Homepage / Bullion Security : Vault Storage Brokers

ExpressGoldCash - 4.9 star - Customer Reviews

Updated on 10/29/2025

Vault Storage Brokerages

of Gold, Silver, and Platinum

Buying Guide

Vault Storage Brokerages work much in the same way a stock brokerage does.

Stock brokerages offer you stocks to buy; when you buy them, the brokerage stores those stocks in your personal segregated account, and when you want to trade or sell those stocks, you use their system to do what you want, with minimal overhead costs

The one difference is that with all stock brokerages, getting a physical stock certificate doesn't happen anymore because stock brokerages have turned to digital record-keeping.

Whereas getting the physical bullion from a vault storage broker is commonplace and, in many cases, expected.

Vault Storage Brokerages trade digital precious metals; you make trades like the professionals on the COMEX into wholesale LBMA Gold and Silver Good Delivery Bars.

Low Cost Precious Metals

Low in Cost, in regards to buying precious metals with low premiums.

In most cases, when you buy precious metals on the secondary market, there are premiums added to the intrinsic value of the metal.

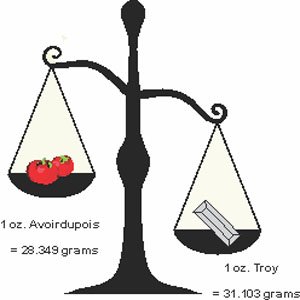

Vault Storage Brokerages like Bullion Vault trades in LBMA 400 troy oz. "Good Delivery" gold bars, 1,000 troy oz. Silver bars, and kilogram Platinum bars. OneGold also trades in these forms of bullion, however they also offer smaller forms of bullion for your brokerage account or for home delivery.

The fact that bullion brokerages trade in large wholesale bars is what allows their customers to buy any amount of gold, silver, or platinum at professional market prices.

What to Know

This page will review two of the Top Vault Storage Brokerages based on their customer reviews, they are: Bullion Vault & OneGold

|

|

Minimum to Start an Account

Free to Open Account

- There is No obligation to trade. (The amount you choose to invest, if/when you decide to do so)

Read Bullion Vault's page about how to "Get Started" in opening an account here.

|

Free to Open Account

Read OneGold's page about "How it Works" here. |

Segregated, Allocated Accounts

When you make your first purchase of precious metal from one of these brokerages, the amount of the metal you purchase no longer appears on the brokerages' balance sheet.

When you open an account with a Vault Storage Brokerage, you are setting up a contract or custody arrangement that creates a segregated, allocated account of gold, silver, and platinum.

Vault storage companies act as custodians of your bullion. When a person opens an account with a company that trades and stores bullion, they are in a "Bailment" Agreement.

A Bailment is a legal relationship between two entities involving tangible assets, in this case, the person who buys the bullion and the vault storage brokerage.

The Vault Storage Brokerage is the custodian or "bailee," and the person who buys and owns the bullion is known as the "bailor."

The bullion is not part of the company's balance sheet because it is not their property; it is now in the buyer's name, and the brokerage is storing it for them.

Even in the case of the bankruptcy of the "Bailee's," creditors cannot claim your bullion as theirs because of the Bailment Agreement.

International Storage

International Storage Advantages:

- Global Diversification of Assets

- Insurance companies rate international gold vaults as the most secure locations on earth.

- Reduce the risk that you have at home (crime or natural disasters).

- Keeping assets in a country politically and socially stable

- Keeping assets in countries that have favorable personal property laws (Switzerland, Singapore, Cayman Islands)

- Keeping assets in countries that don't have a history of confiscation

- Keeping assets in countries that haven't had issues with internal government turmoil

Fully Segregated / Allocated Accounts

in

Zurich, CH

London, U.K.

Singapore

New York, U.S.A.

