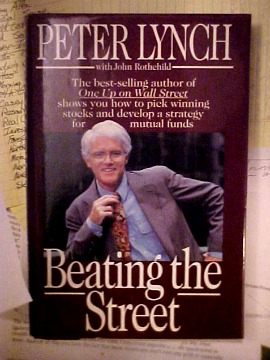

Homepage / Wise Investors: Free Market Capitalists / Peter Lynch

Investment Guru - Peter Lynch

Investment Guru - Peter Lynch is known for his outstanding achievements as the manager of the Fidelity Magellan Fund from 1977 to 1990.

He has shown his expertise in the field of investment by using a common sense approach to picking stocks.

History

Peter Lynch was born on January 19, 1944, in Newton, Massachusetts, a suburb of Boston.

He did not have an easy childhood, as one may think when they hear of a successful Wall Street fund manager.

When Peter was a young boy, his father died at the age of 46 from cancer.

He helps his mother with the finances during this hard time by working odd jobs. One of those odd jobs was that of a golf caddy at Brae Burn Golf Club in his hometown of Newton.

The job was a blessing because it helped him meet many Wall Street investors.

After repeatedly caddying for them, he picked up on the investment language and some strategies for investing by listening to their conversations.

Peter's caddying earned him the Frances Wimen Scholarship, a financial aid scholarship that ultimately helped him get a degree in finance from Boston College in 1965.

In 1966, he joined Fidelity as an intern, and in 1968, he earned a Master's degree in Business Administration from the Wharton School of the University of Pennsylvania.

After serving two years in the Army, Fidelity hired Peter as a full-time investment analyst; shortly thereafter, he became the head of their textiles, mining, metals, and chemicals investment sector.

Eventually, he became the firm's director of research, a position he held from 1974 to 1977. Then, in 1977, he was named manager of the little-known Magellan Fund, which had $18 million in assets.

Over the next 13 years, Peter Lynch grew the Magellan Fund into one of the top asset funds in the world, with a 29.2% average annual return.

By the time Lynch resigned as a fund manager in 1990, the Magellan Fund had grown to more than $14 billion in assets with more than 1,000 individual stock positions.

Investing

Here are some of Investment Guru - Peter Lynch's fundamental principles for his investing process.

- Invest in what you know.

- Identify and recognize exceptional investments.

- Don't buy on impulse or emotion

- Avoid long shots.

- Be flexible and humble, and learn from mistakes.

- Before you invest, you should be able to explain why you're buying it.

Peter Lynch bought stocks he knew and could easily understand. He dedicated himself to doing his homework on a stock, leaving no stone unturned when researching a stock.

He would concentrate on the company's management and fundamentals and not follow what the whole market was doing. One of Peter's best quotes is: "Investing without research is like playing stud poker and never looking at the cards."

|

The video to the right is from a group of students who did a video report about Peter Lynch; it adds some additional insight into his career and investment philosophy. |

Expand Screen to see Video Better |

Investment Guru - Peter Lynch's Articles & Commentary

The video below comes from Fidelity Investments. In the video, Peter Lynch goes in-depth into his investment strategy.

2010

Peter Lynch interview with Frontline - (interview)

A Good Place To Be - (interview)

Investment guru Lynch funds US education initiative

2009

Beating The Dalal Street - (interview)

Free Shipping on Orders $199+ | 5.0 star Customer Reviews

Other pages, on this Guide, that you

may like...

|

|

|

Investment Guru - Peter Lynch

For Bullion Market News...

|

Support this Guide & Paypal Thank You for Your Support |

|

|

| |||||

Free Bullion Investment Guide

Keep this Guide Online

& Paypal

Thank You for

Your Support

Search the Guide

| search engine by freefind | advanced |

Daily

Newsletter

Mintages

for

2024

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

2025

Gold & Silver Chinese Panda

|

Silver Panda |

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

March's

All Articles were Originally Posted on the Homepage