Homepage / Buying Guides: Plat / Pall Guide

Platinum and Palladium Bullion

Buying Guide

with a list of

Reputable Bullion Dealers

Platinum and Palladium are two precious metals that are in a family of metals called Platinum Group Metals.

Platinum Group Metals (PGMs) are six extremely rare metals that share many of the same chemical, physical and structural properties.

The following are the characteristics of Platinum Group Metals (PGMs) provided courtesy of Johnson Matthey:

- Ruthenium and Osmium are hard, brittle and almost unworkable in the metallic state, with poor oxidation resistance, but are valuable as additions to other metals, usually other pgm, and as catalysts.

- Rhodium and Iridium are difficult to work, but are valuable alone as well as in alloys. Their chemical compounds have many uses, and rhodium is a particularly good catalyst.

- Platinum and Palladium are soft, ductile and resistant to oxidation and high temperature corrosion. They have widespread catalytic uses. In industry they are often used with the addition of other metals, including other pgm.

Investors who want to buy or sell Platinum and or Palladium should keep their eyes on the metals Supply and Demand.

Free Shipping on Orders $199+ | 5.0 star Customer Reviews

Supply of the

Platinum and Palladium

Market

Mine Production

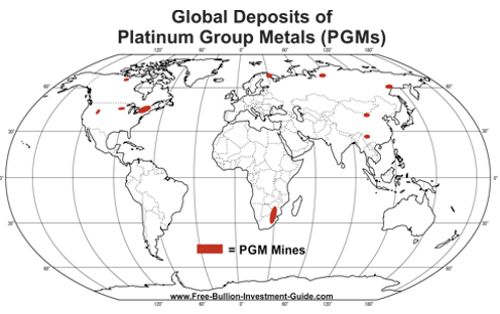

The small orange circles and ovals, on the world map below, offer you a glimpse into how rare Platinum Group Metals occur in the earth's crust.

Platinum Group Metals (PGMs) ore deposits are 30-times more rare than gold.

Mine Production or lack thereof is one of the first things that investors in Platinum and Palladium should keep on their minds.

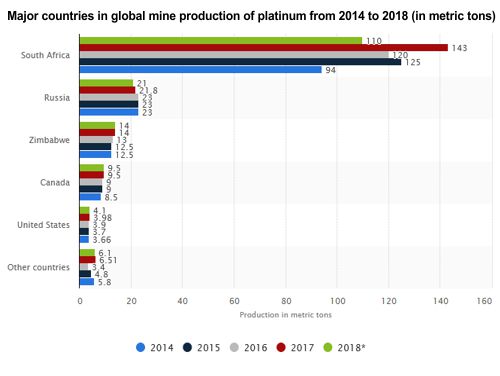

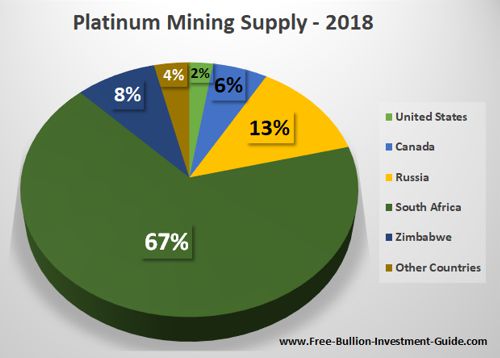

Platinum Supply

In the chart below, you can see that 2018 saw a reduction in platinum mine supply.

If platinum supply continues to be suppressed, and if demand increases, in the future, its market could easily see the same gains as palladium's market saw in 2019.

