Homepage / Bullion Coins: U.S. Mint and U.S. Bullion Coins

Updated on 02/18/2024

U.S. Mint &

U.S. Bullion Coins

The U.S. Mint, along with its satellite branches in West Point, San Francisco, and Philadelphia, is responsible for producing all Gold, Silver, Platinum, and Palladium American Eagle bullion coins.

To provide maximum availability to the public, the United States Mint distributes US Bullion coins to a network of wholesalers, brokerage companies, precious metal firms, coin dealers, and participating banks known as the "Authorized Purchasers."

The U.S. Mint does not sell any bullion coins directly through its website.

The United States Mint also produces all commemorative and collector coins and all the circulated coins used by Americans in everyday life; you can purchase these coins directly through the U.S. Mint's Website or from a reputable dealer.

The History of the US Mint

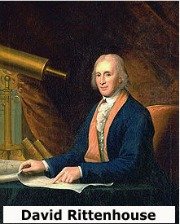

First Director of the US Mint

Nine years after the United States won its Independence from Britain and the ratification of the U.S. Constitution, the Secretary of the Treasury, Alexander Hamilton, prepared plans for a National Mint.

After the U.S. Congress passed the Coinage Act of April 2, 1792, President George Washington appointed David Rittenhouse, the former treasurer of Pennsylvania, to be the first Director of the United States Mint.

David Rittenhouse was also a celebrated astronomer and philosopher; his initial salary was $2000.00 a year. His achievements readily place him in the same distinguished class as Benjamin Franklin.

Rittenhouse believed that a coin’s design was a piece of artwork. A year after he was appointed to be the Director of the U.S. Mint, the first U.S. coins were minted.

Half dimes made of silver were the first official United States coinage; it is a rumor that the silver for the half dimes came from George and Martha Washington's very own silverware.

The silver half dimes did not go into circulation; they were likely gifts to dignitaries and friends.

Under Rittenhouse, on March of 1793, the US Mint produced its first circulated coins, 11,178 copper cents.

David Rittenhouse resigned from the Mint on June 30, 1795, due to poor health; he died a year later on June 26, 1796.

In 1871, Congress approved a commemorative medal in Rittenhouse's honor.

In 2012, one of these early copper coins sold at auction for 1.38 million.

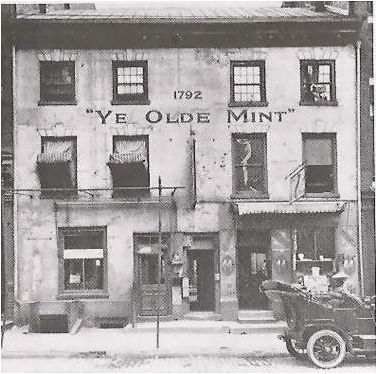

"Ye Olde Mint"

The Coinage Act of April 2nd, 1792, created the U.S. Mint and authorized the construction of the first United States Mint in Philadelphia, PA., the nation’s capital at the time.

Shortly after David Rittenhouse became the Director of the U.S. Mint, he purchased two lots of land in Philadelphia, at Seventh Street and 631 Filbert Street, for $4,266.66.

"Ye Olde Mint" was built a few months later.

The newly built U.S. Mint site consisted of the "Ye Olde Mint" building, a smelter house, a mill house, and in the basement of the Mint, large brick vaults contained gold, silver, copper bullion bars, and pressed coins.

The Ye Olde Mint produced coins at this location for more than 20 years.

Unfortunately, in 1816, a fire broke out at Ye Olde Mint, and it destroyed the smelter house and the mill house.

The mill house burned to the ground. Replacing it was a

large brick building included a new powerful steam engine in the basement to run the coin-pressing machinery on the floor above.

The U.S. Mint did not rebuild the smelting house at the Ye Olde Mint location; they moved it to a second Philadelphia location.

In 1833, all U.S. Mint operations moved to the second Philadelphia Mint location, and the U.S. Mint sold Ye Olde Mint.

The "Ye Olde Mint" building was demolished a few years after the photo above was taken.

