A Positive Sign in

Gold and Silver's

short-term trade

Precious Metals Review and Outlook from

9/26 thru 10/06/2017

Originally Posted on 10/02/2017 @ 11:22am

by Steven Warrenfeltz

Subscribe to this Blog

Hello,

Thank you for visiting the Free-Bullion-Investment-Guide's latest blog post, before we get to the precious metals review and outlook, below are some of the Best Bullion Market-Related News articles that were taken from this guide's home page.

VIDEO: We're Reaching Peak Gold - Bloomberg

Platinum, palladium hit price parity for first time in 16 years - Reuters

AUDIO: QE Still Alive and Well: Worldwide Central Banks Pumping in 300 Billion Per Month - McAlvany Weekly Commentary

CHARTS : A Look at NYSE Margin Debt and the Market - Financial Sense

Fed Can’t Reach ‘Normal’ - Numismaster

Best of the Week for Gold NanoParticle Cancer Research

GOLD NANOPARTICLE ~ CANCER RESEARCH: A Step Closer to Treating Oral Cancer Without Surgery - The Hindu

GOLD

In Review

Below is the gold outlook from last week.

For the week to come, I could not find any definitive patterns in gold's chart, that's why the chart below looks almost bare.

So instead of showing you a pattern in this week's chart, I pointed out to you where gold should find support and either stop its fall or start to consolidate before it regroups and decides which way it wants to move.

In Review - continued

As you can see in the chart below, last week, the price of gold mostly just fell in price to a low of about $1275, and it closed the week at 1279.

Gold - This Week's Outlook

As the chart above suggests, if gold continues to fall in price, its support should help it change directions soon.

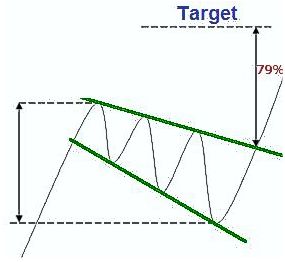

In addition, a 'Falling Expanding Wedge' has formed in gold's price chart, this is a positive sign for gold.

Another positive sign in the gold chart below, comes from gold's MACD and RSI, which is indicating that although the price may fall a little more, a bottom or a transition in gold's latest price movement shouldn't be too far away.

Charts provided courtesy of TradingView.com

Gold's Price Resistance and

Support Levels

Gold's Resistance Levels

$1350.00

$1300.00

Gold's Support Levels

$1275.00

$1250.00

SILVER

In Review

Below is the silver outlook commentary and chart from last week.

After studying the silver chart, I found a positive pattern, a 'Falling Expanding Wedge.'

How soon the wedge will be confirmed is anyone's guess, but silver's MACD and RSI look to be signaling that silver may be ready to stop falling.

So it looks like for the first part of the week we'll be looking at some consolidation in silver's price, then it will be up to the market as to how soon the wedge plays itself out.

In Review - continued

In the chart below, you can see that silver continued to move inside its positive Falling Expanding Wedge pattern, but it also continued to fall in price.

In addition, its MACD proved that it was only starting its move down and that it needed to break the 'Zero-line' before it started to indicate a change in price was coming.

Silver - This Week's Outlook

For the week to come, in the chart below, now that silver's MACD has moved under the 'Zero-line' the indicator looks to be showing that the price should start to consolidate in the beginning of the week.

But, silver's RSI looks like it is showing that silver may still have some room to fall.

So this week we'll see some consolidation in the price of silver, then when the two bottom indicators start to agree on a bottom, we should start to see silver test the upper trend-line of its 'Falling Expanding Wedge.'

charts provided courtesy of TradingView.com

Silver's Price Resistance &

Support Levels

Silver's Resistance Levels

$17.25

$17.00

Silver's Support Levels

$16.45

$16.15

US DOLLAR

In Review

Below is the U.S. Dollar's commentary and chart from a week ago.

For this week's outlook, it looks like we're back at where we started back in late July when I posted this 'Falling Expanding Wedge' in the U.S. Dollar chart.

Here's the post: A Transition is Coming in Gold and Silver's short-term trade.

The candlestick chart itself isn't giving much of an indication as to which way the price of the U.S. Dollar will move, and because of this, we may just see some consolidation in the beginning of the week.

But the MACD and RSI are giving the indication that more upside will happen this week, so we may see the dollar finally confirm the 'Falling Expanding Wedge' this week; time will tell.

In Review - continued

By looking at the chart below you can see that the U.S. Dollar has 'finally' moved above the upper falling trend-line of the 'Falling Expanding Wedge' confirming the positive characteristics of the technical pattern.

U.S. Dollar - This Week's Outlook

In the outlook chart below, a negative 'Rising Expanding Wedge' pattern has formed in the U.S. Dollar Chart.

