Recurring Themes

Precious Metals Market Analysis

02/06 thru 02/17/2017

Gold, Silver, the U.S. Dollar, Platinum & Palladium

Originally Posted on 02/12/2017 @10:38pm

Hello,

I hope that you and your family have been safe and well.

I noted in last week's post titled 'Hard News' that starting this week I would post the best articles taken from this guide’s home page, from the prior week.

In addition to Bullion Market News, I will also include one of the best articles, from the week, about Gold Nano-Particle Cancer Research.

These articles are not listed in any particular order.

CHART : Energy and Resource Digest - The One Gold Chart You Need to See

Investopedia - London Banks Want Gold Traded on Exchange

CHARTS : RIA - The Lowest Common Denominator: Debt

GOLDSEITEN.de (Germany) - What you always wanted to know about platinum - google translation link

City Journal - In Debt They Trust

Best of the Week for Gold NanoParticle Cancer Research

GOLD NANOTECHNOLOGY : CANCER RESEARCH : New Scientist - Blood Test Could Catch Pancreatic Cancer before It’s Too Late

Recurring Themes

Yesterday, as I started to write this post, I sat back in my chair and took a look at all the Precious Metals charts, I could see a pattern forming in all of the charts, but I didn’t have any lines drawn.

Then I started to line up the trend-lines; I first found the pattern that is a 'Recurring Theme' in the Platinum chart, then one by one, I found the same pattern again and again in all the precious metals charts.

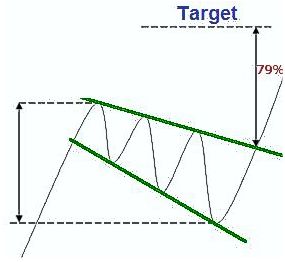

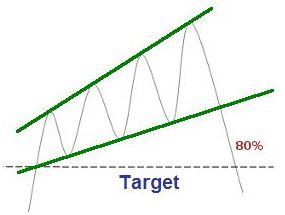

Q: What’s the Pattern?

A: a Rising Wedge

A rising wedge is a bearish indicator, and all the precious metals charts have one, and I’ll show you where in the charts below.

Note: Click the 'Rising Wedge' chart (to the right) for a definition of the technical pattern.

GOLD

Last week, gold continually moved up breaking above the red resistance line of the ‘Falling Expanding Wedge.

In the chart below you can see how Gold moved upward last week, and you can see how it formed its ‘Rising Wedge.’

But before we move on, if you take a broader look at the Gold Chart (below), we can see that gold has been on a tear since mid-December, with only one good consolidation level.

Gold looks like it could move a little higher before it pulls back, confirming the ‘Rising Wedge’s’ pattern.

As far as how much gold’s price will pull back is anyone’s guess, but because of the amount of uncertainty that is still in the markets, I expect gold to continue to move up after it pulls back in the next week or two.

Uncertainty is Gold’s Best Friend.

Note: Click the chart (to the right) of a 'Falling Expanding Wedge' for Forex-Central's definition of the technical pattern.

Gold's Price Resistance &

Support Levels

Gold's Resistance Level

$1265.00

$1250.00

Gold's Support Levels

$1225.00

$1200.00

$1180.00

SILVER

Last week, I posted the Silver chart below and stated the following:

“…by judging its movement over the last few weeks, it looks like we can expect more of the same; a quick move up, followed by some consolidation.”

(continued...)

Charts provided courtesy of TradingView.com

By looking at the chart below, you can see that Silver had continued its movement from the previous weeks.

But now, Silver’s price looks like its running out of steam and needs to regroup before it regains its strength and breaks above the 'Falling Expanding Wedge'.

In the week to come, look for the red line of the Falling Expanding Wedge to act as resistance against silver's price.

Silver's Price Resistance and

Support Levels

Silver's Resistance Level

$18.15

$18.00

Silver's Support Level

$17.50

$17.10

$16.95

US DOLLAR

Last week, the U.S. Dollar broke back above its support/resistance level of $100.00, which doesn’t make a whole lot of sense because of all the Dovish talk coming out of the Federal Reserve and last week’s report on Consumer Credit.

