Technical Analysis Shine

When

Fundamentals Fail

Review and Outlook for the U.S. Dollar, Silver, and Gold

Originally Posted on 11/21/2017 @ 9:17am

by Steven Warrenfeltz

Subscribe to this Blog

Hello,

Thank you for visiting the Free-Bullion-Investment-Guide's latest blog post, before we get to the precious metals review and outlook, below are some of last week's Best Bullion Market-Related News articles that were taken from this guide's home page.

Mysterious Gold Trades of 4 Million Ounces Spur Price Plunge - Bloomberg

Ray Dalio Goes On Gold Buying Spree, Adds 575% To GLD Holdings, Becomes 8th Largest Holder - Zero Hedge

Einhorn: "None Of The Problems From The Financial Crisis Have Been Solved" - Zero Hedge

PDF: 3rd QUARTER 2017 - REPORT ON HOUSEHOLD DEBT AND CREDIT - New York Fed

Fed on Collision Course With Bond Markets in Curve Conundrum - Bloomberg

Concerns About Counterfeit Gold Grow Louder - Gainesville News

Best of the Week for Gold NanoParticle Cancer Research

Nanoparticle 'Depot' Promises Improved Cancer Treatment - medical physics web

Nanoshells Could Deliver Cancer Drugs Directly to Tumors with Fewer Side Effects - UPI

'Fundamentals trump Technical Analysis;' those who follow this blog have read these words from me more than once, it's also the title of a previous blog post seen here.

The phrase is completely true, but so is the opposite; 'Technical Analysis Shine when Fundamental Fail.'

The Fundamentals that have failed may only be temporary, but the two fundamental factors below have failed to move the markets as many market participants had expected.

- Tax Cuts are in Limbo; the markets believe that it will be a boon for the dollar if Tax Cuts are passed, if they are passed it will definitely be a good thing for the economy, but the U.S. Dollar's future may not be so bright (I wrote about the intro of this blog post a month ago.)

- North Korea Tensions at ease; although the United States currently has 3 carrier battle groups sitting within striking distance of North Korea, tensions do not seem to be rattling the markets (but this can change at any moment).

To clarify, for most of this year fundamentals have trumped technical analysis, but over the last month, my technical analysis has shown that the U.S. Dollar was trading in a Negative Pattern and Gold and Silver was trading in Positive patterns.

Due to fundamental factors, this was the opposite of what many in the market were expecting from the three market assets.

But, the fundamentals have failed and let technical analysis confirm the patterns in the charts below.

In the future, I don't doubt that fundamentals shine again, and the new technical outlook patterns, in the charts below, will break one way or another in the days and weeks to come.

Review & Outlook

|

All the charts on this blog are Daily Charts unless noted otherwise.

US DOLLAR

In Review

Two weeks ago, I wrote the following about the U.S. Dollar and posted the chart below.

As for the week to come, if the U.S. Dollar continues to rise, it will start to hit resistance at the $95.50 level.

Therefore, although I have little doubt that the U.S. Dollar will continue to trade inside the 'Rising Expanding Wedge' some pullback may happen this week.

In addition, the Dollar's MACD and RSI are starting to move a little higher in the overbought territory, so if the dollar hits the $95.50 level this week, the dollar will consolidate at this level, and we may see a pullback.

In Review - continued

The week before last, the dollar moved up a little, and it traded a little over the 95.00 level, but it could not close a trading day above it.

In addition, for most of the last week, the dollar fell in price and on Friday, November 17th, it confirmed the expected negative outcome of the Rising Expanding Wedge.

U.S. Dollar - This Week's Outlook

A new pattern has been recognized in the Dollar's price chart, a Descending Channel.

The descending channel that the dollar is trading in is very narrow and will undoubtedly be broken sometime in the near future.

However, in the week to come, the Dollar's MACD (lower indicator) looks like it is signaling a fall in the dollar's price.

But, one way to read the MACD is that the greater the separation between the MACD's signal lines the greater a price change is in the future.

So we may see the channel broken to the upside this week, however, the dollar's RSI is moving in a neutral zone, so the price may just bounce around inside the descending channel this week. Time will tell.

Charts provided courtesy of TradingView.com

U.S. Dollar's Price Resistance and Support Levels

U.S. Dollar's Resistance Levels

$95.00

$94.00

U.S. Dollar's Support Levels

$93.00

$92.00

SILVER

In Review

Below is silver's commentary and chart outlook from 2 weeks ago.

For the week ahead, silver continues to show very little as to which way it's going to move.

Although it did come close to breaking the upper falling trend-line of the wedge last week, the price did not close the day out above it.

In addition, Silver's MACD and RSI are both giving little indication as to which way the price may move, so we may continue to see the price move sideways, and perhaps that sideways movement may ultimately break the wedge. Time will tell.

