Homepage / Bullion News & Charts Archives: Quarterly Precious Metals Charts & News

Updated on 02/02/2024

Quarterly Precious Metals

Charts & News

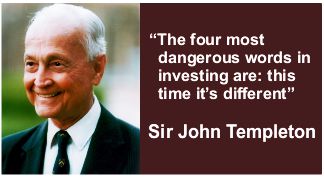

In any market, an investor should know as much as possible about an investment before deciding to get in or out of it.

Directly below the quarterly links, you will find definitions and descriptions of technical indicators investors use on charts to help them decide the direction of their investments money.

Quarterly Precious Metals

Charts & News

|

2021 2019 2017 2015 2013 1st Quarter - 2013

2011 |

2022 2020 2018 2016 2014 2012 1st Quarter - 2012

|

BGASC - Customer Reviews - 4.8 stars

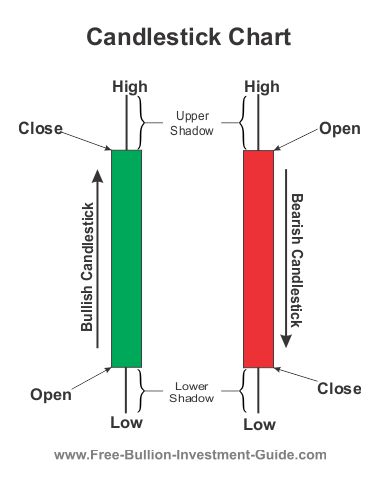

Candlestick Charts

Candlestick charts display the opening, high, low, and closing for an asset's price.

Candlesticks can be measured in minutes, hours, days, weeks, months, years, etc.

The graphic to the right is a diagram of how to read each area of a positive or negative candlestick.

The wide part of the candlestick is called the "real body."

The top and bottom of each candlestick indicate the opening or closing price, depending on whether it was a negative or positive movement that day.

The extended line above or under each candlestick is called the "shadow."

Shadows show the priced items high and low.

Candlestick shapes, influenced by price movement, vary in size and can provide insight into future price trends.

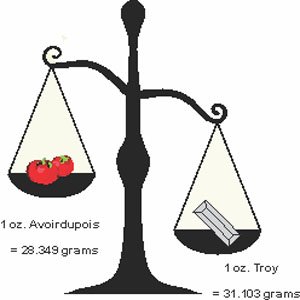

Moving Averages

Moving averages are trend lines that indicate the average price movement. by a certain number of days or a set amount of time.

In the gold price chart below, the 50MA moves closer in relation to the price of gold than the 200MA; the shorter the time period of the moving average, the closer it will be to the asset price.

When the lines move on the chart cross, they form either a Death Cross or a Golden Cross.

To Learn More about Moving Averages, Go to this StockCharts.com page Simple and Exponential Moving Averages.

SD Bullion - 4.8 star Customer Reviews

Golden Cross / Death Cross

When Moving averages cross, technical analysts call these actions a Golden Cross or a Death Cross.

A Golden Cross is a bullish indicator, it happens when a Shorter Moving Average (50MA) crosses over and above a Longer Moving Average (200MA).

Whereas a Death Cross is a bearish indicator, it happens when a shorter moving average (50MA) crosses below a longer moving average (200MA).

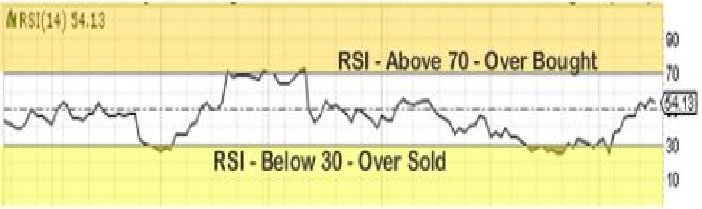

RSI - Relative Strength Index

The Relative Strength Index is an easy indicator to use when trying to forecast price action.

The RSI is a technical momentum indicator that compares recent gains to recent losses in an attempt to determine the overbought and oversold conditions of an investment.

As you can see from the chart above, when the RSI indicator goes above 70, the price of the investment is overbought, and when the RSI is below 30, the price of an investment is oversold.