This week, the U.S. Dollar's Candlestick price chart, MACD, and RSI are all indicating that a price pullback is in the process.

Support for the U.S. Dollar currently sits at the $92.00 level and the $92.00 level is below the bottom trend-line of the 'Rising Expanding Wedge.'

But, the 'Rising Expanding Wedge' pattern in the dollar's chart is very broad, so it's doubtful that the U.S. Dollar will confirm it this week, time will tell.

Charts provided courtesy of TradingView.com

U.S. Dollar's Price Resistance and Support Levels

U.S. Dollar's Resistance Levels

$94.00

$93.00

U.S. Dollar's Support Levels

$91.00

Platinum

In Review

Below is the outlook chart and commentary from the Platinum section in last week's blog post.

Although Platinum literally fell like a rock last week, its MACD and RSI look like the fall has stopped or will shortly.

In addition, a positive 'Falling Wedge' pattern has formed in Platinum's chart, so we should see the price move up, sometime this week, confirming the wedge.

In Review - continued

As you can see in the chart below, the price of platinum kept falling last week. In addition, even though its RSI bottomed out, its MACD kept on falling.

I apologize for my incorrect assessment from last week.

Platinum - This Week's Outlook

The positive 'Falling Wedge' in platinum's chart is still intact as the price of platinum has literally squeezed itself down into the bottom of it.

The MACD's pink, histogram, bar chart has started to retreat, from its short-term low, this is typically a sign that a price change is inevitable; if it already hasn't happened.

In addition, the $900 level is a strong support level for platinum, which coincidentally sits at the bottom the wedge, so this week we should see the 'Falling Wedge' pattern either be confirmed or denied,

Charts provided courtesy of TradingView.com

Platinum's Price Resistance and Support Levels

Platinum's Resistance Levels

$965.00

$925.00

Platinum's Support Levels

$900.00

$890.00

Palladium

Below is the commentary and chart from last week's Palladium section.

In Review

In the week to come, Palladium has formed a positive 'Falling Wedge' and since it is so narrow, it should break it some time this week.

I say this not only because the wedge is so narrow, but because the MACD and RSI, in the chart below, have already started to show that a change in the direction of Palladium's price is imminent.

In Review - continued

The chart below shows you that the 'Falling Wedge' pattern was confirmed, last week.

To understand some of the driving forces behind the recent rise of palladium, the article below highlights a lot of these factors.

Palladium - This Week's Outlook

For the week to come, Palladium's chart has formed a negative 'Rising Expanding Wedge' pattern.

Although this is a negative pattern, Palladium's MACD and RSI are giving the indication that the price may rise, this week.

So palladium's giving mixed messages, which isn't new to those who watch the palladium market, so adding these two factors together it looks like this week time will tell as to which way this market decides to move.

Charts provided courtesy of TradingView.com

Palladium's Price Resistance and Support Levels

Palladium's Resistance Levels

$950.00

Palladium's Support Levels

$900.00

TNX - Ten Year Treasury Note

The TNX, Ten-year Treasury note, is a chart that I often watch to get an idea of what gold will do because the TNX almost always moves in the opposite direction of gold, you can see this in the TNX chart below.

You can also see, in the chart below, that the Ten-year treasury note has formed a negative 'Rising Wedge' pattern.

Time will tell when the pattern is confirmed, I'll update you when it does.

Thank You for Your Time.

Have a Great Week.

God Bless, Steve

'Click Here' see all of the prior Blog posts,

Thank You for Your Time!

|

Investment/Information Disclaimer: All content provided by the Free-Bullion-Investment-Guide.com is for informational purposes only. The comments on this blog should not be construed in any manner whatsoever as recommendations to buy or sell any asset(s) or any other financial instrument at any time. The Free-Bullion-Investment-Guide.com is not liable for any losses, injuries, or damages from the display or use of this information. These terms and conditions of use are subject to change at anytime and without notice. |

|

Support this Guide & Paypal Thank You for Your Support |

|

|

| |||||

This website is best viewed on a desktop computer.

Keep this Guide Online

& Paypal

Thank You for

Your Support

with Feedly

Search the Guide

| search engine by freefind | advanced |

Premium Canadian Bullion

Give a lasting gift of the iconic Silver Maple Leaf bullion coin [More]

Free Shipping on Orders over $100 (CDN/USA)

or

From the U.K. Royal Mint

Daily

Newsletter

Updated Mintages for

American Gold Buffalo

American Gold Eagle

American Silver Eagle

2024 & 2025

Jerusalem of Gold Bullion

Coin photos

(bottom of page)

Mintages

for

2024

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

Last Month's

In No Particular Order

January 2026

All Articles were Originally Posted on the Homepage