In Review - continued

Two weeks ago, the price of silver moved sideways, but it didn't break the upper falling trend-line of the wedge until late last week.

But when silver did finally break the trend-line, it confirmed the expected positive outcome of the Falling Wedge.

Silver - This Week's Outlook

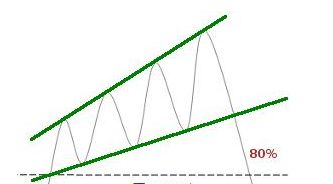

Palladium's Broad Ascending Channel

Palladium's Broad Ascending ChannelIn silver's outlook chart below, like the dollar, it has formed a channel, but in silver's case, it has formed an Ascending Channel.

Silver's channel is a bit broader than the dollar's channel, but it is still narrow.

Typically, a broader channel offers more insight into what you can expect in an assets future price.

For instance, Palladium (right) has been trading inside a broad ascending channel since December of 2015.

As for the week to come, silver's MACD and RSI (lower indicators) are offering very little insight into which direction silver will move, so silver is expected to simply trade inside the channel this week.

Or silver may break the channel if fundamentals move the precious metals, narrow channels are very hard to judge and the current events in the news seem to be in limbo, so we'll just have to wait on time to see which way it will move.

Charts provided courtesy of TradingView.com

Silver's Price Resistance &

Support Levels

Silver's Resistance Levels

$17.75

$17.50

Silver's Support Levels

$16.80

$16.50

GOLD

In Review

Below is the gold outlook from two weeks ago.

As for the week ahead, gold's MACD and RSI are looking a little more positive than silver's lower indicators.

To clarify, they don't look positive because they are in positive territory, nor do they look like they are indicating a positive change in price.

They look positive because unlike silver, they've been moving in oversold territory for more than a week and sometimes when price indicators move in the oversold territory for so long, a change in price usually isn't far behind.

So like silver, we may see the price of gold move sideways this week or perhaps it could move up in price, either way, it looks like the upper falling trend-line of the wedge will be tested this week.

In Review - continued

In the review chart below, you can see that gold's price did move sideways with an upwards slant.

In addition, gold's MACD and RSI didn't fall anymore and moved up, although slightly.

Gold also broke the Falling Wedge over a week ago. confirming the positive pattern.

Gold - This Week's Outlook

For the week to come, like silver, an ascending channel was also found in gold's chart.

Gold's channel is narrower than the one found on silver's chart, so its a little more fragile and is expected to break in one direction or the other sometime in the near future.

But as for now, there is no overwhelming signal as to which direction the price of gold will move, so time will tell what it does.

Charts provided courtesy of TradingView.com

Gold's Price Resistance and

Support Levels

Gold's Resistance Levels

$1310.00

$1300.00

Gold's Support Levels

$1260.00

$1250.00

Music

Last weekend, Malcolm Young died, he was a guitarist and one of the founding members of AC/DC.

When I was growing up, AC/DC's music was too hard for my parent's taste, so I didn't hear their music in my house.

However, a good friend of mine who lived across the street from me loved AC/DC, so I actually heard them all the time.

I'll never forget an early interview of the band that solidified my love for their music.

I remember the interviewer asking:

"When are we going to hear some ballads from you?" I don't remember which band member answered but I'll never forget what he said:

"We don't play ballads, we play Rock n' Roll, Hard and Loud."

In the 80's, at least one ballad from a heavy metal band was the norm.

For me, a kid that was growing up on Frank Sinatra and other ballad rich music, after I heard that response I had a new-found respect for AC/DC because they didn't 'Not Following the Crowd.'

Rest in Peace Malcolm Young and God Bless You.

AC/DC - Rock And Roll Ain't Noise Pollution

Thank You for Your Time.

Have a Great Week.

God Bless, Steve

'Click Here' see all of the prior Blog posts,

Thank You for Your Time!

|

Investment/Information Disclaimer: All content provided by the Free-Bullion-Investment-Guide.com is for informational purposes only. The comments on this blog should not be construed in any manner whatsoever as recommendations to buy or sell any asset(s) or any other financial instrument at any time. The Free-Bullion-Investment-Guide.com is not liable for any losses, injuries, or damages from the display or use of this information. These terms and conditions of use are subject to change at anytime and without notice. |

|

Support this Guide & Paypal Thank You for Your Support |

|

|

| |||||

Free Bullion Investment Guide

Keep this Guide Online

& Paypal

Thank You for

Your Support

Search the Guide

| search engine by freefind | advanced |

Daily

Newsletter

Mintages

for

2024

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

2025

Gold & Silver Chinese Panda

|

Silver Panda |

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

March's

All Articles were Originally Posted on the Homepage