Chart provided courtesy of Statista

Chart provided courtesy of Statista

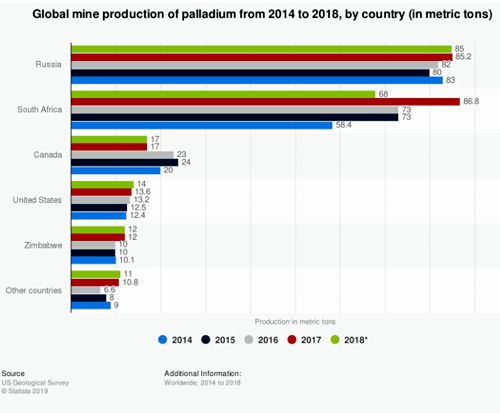

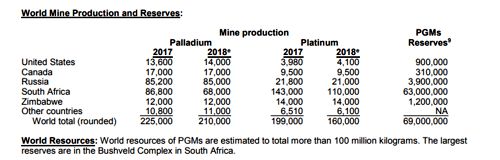

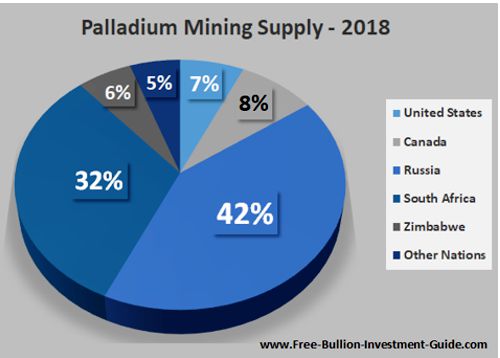

Palladium Supply

Since 2018, Palladium supply has been reported as being in decline, in relation to demand, which has helped palladium's price rise considerably, this deficit in supply can be seen in the chart below.

In addition to Palladium's limited supply last year, here's an article by Reuters that states that 2019 would be another year of deficit for Palladium supply.

Recycling

Recycling also plays a large part in the supply of Platinum and Palladium, over the last several years recycling for both metals have been consistently reported to be more than 2 million ounces.

Demand of the

Platinum and Palladium

Market

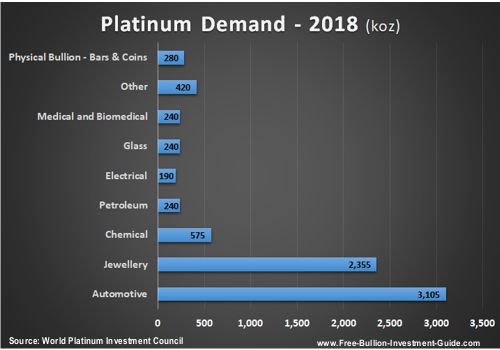

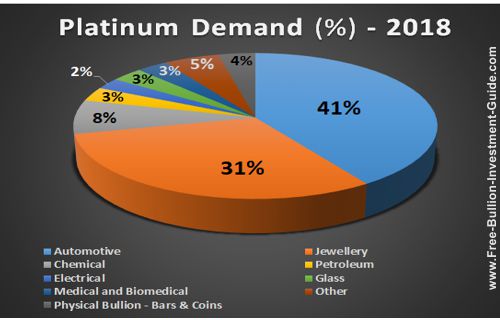

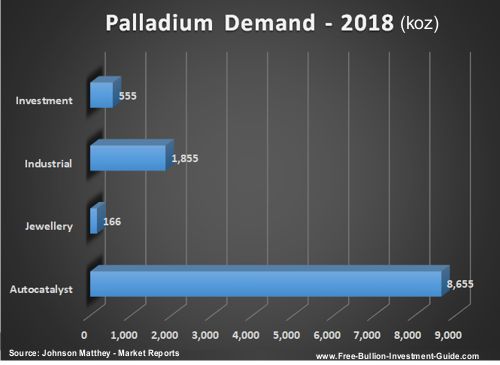

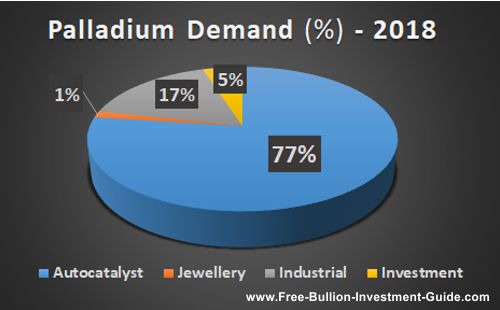

Below are a few charts showing you Platinum and Palladium's demand in both Metric Tons (koz) and in Percentages (%).

Platinum Demand

Industrial uses of palladium constitute 65% of demand.

The automotive sector dominates with over 40% of demand, with other industries taking their stake in the rest of platinum's industrial market.

Jewellery and Physical bullion are greater in platinum's markets than palladium

making up 35% of the precious metal's demand.

Source: World Platinum Investment Council

Palladium Demand

Industrial uses of palladium constitute 94% of demand, and it's dominated by the automobile market.

Only about 5% of Palladium demand is used for investments with a very small jewellery demand at 1%.

Source: Johnson Matthey - Market Reports

Automotive Sector

As you saw from the two demand charts above Platinum and Palladium's largest demand market comes from the Automotive Sector.

This market sector should be one of the first sectors researched to find out how these metals have moved in the past, are moving now, and may move these precious metals in the future.

Q: What is it about the Automotive sector that influences Platinum and Palladium so much?

