Homepage / Bullion Security : Vault Storage of Assets

Last Updated on 01/23/2025

Vault Storage of Assets

(and Bullion) Buying Guide

When considering vault storage, individuals typically choose three general methods: home safes, a bank's safe deposit box, and private third-party vault storage.

This page discusses all three and other alternatives to vault storage that a person can choose to store valuable assets or precious metals bullion and their pros and cons.

Discernment, Security, and Convenience

Discernment, security, and convenience are what everyone wants in the storage of their assets.

- Discernment in knowing you chose the best solution for the assets you want to safeguard.

- Security in knowing that your worries are addressed and taken care of to protect your belongings.

- Convenience in choosing the method of asset auditing and check-up that best suits you.

The following are crucial factors to review before you decide which method of vault storage is most suitable for you and your assets.

Unforeseen Dangers at Home

Anyone can be a victim of a natural disaster or burglary.

Most natural disasters, besides hurricanes, occur with little or no warning and can change in severity without notice.

If your area has experienced natural disasters like fire, flood, tornado, or earthquake, be cautious before storing assets or bullion in your home, and consider storing them in off-premises vault storage.

Crime is another variable to contemplate while deciding how to store your assets or precious metals bullion.

Law enforcement statistics indicate that individuals residing in large metropolitan areas or renting their residences are more susceptible to burglary.

Furthermore, burglary statistics show that most home burglaries are committed by someone the owner knows or has met, especially if they live with roommates or have frequent guests.

The sections that follow will further help you refine your vault storage options.

After you've fully scrutinized which type of vault storage works best for you, you will acquire the knowledge that supports discernment, security, and convenience.

Home Safes

(One time costs of $30.00 to $15,000+)

When you want to keep valuable assets at home out of the reach of curious hands or prying eyes, the first thing that springs to mind is purchasing a home safe.

The next step is to determine the appropriate home safe type for the level of protection needed to safeguard your assets.

The size of the home safe depends on what you are putting in it and if you expect to add to what is in it or not.

In addition to purchasing a safe for your house, an individual should think about other security expenses, such as supplemental insurance for the assets kept inside the safe, a home alarm, motion-detecting lights, security cameras, etc.

➤ Keep in mind the best advice Law Enforcement Officials offer

regarding your valuables assets at home is "don't tell anyone about them."

➤ In the past year, the FBI gained access to a private citizen's gun-safe because the manufacturer willfully gave them the combination to it; read the full story in the article below.

Liberty Safe Let FBI Seize Customer’s Gun Safe Contents Without A Court Order - The Federalist

➤

To find the best home safe for you, see this site's Home Safe Buying Guide; it provides all the information you need before you purchase a safe and lists of reputable manufacturers and retailers to help you find one.

Home Safe Retailers

♜ Lowes

♜ RPNB

♜ The Home Security Superstore

♜ Walmart

Learn more from our

Home Safe Buying Guide

Bank Safe Deposit Box

Local Bank

(Yearly rent/lease costs of $20 to $150+)

Safe deposit boxes are made of metal and sit inside a bank's vault; bank vaults are made of reinforced steel on the inside and reinforced concrete on the outside, and they can resist an F5 tornado.

Safe deposit boxes have a two-key locking system; the boxes are rented by size, the most common being 3"x5"x22." Prices are reasonable, but they are always changing.

When an individual has a bank deposit box and wants to access it, they will go inside the bank vault with a bank employee, and both will have a key to unlock the box; the employee's key is called a "guard key."

Once both keys have unlocked the safe deposit box, the individual is left alone to deposit or withdraw items.

Pros

- Available at Most Local Banks

- High Security and Surveillance.

- reinforced to withstand fire, floods, hurricanes, tornadoes, and other natural disasters

- Ideal for important documents that are not going to be needed in an emergency

- Double Key Entry (with Bank Manager or Employee)

- Private Insurance is available through SDBIC

Cons

In the United States,

- Because of provisions under the Patriot Act, Dodd-Frank, and other laws enacted, the government of the United States (if it chooses) has full access to a box's contents.

- Bank Safe deposit boxes can be inventoried and confiscated by the IRS in the event of a settlement against you or in the case of taxes owed after death.

- Bank safe deposit boxes are not FDIC-insured.

