |

|

Austrian Vienna Philharmonic

Gold Bullion Coins

1989 - Present

|

1 oz. Austrian Philharmonic Gold 1/2 oz. Austrian Philharmonic Gold 1/4 oz. Austrian Philharmonic Gold 1/10th oz. Austrian Philharmonic Gold |

Austrian Vienna Philharmonic

Silver Bullion Coins

2008 - Present

1 oz. Austrian Philharmonic Silver Bullion Coin

Austrian Vienna Philharmonic

Platinum Bullion Coins

2016 - Present

1 oz. Austrian Philharmonic Platinum Bullion Coin

1/25 oz. Austrian Philharmonic Platinum Bullion Coin

Other Pages you may like...

|

|

|

|

|

|

Free Shipping on Orders $199+

Austrian Mint and Austrian Bullion Coins

For the Best Bullion Market News...

Notice:

The charts, commentary, and information on the Free-Bullion-Investment-Guide.com are in no way an endorsement of how you should invest or divest.

|

Support this Guide & Paypal Thank You for Your Support |

|

|

| |||||

This website is best viewed on a desktop computer.

Keep this Guide Online

& Paypal

Thank You for

Your Support

with Feedly

Search the Guide

| search engine by freefind | advanced |

Premium Canadian Bullion

Give a lasting gift of the iconic Silver Maple Leaf bullion coin [More]

Free Shipping on Orders over $100 (CDN/USA)

or

From the U.K. Royal Mint

Daily

Newsletter

Updated Mintages for

American Gold Buffalo

American Gold Eagle

American Silver Eagle

2024 & 2025

Jerusalem of Gold Bullion

Coin photos

(bottom of page)

Mintages

for

2024

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

Last Month's

In No Particular Order

January 2026

All Articles were Originally Posted on the Homepage