A: Catalytic Converters & Fuel Cells

Catalytic Converters

Platinum, Palladium, and Rhodium are catalysts that are commonly found in Catalytic Converters, which work by neutralizing 99% of a car's toxic exhaust gases to less harmful gases and water.

The gases that come out of an engine before they move through a catalytic converter are Hydrocarbons (HC), Oxides of Nitrogen (Nx), and Carbon Monoxide (CO).

After the gases move through the PGM honeycomb of a catalytic converter, the catalysts react with the toxic gases, converting them to Carbon Dioxide (CO2), Nitrogen (N2), and Water (H2O).

The Environmental Protection Agency has called the Catalytic Converter "One of the Great Environmental Inventions of All Time.”

Gasoline vs. Diesel

Catalytic Converters

Investors often look at the gasoline and diesel auto sector sales to get a grasp of how much demand is in the market for Platinum or Palladium.

The key to knowing which metal will receive more demand in this sector is knowing which metal is used in each type of combustion engine.

Gasoline Engines

- Gasoline catalytic converters use more Palladium than Platinum

Diesel Engines

- Diesel catalytic converters use more Platinum than Palladium

Overall catalytic converters are found in generators, motorcycles, buses, tractor trailer trucks, and trains. They are found in the exhaust systems of almost every thing with an internal combustion engine.

The key is to know what industries use either gas or diesel engines that determine where demand may grow for Platinum Group Metals.

Fuel Cells

Currently, fuel cells are still in their infancy stage in regards to what type of fuel cell works best and can hold the most charge for the longest time.

Platinum Group Metals are currently used in many different types of fuel cells, as seen here, so as electric cars become more prevalent on the roads, this Auto Sector will become another area of attention for the metals.

Platinum and Palladium

Bullion Coins

Present and Past

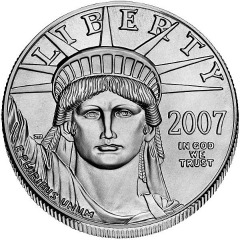

American Eagle Platinum

1oz. | 1/2oz. | 1/4oz. | 1/10oz.

1997 - Present

American Eagle Palladium

2017 - Present

Canadian Platinum

Maple Leaf

1988 to Present

Canadian Palladium

Maple Leaf

2005 to Present

Austrian Platinum

Philharmonic

2016 to Present

U.K. Platinum

Queen's Beasts

1oz.

2017 to Present

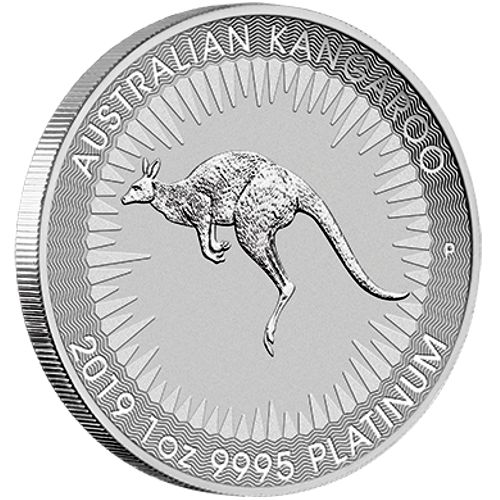

Platinum Australian

Kangaroo

2018 to Present

Platinum Australian

Lunar

2020 to Present

Platinum Australian

Platypus

2011 - 2018

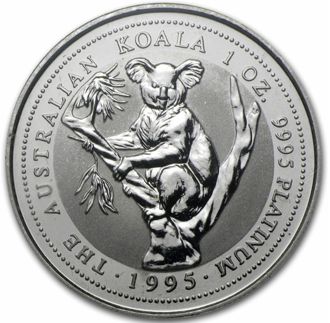

Platinum Australian

Koala

1 kg. | 10oz. | 2oz. | 1oz. | 1/2oz | 1/4oz | 1/10oz. | 1/20 oz.

1987 - 2000

Palladium Australian

Emu

1oz.

1996 - 1998

Soviet Union / Russian Palladium

Ballerina

1oz. | 1/2oz. | 1/4oz. | 1/10 oz.

1989 - 1995

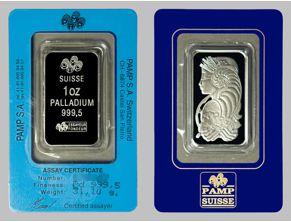

PGMs Bullion Bars

Platinum and Palladium bars are available in all shapes and sizes.

Bullion bars come in three categories, Minted, Extruded, and Cast a.k.a. Poured bullion.