- Due to the Cons (above), it is not "safe" to put cash or precious metals here.

- You have no access to your box during a bank holiday or after banking hours.

- Not Insured

- Banks usually only allow their customers to rent a safe deposit box from them.

If you decide to rent a safe deposit box, below are a few articles to assist with what you should and should not store in a safe deposit box.

Things You’ll Regret Keeping in a Safe Deposit Box - KiplingerSafe Deposit Box: What You Should/Shouldn't Store in One - Investopedia

To rent a safe deposit box, consult your local bank for sizes and charges, as most banks require an active account to rent the box.

A few key reminders:

- Don't forget about your safe deposit box after storing your items.

- Check on the box regularly

- Keep an inventory or photograph the contents

- Tell your lawyer or a trusted family member about the box.

Lastly, because safe deposit box thefts aren't uncommon, there is an Insurance Company that specializes in protecting you if your safe deposit box is compromised; it's called SDBIC (Safe Deposit Box Insurance Company).

"Bailment" Custody Agreement

Bailment is a common-law, legal, contractual relationship where the owner transfers physical possession of their personal property for a period of time but retains ownership.

In a Bailment Agreement, the Vault Storage Company is the custodian, or "bailee," and the person who buys the vault is the "bailor."

The assets in a vault are not part of the company's (bailor) balance sheet because it is not their property; it is in the renter's (bailee) name, and the company is storing it for them.

Even in the case of the bankruptcy of the "Bailee's," creditors cannot claim your assets as theirs because of the Bailment Agreement.

When you open an account with any Vault Storage Company, you want to make sure your assets are segregated in an allocated account independent from the assets of the business you are dealing with (off their balance sheet) because the assets are yours, not theirs.

Otherwise, they can walk away with your assets, and you would have no legal recourse.

Private Vault Storage

Local Safe Deposit Box & Vaults

(Yearly rent/lease costs of $100.00 to $6,000.00+)

There are several reasons Private Vault / Safety Deposit box storage services have begun to pop up in the United States and globally.

- Banks have started to remove Safe Deposit boxes from their facilities.

- People are living in areas that are having more problems with crime and violence than just a few years ago.

- Due to laws enacted by the U.S. Congress (Patriot Act, Dodd-Frank, etc.), Bank Safe Deposit boxes are no longer safe from Federal Agency or Bank confiscation.

All private vault storage services should do business under a bailment agreement; if you find one that doesn't, walk away because it may cost you your possessions.

Case in point:

In March 2021, a private vault storage company based in California named "U.S. Private Vaults" was raided by the FBI, which seized $86 million of the vault company's clients' assets.

However, two U.S. Private Vaults clients sued the FBI for their unlawful seizure and prevailed in the 9th Circuit Court of Appeals.

The articles below are about this case.

9th Circuit: FBI Illegally Raided Hundreds of Safe Deposit Boxes - Money Metals ExchangeThe FBI's Lawless Raid on U.S. Private Vaults Shows Why the Founders Created the Fourth Amendment - Foundation for Economic Education (FEE)

Pros

- 9th Circuit Court of Appeals ruling against FBI seizure

- High Security and Surveillance.

- reinforced vaults able to withstand fire, floods, hurricanes, tornadoes, and other natural disasters

- Separate from the Banking System

- Some services do not require a driver's license or social security number to rent a vault

- Most offer insurance up to $5,000.00

- You have direct title to your assets through the Bailment Custodian Agreement

Note: Here are some phrases associated with Bailment Custodian Agreements: allocated accounts, segregated accounts, and assets off the balance sheet.

Cons

- Possibly Hard to Find: If one near you isn't listed below, check your local listings or do an internet search for "Private Security Deposit Box or Private Vault Storage in your area.

- If electricity is down, access to the facilities that offer keyless entry or automated services will be obsolete for that time period.

- Few services have 24/7 access, and most only allow access during business hours.

Private Vault & Safe Deposit Box Services

Note: Not all the companies below state that they have customer-allocated or segregated accounts that are off their balance sheets; it is advised to read your contract thoroughly because you want to get it in writing before you store any assets with them.

♜ AVM - Automated Vault Machine (Buford, Georgia, U.S.)