Reuters - Fed's Bullard says rates can remain low through 2017

Market Watch - Fed’s Evans wants interest-rate hikes rolled out at a ‘slow’ pace

Bloomberg

- U.S. Consumer

Credit Posts Smallest Annual Gain Since 2013

Nevertheless, the dollar rose last week, and it broke through the descending channel I’ve been drawing in its chart for the last month; something I did not think it would do.

Also, the U.S. Dollar’s MACD (lower indicator) is changing direction, so the dollar looks like it will rise in the beginning of next week, but something in the charts makes it look like this bounce may not have too much momentum behind it.

Plus, the $101.00 resistance

level could be a hard line for the U.S. dollar to break.

Note: Click the chart above for Forex-Central's definition of the Rising Expanding Wedge or 'Ascending Broadening Wedge.'

U.S. Dollar's Price Resistance and Support Levels

U.S. Dollar's Resistance Level

$101.40

$101.00

U.S. Dollar's Support Level

$100.00

$99.75

Platinum

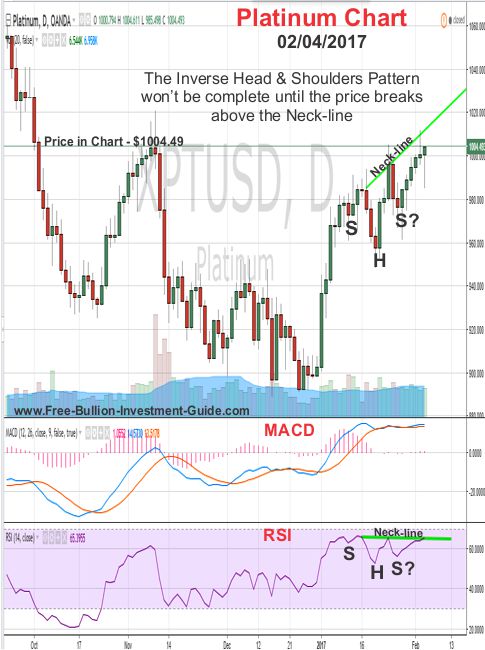

Last week, I posted the Platinum chart below, the chart looked like it had formed an 'Inverse Head and Shoulders' pattern, but I stated that it needed to break above the neckline for the pattern to be confirmed.

Although it broke the neckline in the RSI (lower indicator), in the chart below, the Price of Platinum was unable to break above the neckline.

As for the week ahead, the ‘Rising Wedge’ is a little broader in Platinum’s chart than it was in gold or silver’s charts, so we may see the price of Platinum continue to creep up or it may pull back now, only time can tell.

Platinum's Price Resistance and Support Levels

Platinum's Resistance Level

$1025.00

$1015.00

Platinum's Support Level

$1000.00

$980.00

$960.00

Palladium

Like all the other precious metals, platinum moved up in price last week.

Platinum’s 'Rising Wedge' is the broadest among all the precious metals, so it may continue to move up in price or it may not; either way I expect it to continue to trade inside its ascending channel.

Palladium's Price Resistance and Support Levels

Palladium's Resistance Level

$800.00

$785.00

Palladium's Support Level

$770.00

$740.00

Music

This week I listened to the Scorpions, their song 'Send Me an Angel' is one I can loop and listen to over and over again.

So this week I leave you with: 'Send Me an Angel."

Have a Great Week.

Thank you for your time & God Bless,

Steve

Thank You for Visiting the Free Bullion Investment Guide

This Guide gives 50% or more of what it earns to those who are Battling Cancer.

Please Help Us Give by Supporting our Affiliates.

(Every Advertisement on the Guide is from one of our Affiliates)

'Click Here' see all of the prior Blog posts,

Thank You for Your Time!

|

Support this Guide & Paypal Thank You for Your Support |

|

|

| |||||

Free Bullion Investment Guide

Keep this Guide Online

& Paypal

Thank You for

Your Support

Search the Guide

| search engine by freefind | advanced |

Daily

Newsletter

Mintages

for

2024

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

2025

Gold & Silver Chinese Panda

|

Silver Panda |

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

March's

All Articles were Originally Posted on the Homepage