Most Platinum and Palladium bullion bars are minted which has a lot to due with Platinum and Palladium's limited supply and high melt temperatures.

- Platinum's melt temp is 3,215°F / 1,768°C

- Palladium's melt temp is 2,831°F / 1,555°C

Minted bars have a more refined, smoother look than other bullion bars, plus many have a proof-like finish.

Bullion Bar Bullion BarMinting Process |

PAMP - Minted PAMP - Minted1oz. Palladium Bar |

You can find platinum, palladium, and rhodium bullion bars produced by PAMP, Credit Suisse, Valcambi, Johnson Matthey, and Engelhard, among other bullion refiners.

Below you'll find bullion dealers that offer several different types of platinum and palladium bullion.

List of Reputable

Platinum / Palladium

Bullion Dealers

Note: As a suggestion to anyone interested in buying bullion from any one of the sites listed below, Please Read each company's ordering instructions and shipping rules carefully.

BGASC

(- Platinum Bullion link)

BGASC is one of the largest coin and bullion dealers in the United States.

Buy Gold And Silver Coins.com's goal is to be the kind of dealer you've always wanted to trade with: to be in stock, ship fast, be fair & reasonable, and operate honestly and efficiently.

Every single package they ship is sent fully insured for its time in transit.

Customers all across the country have quickly come to recognize BGASC as one of the fastest, and most trusted online precious metals suppliers in the U.S.

Free Shipping on Orders $199+

Money Metals Exchange

Stefan Gleason is president of the Money Metals Exchange, which is a national precious metals investment company and news service with over 500,000 readers and 75,000 customers.

Gleason

founded the company in 2010 in direct response to the abusive methods

of national advertisers of collectible, and numismatic coins.

Money Metals Exchange

Money Metals Exchange believes the average investor should never purchase precious metals that are not priced at or near their actual melt value.

Now you can safeguard your assets from financial turmoil and the devaluing dollar – without paying costly middleman mark-ups or fending off high pressure, bait-and-switch sales tactics.

Savvy, self-reliant investors are embracing Money Metals Exchange as their trustworthy resource for gold and silver bullion.

Free Shipping on Orders $199+

BBB - Customer Reviews

SD Bullion

SD Bullion is a Precious Metals Dealer located in Michigan and is part of the Silver Doctor's network.

In 2011, two doctors started the website SilverDoctors.com with one dream: To educate the masses on the value of hard assets and preparation.

The rapid success of this website gave way to the launch of SDBullion.com in March of 2012. SD Bullion now is one of the most trusted, lowest cost online retailers of bullion.

SD Bullion

Since 2012, SD Bullion has shipped more than 300,000 orders and hit Inc. Magazines list of 500 Fastest Growing Companies in the United States twice.

They did all this while staying true to their original mission of offering the absolute lowest prices on gold bullion and silver bullion in the industry, guaranteed.

Free Shipping on Orders $199+

SilverGoldBull

SilverGoldBull has tens of thousands of satisfied customers who have taken their financial future into their own hands by investing in gold and silver.

This bullion dealer is based in Canada and offers a wide variety of precious metals bullion for you to choose from, their commitment to you is to provide extraordinary service throughout your bullion buying experience.

SilverGoldBull provides you with competitive, up-to-minute pricing and we make sure your precious metals are delivered to your door discreetly and fully insured.

SilverGold Bull's in-house customer service representatives will work to assure your satisfaction in a timely, friendly, and professional manner. Never hesitate to get in touch - building relationships with our clients is our number one priority.

If you would like to learn more about what our customers are saying about our service, please view our customer reviews (below).

Free Shipping on Orders $199+

Platinum, Gold, and Silver

Bullion Broker &

Storage

Bullion Vault

|

BullionVault is the world's largest online bullion investment service taking care of $2 billion for more than 75,000 users. The bullion you own is held in vaults. Bars are stored in professional-market vaults in Zurich, London, Toronto, Singapore or New York. You choose where. Because of their size, you benefit from the low storage costs they've negotiated, which always include insurance. |

with Bullion Vault |

The video below goes into further detail about Bullion Vault's services.

