Homepage / Bullion Investment Basics: Graded Coins

Last Updated on 06/17/2024

Graded Coins

A Guide for the Bullion Investor or Collector

The Sheldon Scale for Graded Bullion Coins

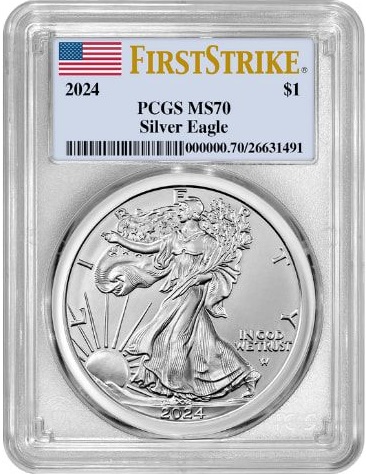

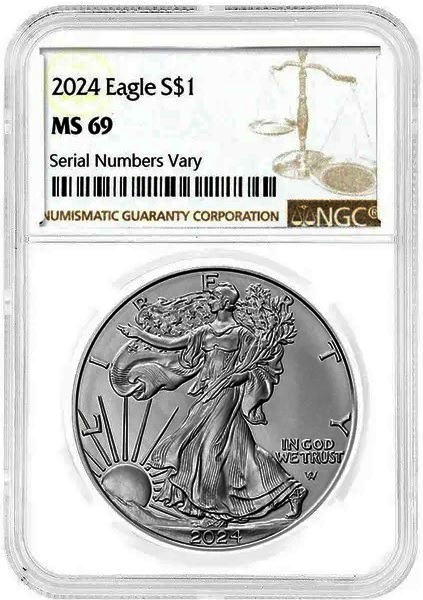

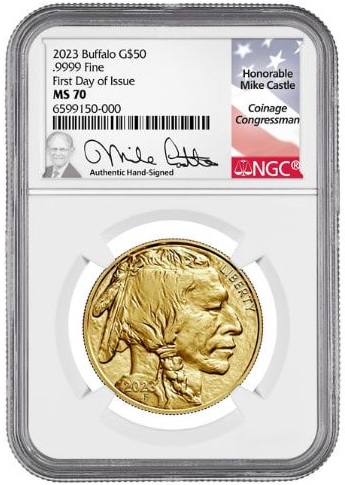

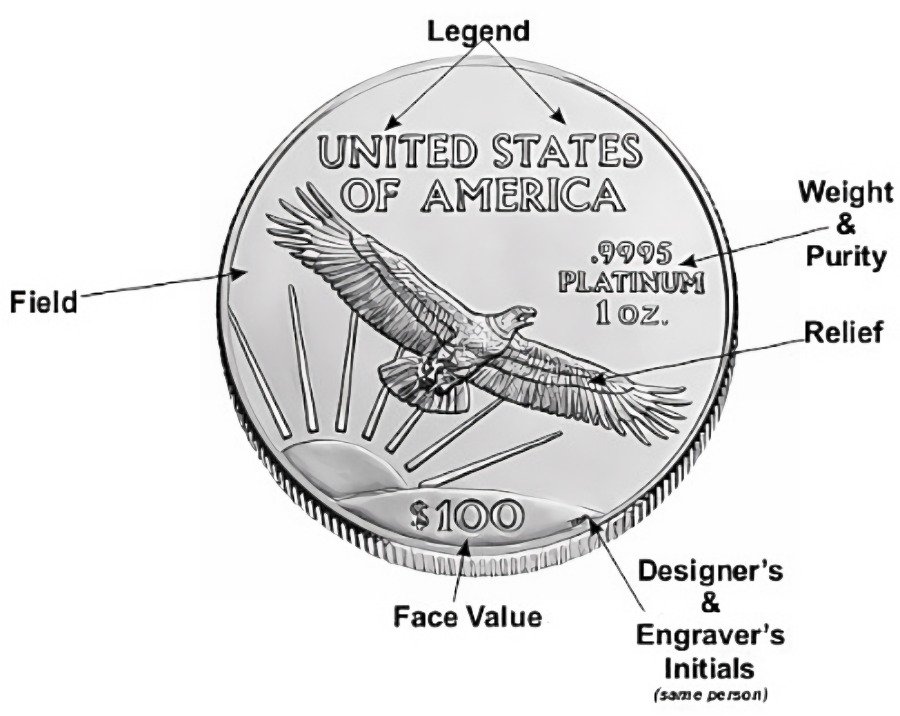

"Graded Coins" are coins certified by a grading service, encased in sonically-sealed protective plastic called "coin slabs," indicating their physical condition and appearance.