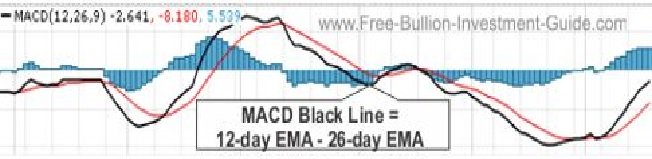

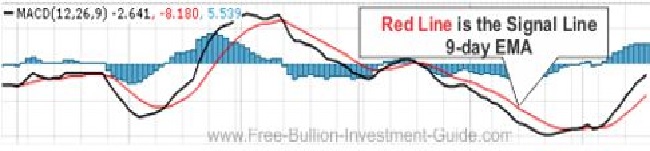

MACD -

Moving Average Convergence/Divergence

Oscillator

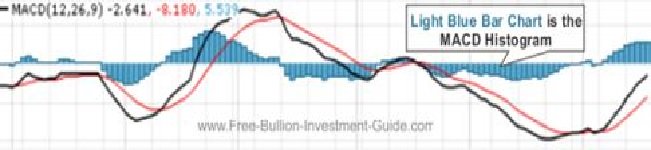

MACD is pronounced just as it looks, "Mac-D."

The MACD (black line) is calculated by subtracting the 26-day EMA.(exponential moving average) from the 12-day EMA.

The red line, called the "signal line," is a 9-day EMA, functioning as a signal to buy or sell.

The MACD histogram represents the difference between the MACD black line and the red signal line.

The MACD histogram starts from the "center-line," known as the "zero line."

When the histogram is above the zero line, it shows a buy signal, and when it is below the zero line, it indicates a sell signal.

To learn more about the MACD and how to read its moving averages, go to the StockCharts.com page defining MACD: Moving Average Convergence/Divergence Oscillator.

Free Shipping on Orders $199+ | 5.0 star Customer Reviews

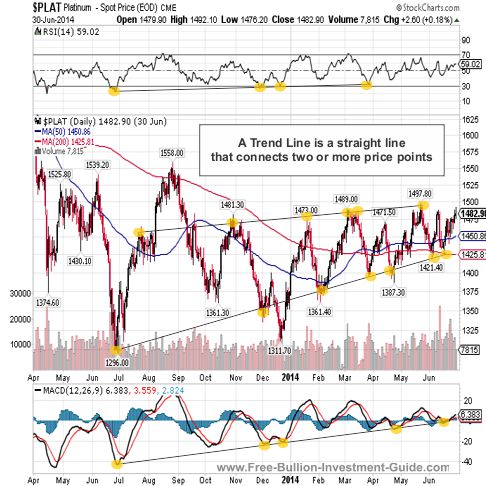

Trend-lines -

Support & Resistance Price Levels

A trend line is a straight line that connects two or more price points.

Trend Lines are an easy tool to use to identify the price movement on a chart.

To Learn More about Trend Lines - Go to this StockCharts.com page defining: Trend Lines

Support Price Levels

Support Price Levels develop after a price has tested a level more than once, then bounced back above it each time it happened.

As you can see in the Gold price chart below, from mid-2010 through the first quarter of 2013, the price of gold repeatedly touched the $1,525.00 price level, then moved upward each time it happened; after this action occurred more than once, this action in price created a Support Price Level.

ExpressGoldCash - 4.9 star - Customer Reviews

Resistance Price Levels

Price charts create Resistance Price Levels when support price levels break.

In the chart below for the 2nd quarter of 2013, the price of gold collapsed under its support level of $1525, making this level a Resistance Price Level for Gold.

Likewise, in the chart, you can see the resistance level confirmed when Gold's price tried to come back up to the level but was unable to break its new Resistance Price Level.

When gold's price broke back above the $1525.00 level; this level again became a support price level.

To Learn More about Trend Lines: Go to this StockCharts.com page defining Trend Lines.

Other pages, on this Guide, that you

may like...

Quarterly Precious Metals Charts & News

For Bullion Market News...

|

Support this Guide & Paypal Thank You for Your Support |

|

|

| |||||

Free Bullion Investment Guide

Keep this Guide Online

& Paypal

Thank You for

Your Support

Search the Guide

| search engine by freefind | advanced |

Daily

Newsletter

Mintages

for

2024

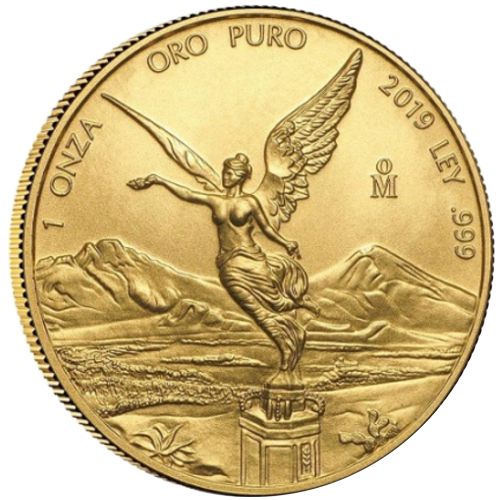

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

2025

Gold & Silver Chinese Panda

|

Silver Panda |

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

March's

All Articles were Originally Posted on the Homepage