♜ Blue Vault (Orange County and San Diego, California, U.S.)

♜

Colorado Vault & Safe Deposit Box Co. (Colorado, U.S.)

♜ CommonWealth Vault & Safe Deposit Co. (Loudoun Co., Virginia, U.S.)

♜ Florida Intervault (Ft. Lauderdale, Florida, U.S.)

♜ Guardian Vaults (Melbourne & Sydney, Australia)

♜ IBV International Vaults (Multiple Locations, Not available in the U.S.)

♜ Idaho Armored Vaults (Idaho, U.S.)

♜ International Depository Services Group (Delaware, Texas, U.S.)

♜ Mountain Vault (Phoenix, Arizona, U.S.)

♜ The Security Center - (New Orleans, Louisiana, U.S.)

♜ The Vaults Group (United Kingdom - multiple locations

♜ Ultra Vault by MALCA-AMIT (Multiple Locations in the United States and Around the World)

A few key reminders:

- Don't forget about your safe deposit box after storing your items.

- Check on the box regularly

- Keep an inventory or photograph the contents

- Tell your lawyer or a trusted family member about it.

Gold Broker - Customer Reviews

Bullion Dealers

U.S. Vault Storage (One Location)

(Yearly rates $100.00 to $1000s (+), rates increase by how much you store in the vault)

It is business as usual for many of these precious metals bullion dealers to buy, sell, and deliver precious metals to you.

As part of their business, they regularly keep a portion of the bullion in their inventory in a depository. As a service to you, they are expanding the depository services they use to you in allocated accounts in separate vaults but in the same depository.

Prior to making any financial decisions, an investor should trust where they are putting their money.

Although rare, some individuals have taken advantage of people by claiming to do what these services do.

One of the worst scams happened in 2021 when a precious metals dealer and depository conspired to rob investors of over one hundred million dollars. See the full story here: Argent Asset Group, First State Depository to Pay $146 Million for Precious Metals Fraud.

This investment guide provides you with links to reputable businesses in the industry (below), but the choice is yours on who you do business with; the best advice we can give is to trust the service and investigate them before you do anything with them.

One of the best ways to investigate a service is to see customer reviews from an independent source, which we have provided below.

In addition, we encourage you to visit the Commodity Futures Trading Commission website here and search (top right) for any business or individual you question their legitimacy with selling precious metals.

Pros

- vaults able to withstand fire, floods, hurricanes, tornadoes, and other natural disasters

- Outside Banking System

- Insured by Lloyd's of London

- Immediate Delivery to you is available

- Instant Liquidity when you sell

- You have direct title to precious metals through the Bailment Custodian Agreement

Cons

- Limited Access to Stored Precious Metals

- Fees can become excessive if you're not careful

Bullion Dealers

U.S. Vault Storage (One Location)

♜ Money Metals Exchange - Better Business Bureau Customer Review

♜ Royal Canadian Mint - 4.2 star Customer Reviews

♜ Royal Mint - 4.8 star Customer Review

♜ SD Bullion - 4.8 star Customer Reviews (1st 3-months free)

Bullion Dealers

U.S. & International Vault Storage

(Multi-Location)

(Yearly rates $100.00 to $1000s (+), rates increase by how much you store in the vault)

These services offer international storage for those who want to preserve their wealth through precious metal bullion.

International vault storage locations include the United States, Canada, London, the UK, Switzerland, Singapore, and the Cayman Islands.

The following are the Advantages of International Storage:

- Global Diversification of Assets

- Insurance companies rate international gold vaults as the most secure locations on earth.

- Reduce the risk that you have at home (crime or natural disasters).