In contrast concerning the production of capacity; the modern-day Philadelphia Mint can strike as many as one million coins in a half-hour whereas it would have taken the “Ye Olde Mint” three years to produce the same amount of coins.

Source: Book: (1909) "YE OLDE MINT" by Frank H. Stewart Electric Co.

United States

Designers & Engravers

The initials on the bottom half of U.S.-minted coinage are those of the Designer and the Engraver.

If the coin has the same designer and engraver, there is no specification as to where the initials are found, except that they will be found somewhere on the bottom half of the coin.

This method of recognizing a U.S. coin's designer and engraver is commonplace among modern U.S. coins.

US Bullion Coin Values

The "Face Value" of a bullion coin does not represent the "Intrinsic Value" of a precious metal bullion coin. A coin's intrinsic value is determined by what it consists of and how much it weighs.

US Bullion Coins are bought and sold based on the current market spot price of gold, silver, or platinum, plus a premium to cover minting, handling, distribution, and marketing costs.

Furthermore, the lower the mintage of the bullion coin, the more a collector's premium will be attached to it.

American Eagle Gold

US Bullion Coins

1986 - Present

|

1oz. American Eagle Gold Bullion Coins 1/2 oz. American Eagle Gold Bullion Coins |

American Buffalo Gold

US Bullion Coins

1986 - Present

1oz. American Buffalo Gold Bullion Coins

American Eagle Silver

US Bullion Coins

1986 - Present

1oz. American Eagle Silver Bullion Coins

American the Beautiful

Silver Bullion Coins

2010 - 2021

5oz. America the Beautiful Silver Bullion Coins

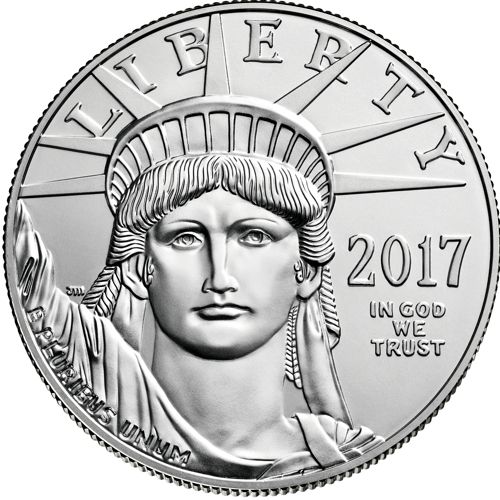

American Eagle Platinum

Bullion Coins

1997 - Present

1 oz. American Eagle Platinum Bullion Coins

1/2 oz. American Eagle Platinum Bullion Coins

1/4 oz. American Eagle Platinum Bullion Coins

1/10 oz. American Eagle Platinum Bullion Coins

American Eagle Platinum

US Bullion Coins

2017 - Present

1oz. American Eagle Palladium Bullion Coins

Sources:

The U.S. Mint: Coinage act of April 2nd, 1792

The U.S. Mint: The History of U.S. Circulating Coins

Book (1909) - "YE OLDE MINT" by Frank H. Stewart Electric Co.

Other Pages, on this guide, you may like

|

|

|

|

|

|

Free Shipping on Orders $199+

US Mint and US Bullion Coins

For Bullion Market News...

Notice:

The charts, commentary, and information on the Free-Bullion-Investment-Guide.com are in no way an endorsement of how you should invest or divest.

|

Support this Guide & Paypal Thank You for Your Support |

|

|

| |||||

This website is best viewed on a desktop computer.

Keep this Guide Online

& Paypal

Thank You for

Your Support

with Feedly

Search the Guide

| search engine by freefind | advanced |

Premium Canadian Bullion

Give a lasting gift of the iconic Silver Maple Leaf bullion coin [More]

Free Shipping on Orders over $100 (CDN/USA)

or

From the U.K. Royal Mint

Daily

Newsletter

Updated Mintages for

American Gold Buffalo

American Gold Eagle

American Silver Eagle

2024 & 2025

Jerusalem of Gold Bullion

Coin photos

(bottom of page)

Mintages

for

2024

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

Last Month's

In No Particular Order

January 2026

All Articles were Originally Posted on the Homepage