The most important thing to know about Graded Coins is what determines its value. Numismatic grading services use the Sheldon Scale to determine a coin's quality.

The Sheldon Scale has become an industry standard after William Sheldon, a numismatist, created it for grading coins in the late 1940s.

The Sheldon Scale is a widely used tool in the coin industry, aiding dealers, collectors, and investors in accurately assessing the grade of coins.

Investors looking for graded bullion coins with the best investment value only need to concern themselves with the higher grades of the Sheldon Scale because most bullion coins with a grade lower than MS-60 aren't worth much more than its precious metal's spot price.

- Mint State (MS) - Uncirculated Coins are struck in the same format as circulation coins but never circulated. A Mint State coin can range from one covered with marks (MS-60) to a flawless example (MS-70).

The following five grades are not part of the Sheldon Scale but are commonly used to grade bullion coins; however, the Sheldon Scale equivalences are provided.

- Brilliant Uncirculated (BU) - The coin has a below-average strike with several abrasions and large scratches; its grade is comparable to coins graded MS60 to MS62.

- Choice BU - The coin has an average strike; it has many surface marks and imperfections in different sizes. The grade is equivalent to coins graded MS63.

- Select BU - The coin has a slightly better-than-average strike but has hairline marks and minor flaws; its grade is equivalent to MS64.

- Gem BU - A coin with a good strike. The coin has minor marks and scratches while retaining luster; its grade is equivalent to MS65.

- Superb BU - A well-struck coin with very minor imperfections, the imperfections should be hard to see with the naked eye, and this coin should have luster. Comparable grades are MS66 and MS67.

Click here for more information about the BU grading designation from PCGS.

- Near Choice Uncirculated (MS-68) - An Uncirculated coin very sharply struck with few slightly visible imperfections. No scuff marks show on the surface of the coin.

- Choice Uncirculated (MS-69) - A fully-struck coin with microscopic imperfections under examination. A tiny imperfection may be able to be viewed with the naked eye.

- Perfect Uncirculated (MS-70) - The finest quality uncirculated coin, showing no marks, blemishes or wear. A coin with no post-production imperfections at 5x magnification. Coins with this grading are of the finest quality and garner the highest prices.

Third Party Coin Grading Services and their Premiums

There are five well-known and respected coin grading services that investors look for when they want to purchase a graded coin.

The Top Grading Services are:

PCGS (Professional Coin Grading Service) Established in 1985, PCGS experts work independently in a controlled environment that provides optimum conditions for studying the characteristics and physical condition of each coin. A series of graders enter independent determinations into a computer database until a consensus is reached and the final grade is assigned. PCGS-graded coins are known for their accurate grades and receive high premiums

NGC (Numismatic Guaranty Corporation) Established in 1987, NGC strives to ensure impartiality and accuracy by having three numismatic experts evaluate each coin submitted for grading, a grading finalizer assigns a final grade to the coin. NGC-graded coins are trusted for their accurate grades and receive high premiums.

ANACS (American Numismatic Association Certification Service) Established by the ANA (American Numismatic Association) in 1972, ANACS is considered the third leading service and is credible; however, their graded coins do not carry the market acceptance or value of PCGS or NGC-graded coins.

ICG (Independent Coin Graders) Established in 1998, ICG-graded coins are evaluated by at least two ICG expert graders, with additional examination if necessary, and a final grade is assigned when a consensus is reached.

CAC (Certified Acceptance Corporation) was founded in 2007 as a company that re-certified NGC and PCGS coins to ensure their quality. In 2022, CAC formed a Grading Service by those in the numismatic community who originally founded the company in 2007 to establish stringent standards with a level of expertise for every submitted coin.

_______

In 2007, the Professional Numismatists Guild (PNG) published a report about grading services and standards.

The survey indicated the professional opinions of numismatists who buy and sell coins. No grading service was listed as "outstanding," PCGS and NGC were ranked as "superior," and ANACS and ICG were ranked as "good."

Turning an Investment Coin

into a Collectable

Government mints that produce bullion coins for the general public

offer them in three versions: bullion coins for investors, proof, and

uncirculated bullion coins for collectors.

Proof (mirror-like) and uncirculated (matte, satin, or burnished) bullion coins are specifically made for collectors, struck with special dies, with limited mintages, and sold individually in a box with a certificate of authenticity.