- Keeping assets in a country politically and socially stable

- Keeping assets in countries that have favorable personal property laws (Switzerland, Singapore, Cayman Islands)

- Keeping assets in countries that don't have a history of confiscation

- Keeping assets in countries that haven't had issues with internal government turmoil

Pros

- Vaults able to withstand fire, floods, hurricanes, tornadoes, and other natural disasters

- Outside Banking System

- Insured by Lloyd's of London

- Delivery to you is available

- Instant Liquidity when you sell

- You have direct title to precious metals through the Bailment Custodian Agreement

- Multiple International Storage locations

Cons

-

Limited Access to Stored Precious Metals

- Fees can become excessive if you're not careful

International Vault Storage

♜ GoldBroker - 4.8 star Customer Reviews

♜ GoldSilver - 4.6 star Customer Reviews

♜ JM Bullion (TDS Storage) - 4.8 star Customer Reviews

♜ SilverGoldBull - 5.0 star Customer Reviews (1st 3-months free)

♜ Sprott Money - 4.8 star Customer Reviews

♜

Strategic Wealth Preservation - 4.6 star Customer Reviews

4.7 star - Customer Reviews

Vaulting Storage Brokerage

Multi-Location International

Vault Storage

(Yearly rates $100.00 to $1000s (+), rates increase by how often you trade, and how much you store in the vault)

Vault Storage Brokerages work much in the same way a stock brokerage does.

Stock brokerages offer you stocks to buy; when you buy them, the brokerage stores those stocks in your personal segregated account, and when you want to trade or sell those stocks, you use their system to do what you want, with minimal overhead costs.

The one difference is that with all stock brokerages, getting a physical stock certificate doesn't happen anymore because stock brokerages have turned to digital record-keeping.

Whereas getting the physical bullion from a vault storage broker is commonplace and, in many cases, expected.

Vault Storage Brokerages trade digital precious metals; you make trades like the professionals on the COMEX into wholesale LBMA Gold and Silver Good Delivery Bars.

Pros

- Buy and Sell Precious Metals like Stocks

- Outside Banking System

- vaults able to withstand fire, floods, hurricanes, tornadoes, and other natural disasters

- Insured by Lloyd's of London

- You have direct title to precious metals through the Bailment Custodian Agreement

- Multiple International Storage locations

Cons

-

Limited Access to Stored Precious Metals

- Fees can become excessive if you're not careful

Vaulting Storage Brokerages

♜ Bullion Vault - 4.6 star Customer Reviews

♜ Gold Republic - 4.8 star Customer Reviews

♜ OneGold -

4.8 star Customer Reviews

♜ Vaulted - New from McAlvany Financial Group - Customer Reviews

⮞ Learn more about these services from our guide on Vault Storage Brokerages.

4.7 star - Customer Reviews

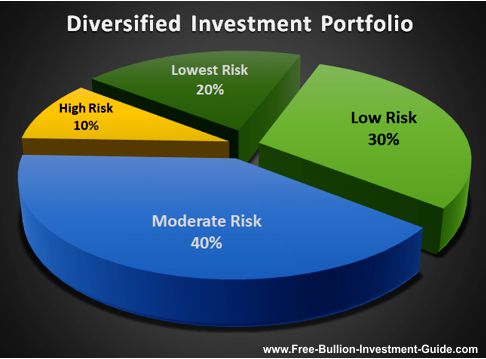

Portfolio

Diversification

- High Risk = Penny Stocks, Venture Capital, Crowdfunding, High Yield Bonds or Junk Bonds, Currency Trading, Crypto-Currency

- Moderate Risk = Exchange Traded Funds (ETFs), Small Cap & Mid Cap Stocks, Corporate Bonds, Real Estate, and Art

- Low Risk = Stock Indexes, Large Cap Stocks, Municipal Bonds, Annuities, Platinum Group Metals (PGMs), Money Market Funds

- Lowest Risk = U.S. Government Bonds, Gold & Silver

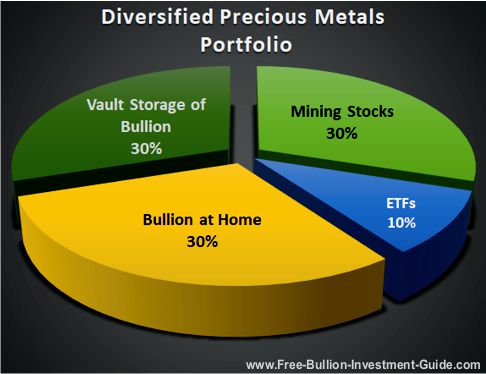

Precious Metals

Portfolio Diversification

Precious metals generally make up 10 to 20% of the average portfolio; however, in comparison to your total investments, the question that many ask is:

How should I diversify my precious metals investments?

Ultimately, you know what works for you, what you can afford, and what form of precious metals works best for you.