Read Bullion Vault's written explanation about their Allocation of Bullion here.

|

In U.S., U.K. & Switzerland Fully Segregated / Allocated Accounts for Gold, Silver, and Platinum Canada

- Royal Canadian Mint

Fully Segregated / Allocated Accounts for Silver Canada - Royal Canadian Mint Pooled Un-Allocated Accounts for Gold Read OneGold's page about Allocated Accounts here. |

Vault Storage

Facilities & Auditing

Storage Facilities

The Bullion Vault and OneGold use security facilities that are under the respected VIA MAT INTERNATIONAL, part of Mat Securitas Express AG of Switzerland, one of Europe's largest and oldest armored transport and storage companies.

Bullion Vault uses the following independent professional Vault Storage operators and LBMA security transport companies.

Read Bullion Vault's page about their bullion storage here.

|

OneGold uses these independent professional Vault Storage operators and LBMA security transport companies. Read OneGold's page about their bullion storage here. |

Auditing

|

OneGold Inventory Audit shows investors that their assets are backed by physical metal and are in one of OneGold's four storage locations.

Read more about OneGold's audit and see the uploads and other information here. |

Vault Storage

Fees

Storage Fees

|

Gold, Silver, Platinum and Palladium Monthly Storage Rates (includes insurance)

Unlike Bank Deposit Protection, your Bullion Vault insurance (included) protects you to the full value of your bullion with no cap. Bullion Vault Insurance Issuers include Malca-Amit, Chubb European Group SE, and Lloyds of London. Read Bullion Vault's Storage Fees here. |

|

Storage Fees Charged per Year Billed Quarterly (includes Lloyds of London insurance)

Storage fees are billed quarterly based on the average daily balance of your holdings multiplied by the (%) each location charges. Storage fees may vary by product and location. Minimum account level storage fee of $5 per quarter. Example: $100k holding of gold would cost $120 per year for storage. Read OneGold's page about how they calculate their Storage Fees here. Read OneGold's Storage Fee Calculator here. |

Buying and Selling

Fees

Buying Fees

- Bullion Vault charges a maximum of 0.50% to buy or sell gold, silver, or platinum on their live order board.

- Above $75,000, you pay less.

Transaction...Purchase...Commission

On the first...$75,000/equivalent....0.50%

On the next...$750,000/equivalent..0.10%

Then...........................................0.05%

- Bullion Vault aggregates your prior deals within the year; you pay lower commissions as the year progresses.

- Commission discounts for both purchases and sales run independently on gold, silver, and platinum.

Read Bullion Vault's Buying and Selling Commission Rates here.

Selling Fees

- Bullion Vault charges a maximum of 0.50% to buy or sell gold, silver, or platinum on their live order board.

- Above $75,000, you pay less.

Transaction....Purchase....Commission

On the first...$75,000/equivalent...0.50%

On the next...$750,000/equivalent..0.10%

Then...........................................0.05%

- Bullion Vault aggregates your prior deals within the year; you pay lower commissions as the year progresses.

- Commission discounts for both purchases and sales run independently on gold, silver, and platinum.

Read Bullion Vault's Buying and Selling Commission Rates here.

Cash & Physical Bullion

Withdraws

Cash Withdraws

|

Only Validated Accounts with cleared funds can withdraw cash. Validated Accounts can withdraw cash at anytime. Learn about Bullion Vault's process of Account Validation here. Withdrawals must be over $100 (USD) or other-currency equivalent. Cash Withdraw Charges where applicable

Common withdrawal fees are:

A small currency holding fee may also apply where Bullion Vault's bank charges negative interest rates. This does not currently apply. Read Bullion Vault's full page on "Getting Paid" here. |

|

OneGold states that your account does not need to be verified to withdraw cash from your account. For those who fund their account via

Credit/Debit Card, PayPal, or ACH, OneGold has some exceptions for you concerning withdraws...Read them here. Read more about OneGold's Cash Withdraws in their FAQs section here. |

Physical Bullion Withdraws

|

|

|

OneGold offers physical bullion through APMEX, a leading precious metals dealer in the United States. OneGold has two requirements to place a successful physical redemption order.