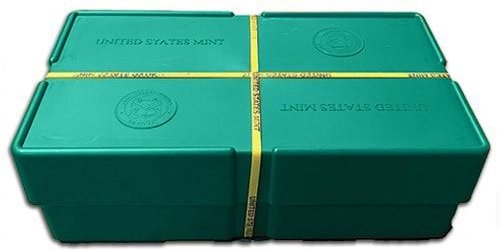

On the other hand, bullion coins for investors are mass-produced and stored in coin tubes inside large plastic boxes known as "Monster Boxes." In general, bullion coin prices are based predominately on their precious metal content, with some exceptions.

Because bullion coins are made and handled in this manner, many of them have imperfections that are too small for the human eye to detect; however, when graded under a magnifying glass, many will receive a BU grade, MS-68, or MS-69 with even fewer receiving an MS-70 (perfect) grade.

Grading a bullion coin turns an investment coin into a collectable.

However, depending on its condition and year of issue, an ungraded bullion coin becomes more collectible as it ages, and the premium it receives rises accordingly.

Premiums on

Graded Bullion Coins

Premiums on graded coins aren't only based on the grade; premiums are also subject to which third-party grading service examines the coin.

Coins graded by PCGS or NGC attract higher premiums than coins graded by other grading services.

Another important notable investors will regularly see when investing in graded bullion coins is that the lower the spot price of the bullion coin, the higher the premium.

For example, a 1oz silver or fractional-sized gold, platinum, or palladium-graded bullion coin will have higher percentage premiums than a 1oz (or larger) gold, platinum, and palladium-graded bullion coin.

BU, MS-68, MS-69

Premiums on ungraded bullion coins vary from 5% to 30% over the metal spot price (or intrinsic value), depending on the type of precious metal used to mint the coin.

BU (Brilliant Uncirculated), MS-68, or MS-69 bullion coins frequently command premiums ranging from 20% to 80% above the coin's intrinsic value.

This may seem costly to some, but when compared to the collector's version of the identical bullion coin, premiums on these near-perfect graded coins range from 30% to 120%(+) above their spot price.

Note: If the bullion coin has a low mintage or some other collectible abnormality, it may garner higher premiums. An example of a low-mintage bullion coin is the Mexican Gold and Silver Libertads.

MS-70

MS-70 is a perfect grade for a coin; it has no post-production imperfections at 5x magnification.

To find a perfect bullion coin is similar to finding a needle in a haystack; you'd think they would receive extremely high premiums, but that isn't the case. Compared to lower-graded bullion coins, they have high premiums, but compared to the collector versions of the coin, the premiums usually pale in comparison.

MS-70 graded bullion coins regularly command premiums ranging from 10% to 300%(+) above the coin's precious metal spot price.

In contrast, a collector's version of the same bullion coin with a flawless grade may command premiums ranging from 100% to 1000% or more over the spot value of the coin's metal content.

Limited Edition Labels on Graded Bullion

The First Strike, First Day of Issue, and Early Release labels boost the premiums on graded bullion coins, while signed limited edition labels significantly enhance their value.

Some of the signed names on these coins include Congressman Mike Castle,

John Mercanti, who was the 12th Chief Engraver at the United States

Mint, Edmund Moy, a former director of the United States Mint, and Emily

Damstra, who is a Master Designer at the United States Mint.

Signatures of celebrities and sports personalities can also be found on these graded coin slabs, increasing their premiums dramatically.

Reputable

Graded Coin Dealers

Free Shipping on Orders $199(+)

Better Business Bureau Reviews

Free Shipping on Orders $199(+)

Free Shipping on Orders $199(+)

|

|

PCGS Silver Bullion Coins PCGS Platinum Bullion Coins PCGS Palladium Bullion Coins |

Free Shipping on Orders $199(+)

The Royal Mint - Delivery Rates ($)

Shipping Fees vary by item

|

|

CAC Silver Bullion Coins CAC Silver Bullion Coins CAC Silver Bullion Coins |

BGASC - Customer Reviews - 4.8 stars

Other pages, on this Guide, that you

may like...

|

|

|

Graded Coins

For the Bullion Market News...

|

Support this Guide & Paypal Thank You for Your Support |

|

|

| |||||

Free Bullion Investment Guide

Keep this Guide Online

& Paypal

Thank You for

Your Support

Search the Guide

| search engine by freefind | advanced |

Daily

Newsletter

Mintages

for

2024

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

2025

Gold & Silver Chinese Panda

|

Silver Panda |

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

March's

All Articles were Originally Posted on the Homepage

18W LED Security Light (Dusk to Dawn & Motion Sensor) - $32.99

from:

LED Lighting

LED Lighting