There are several choices:

- Owning Physical Bullion at Home - ex: Coins, Bars, Rounds

- Owning Physical Bullion through a Vault Storage Bullion Company or Brokerage.

- Gold IRA

- Mining/Royalty Stocks - ex: WMP, NEM, RGLD, AG

- ETFs - e.g., GLD, SLV - metal is non-allocated and annual storage fees.

The chart below is a sample portfolio of how an individual may diversify 20% of their money in precious metals.

4.8 star - Customer Reviews

Other pages you may like...

|

|

|

|

|

|

Vault Storage of Bullion

For Bullion Market News...

This website is best viewed on a desktop computer.

Keep this Guide Online

& Paypal

Thank You for

Your Support

with Feedly

Search the Guide

| search engine by freefind | advanced |

from the Royal Mint

Daily

Newsletter

Newsletter

2024 & 2025

Jerusalem of Gold Bullion

Coin photos

(bottom of page)

Mintages

for

2024

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

Last Month's

In No Particular Order

September 2025

|

Info~Graphic: How Much Metal Can $10K Buy? - Visual Capitalist Precious Metal Price Forecasts 2025: Gold, Silver Platinum and Palladium - Will human forecasts or AI predictions prove most accurate for precious metals in 2025...?- Bullion Vault The Bullish Case For Palladium - The Bubble Bubble Report Why Central Banks Are Turning to Silver — and Why You Should Too - Wealth Daily Gold: The Only Clock That Doesn’t Lie - The Dark Side Of The Boom Lacalle: The Fed Caused High Inflation and the Current Jobs Slump - Hedgeye GOLD SCAM ALERT: Scammers Using Couriers To Pick Up Gold Bars and Cash - WLTX-TV South Carolina Portfolio Pivot: From Bonds to Tangibles - The Assay Wall Street Finally Embraces Gold - 60/40 portfolio allocation becomes 60/20/20- John Rubino's Substack How—and Why—U.S. Capitalism Is Unlike Any Other - "Nowhere else is risk-taking so encouraged—and not coincidentally, nowhere else has innovation thrived as it has here. Both law and culture helped to shape our capitalism in ways that reflect the spirit of the American Revolution."- The Wall Street Journal (msn) Info~Graphic: Ranked: The 5 Largest Gold Producing Countries (2010–2024) - Visual Capitalist Goldilocks and the three rate paths - The economic uncertainties this year dwarf those of past years, but some clarity may be on the way. - Adberdeen Investments When to Buy Dips and Sell Rips - The Bubble Bubble Report Report: Gold ETFs, holdings and flows - World Gold Council 7 Clues to Watch for Signs Gold and Silver Prices Are Running Out of Gas - barchart Gold Isn't Going Up, Your Money Is Just Losing Value - The Bubble Bubble Report Precious Metals and Critical Minerals Feeling Market Love- A “commodity supercycle” is a period of consistent price increases lasting more than five years, and in some cases, decades - Ahead of the Herd The Gold "Fear Trade" is On - Ahead of the Herd Info~Graphic: Top 20 Primary Silver Mines 2024 - Mining Visuals Gold: All That Glints is Ablaze - But when central banks buy, the metal vanishes into deep storage. Those bars get locked in a vault and forgotten, collecting dust for decades - The Dark Side of the Boom (Substack) Pt Prices Rise on Speculation, Market Deficit - argus Gold Nanoparticle Cancer ResearchGold and Titanium Dioxide Nanoparticles Tackle Hypoxic Tumour Resistance - Scientists have shown that gold and titanium dioxide nanoparticles can help radiation kill cancer cells even when oxygen is scarce. It's a major breakthrough for tackling hypoxia-linked treatment resistance - AZOnano Gold Nanoparticles and DNA, a Revolutionary Duo for Medicine: Nanoconjugates in the Fight with Cancer and Other Diseases - EIN Presswire UA Little Rock Student Earns Second SURF Grant for Cancer Research - University of Arkansas at Little Rock |

All Articles were Originally Posted on the Homepage

18W LED Security Light (Dusk to Dawn & Motion Sensor) - $32.99

from:

LED Lighting

LED Lighting

ExpressGoldCash - 4.9 star Customer Reviews