Bullion Vault - Customer Review Links

4.7 star Customer Reviews

Bullion Buying Guides

Other pages you may like...

|

|

|

|

|

|

Free Shipping on Orders $199+ | 5.0 star Customer Reviews

World Bullion Coins Buying Guide

Visit the Bullion Dealers page

OR

For the Latest Bullion Market News...

|

Support this Guide & Paypal Thank You for Your Support |

|

|

| |||||

Free Bullion Investment Guide

Keep this Guide Online

& Paypal

Thank You for

Your Support

Search the Guide

| search engine by freefind | advanced |

Daily

Newsletter

Mintages

for

2024

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

2025

Gold & Silver Chinese Panda

|

Silver Panda |

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

March's

All Articles were Originally Posted on the Homepage

Click Ad to Request a Free Appraisal Kit

ExpressGoldCash

Customer Reviews 4.9 stars

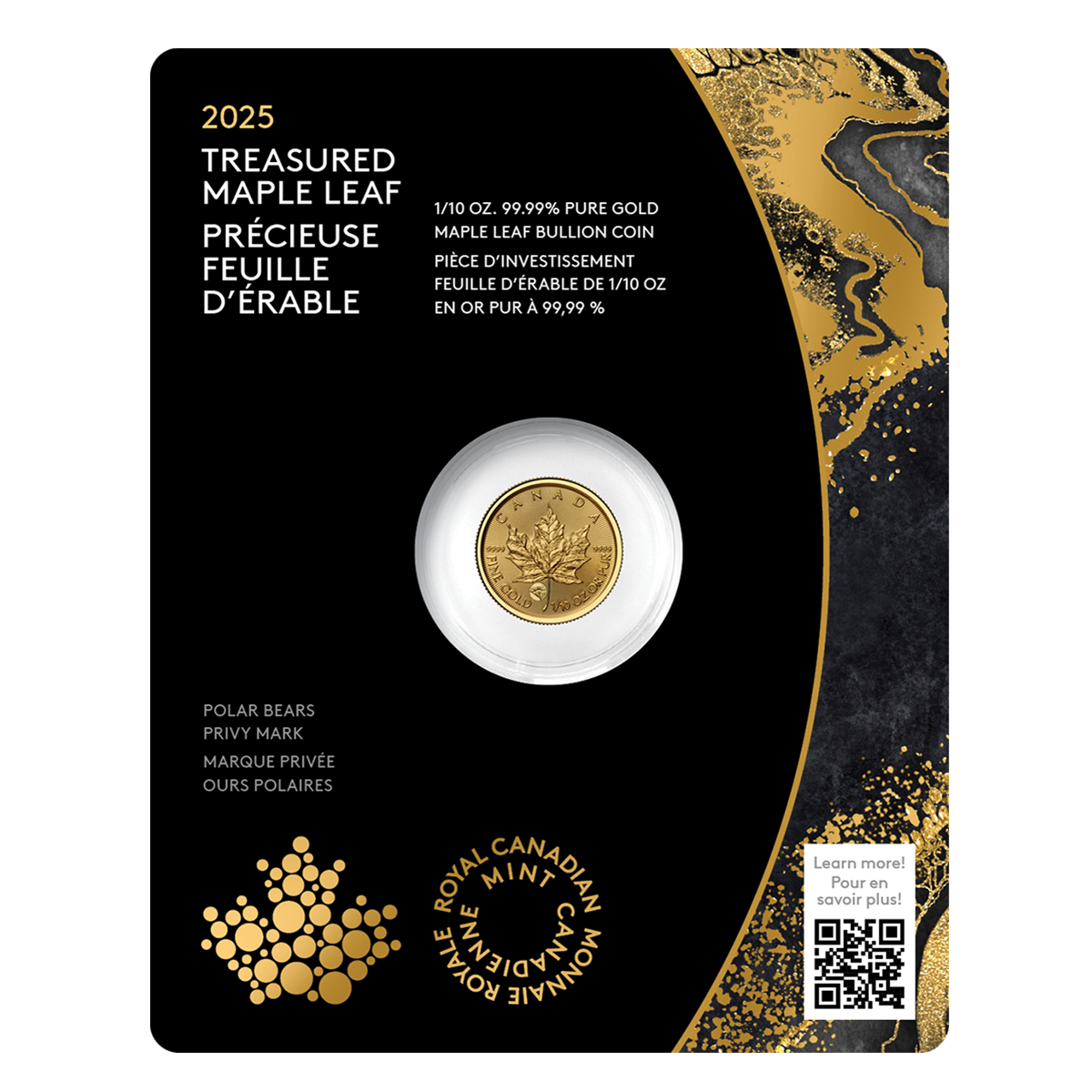

Polar Bears Privy

Give a lasting gift of the iconic Gold Maple Leaf bullion coin with a special privy mark. [More]

Free Shipping on Orders over $100 (CDN/USA)