1.) Verification - Forms of Identification Required to Verify a OneGold Account:

Read more about OneGold's account verification process here. 2.)

Eligible Funds

Read more about OneGold's Physical Redemption here. |

Portfolio

Diversification

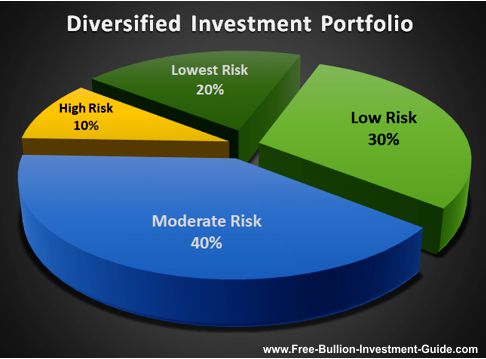

- High Risk = Penny Stocks, Venture Capital, Crowdfunding, High Yield Bonds or Junk Bonds, Currency Trading, Crypto-Currency

- Moderate Risk = Exchange Traded Funds (ETFs), Small Cap & Mid Cap Stocks, Corporate Bonds, Real Estate, and Art

- Low Risk = Stock Indexes, Large Cap Stocks, Municipal Bonds, Annuities, Platinum Group Metals (PGMs), Money Market Funds

- Lowest Risk = U.S. Government Bonds, Gold & Silver

Precious Metals

Portfolio Diversification

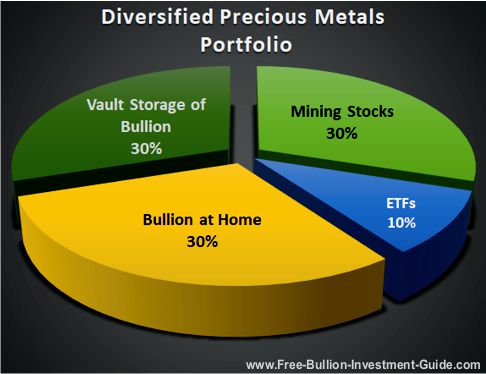

Precious metals generally make up 10 to 20% of the average portfolio; however, in comparison to your total investments, the question that many ask is:

How should I diversify my precious metals investments?

Ultimately, you know what works for you, what you can afford, and what form of precious metals works best for you.

There are several choices:

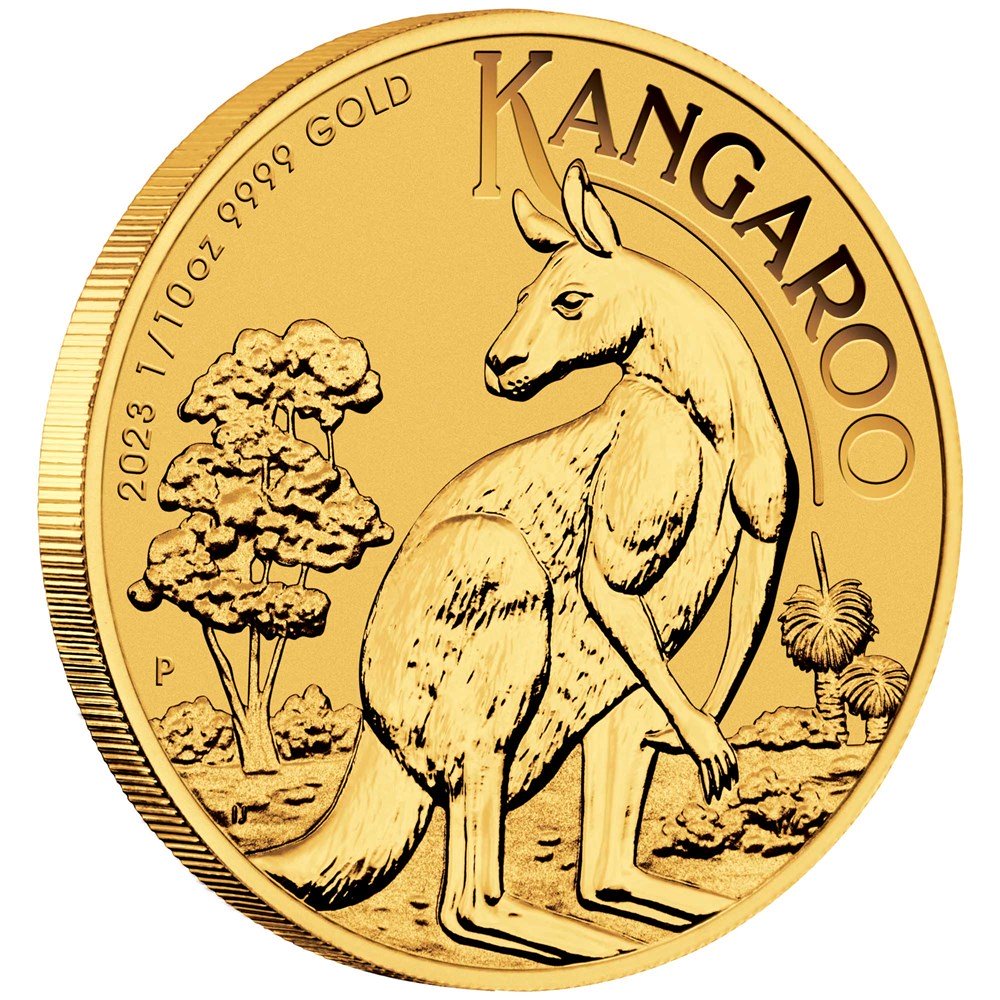

- Owning Physical Bullion at Home - ex: Coins, Bars, Rounds

- Owning Physical Bullion through a Vault Storage Bullion Company or Brokerage.

- Gold IRA

- Mining/Royalty Stocks - ex: WMP, NEM, RGLD, AG

- ETFs - e.g., GLD, SLV - metal is non-allocated and annual storage fees.

The chart below is a sample portfolio of how an individual may diversify 20% of their money in precious metals.

Other pages, on this Guide, that you

may like...

Vault Storage Brokerages

For Bullion Market News...

Notice:

The charts, commentary, and information on the Free-Bullion-Investment-Guide.com are in no way an endorsement of how you should invest or divest.

|

Support this Guide & Paypal Thank You for Your Support |

|

|

| |||||

This website is best viewed on a desktop computer.

Keep this Guide Online

& Paypal

Thank You for

Your Support

with Feedly

Search the Guide

| search engine by freefind | advanced |

Premium Canadian Bullion

Give a lasting gift of the iconic Silver Maple Leaf bullion coin [More]

Free Shipping on Orders over $100 (CDN/USA)

or

From the U.K. Royal Mint

Daily

Newsletter

Updated Mintages for

American Gold Buffalo

American Gold Eagle

American Silver Eagle

2024 & 2025

Jerusalem of Gold Bullion

Coin photos

(bottom of page)

Mintages

for

2024

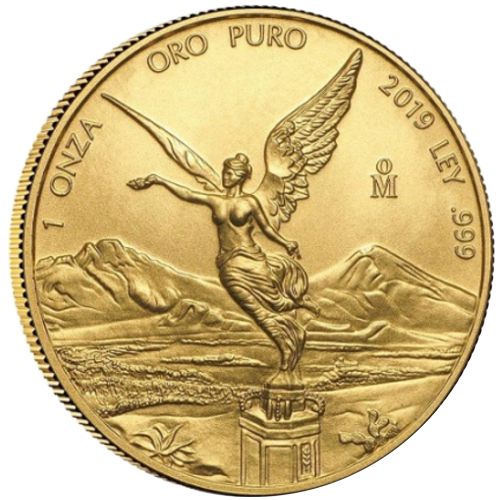

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

Last Month's

In No Particular Order

January 2026

All Articles were Originally Posted on the Homepage

ExpressGoldCash - 4.9 star Customer Reviews