Homepage / Archived News or Quarterly News / 4th Quarter 2015

ExpressGoldCash - 4.9 star - Customer Reviews

4th Quarter - 2015

Charts, Bullion News & Commentary

Date Posted: 3/08/2016 @ 2:14am

This page provides a comprehensive overview of gold, silver, platinum, and palladium during the quarter.

For each of the precious metals, you'll find charts. Below the charts, you will find Bullion News Headlines from the 4th Quarter of 2015. Every news link was originally posted on this guide's homepage.

When investing in any market, a good way to judge price movement in the future is to learn from the past.

The charts below are provided by the courtesy of

Order of Analysis and Commentary

1) US Dollar Charts - 4th Qtr 2015

3) Silver Charts - 4th Qtr 2015

4) Platinum Charts - 4th Qtr 2015

5) Palladium Charts - 4th Qtr 2015

6) 4th Quarter - 2015 Bullion News & Commentary

US Dollar Charts - 4th qtr. of 2015

In the 4th quarter of 2015, the Federal Reserve (the Fed) and European Central Bank (ECB) dictated the US Dollar's movement.

Just like last quarter,

I used dotted lines in the chart below to indicate when the Fed and ECB

made their announcements to show you how it moved the US Dollar.

When you look at the U.S. dollar chart, you're not only looking at a currency chart, but you are also looking at a tug-of-war game played by the World's Central Banks to weaken their currencies against the U.S. Dollar.

This is also known as "Currency Wars." A currency war is also referred to as "the race to the bottom" for currencies, and that is the current climate we find ourselves in.

Currency wars happen when a country's central bank devalues its currency against other foreign currencies, making its exports more competitive by making them cheaper to foreigners. (continued...)

US Dollar Price Chart - 3rd Quarter - (Oct 1st, 2015 - Dec. 31st, 2015)

US Dollar

The quarterly chart (above) gives the impression that the US Dollar was falling at the beginning of the quarter, but actually, the US Dollar had been moving in a choppy sideways trade since May of 2015.

The first dotted line on this quarterly chart (above) indicates when the Federal Reserve chose not to raise rates at its October meeting. They stated that they did not want to raise rates due to volatility in global markets.

After the Fed didn't raise rates in October, the heat was on them from Wall Street to raise rates in December. (continued...)

US Dollar Price Chart - (Oct. 1st, 2014 - Dec. 31st, 2015)

The US dollar rose after the Fed's October meeting until the ECB announced that they were not going to extend their version of QE (quantitative easing) as long as economists and investors had predicted.

See Article: ECB Day: Markets tumble as Draghi disappoints investors - as it happened

Before the ECB's announcement, the U.S. dollar broke above the $99.00 resistance level, but after the ECB's decision, the U.S. dollar lost a lot of strength, falling back below $99.00.

US Dollar Price Chart - (Oct 1st, 2012 - Dec. 31st, 2015)

After the Fed failed to raise rates in October, the market expected two things to happen in December.

- For the ECB to weaken the Euro more than they did in December

- The Fed to raise Interest Rate in December.

After the U.S. dollar fell in response to the ECB's announcement, it stayed above the $97.00 support level for the rest of the year.

The US Dollar's long-term resistance level currently sits at $101.00 and its support levels currently sit at $93.00 and $90.00.

US Dollar Price Chart - (Jan 1st, 2006 - Dec. 31st, 2015)

Back to Order of Analysis and Commentary

ExpressGoldCash - 4.9 star - Customer Reviews

Gold Price Charts - 4th qtr. of 2015

Gold Price

Gold hit new lows in the 4th quarter of 2015; for the last two years, gold's price has been dictated by the Fed's decision, or lack thereof, to raise interest rates.

Since the Federal Reserve ended Quantitative Easing (QE) in October of 2014, Wall Street has been expecting an interest rate hike, but the Fed failed to act.

Dovish talk from the Federal Reserve caused gold to rise in the

first few weeks of the quarter. The price of gold rose so much that it briefly broke above the $1180 price resistance level.

After failing to raise rates in October, the Federal Reserve shifted its stance and began advocating for a rate hike in December.

Gold Price Chart - (Oct 1st, 2015 - Dec. 31st, 2015)

In early December the markets expected the ECB (European Central Bank) to increase Quantitative Easing at a December 3rd meeting. The ECB's announcement disappointed markets which caused a small spike in the price of gold.

Following the Fed's announcement that it was raising rates by 25 basis points (0.25%), gold traded sideways for the rest of the year. In its sideways movement, gold's price briefly touched the $1045 price level twice while staying above it, making it a new support level.

Gold Price Chart - (Oct 1st, 2014 - Dec. 31st, 2015)

Gold's price support levels currently sit at $1045 and $1000, and its price resistance levels sit at $1180 and $1350.

Gold Price Chart - 10year - (Jan 1st, 2006 - Dec. 31st, 2015)

Back to Order of Analysis and Commentary

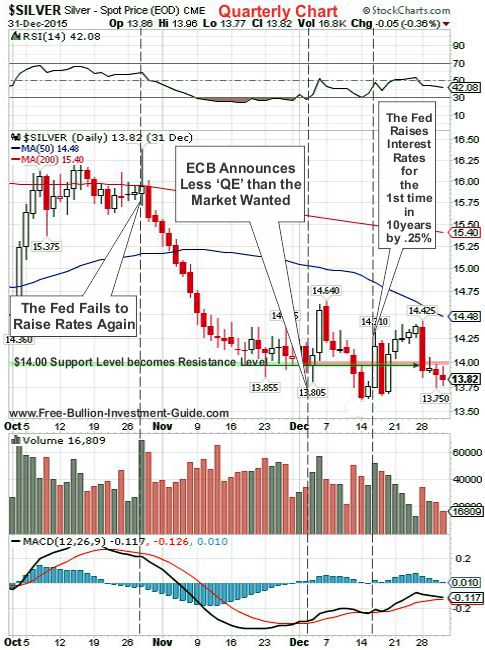

Silver Price Charts - 4th qtr. of 2015

Silver Price

Silver's price chart for the 4th quarter of 2015 looks almost identical to gold's price chart and the rest of the precious metals.

Like gold, silver's movement was mostly dictated by the actions of central banks.

Silver Price Chart - 3rd Quarter - (Oct 1st, 2015 - Dec. 31st, 2015)

In mid-November the price of silver fell to its support level of $14.00 a troy ounce.

The $14.00 price support level for silver was identified in last quarter's silver charts here: Silver Charts - 3rd Qtr 2015

Silver Price Chart - (Oct 1st, 2015 - Dec 31st, 2015)

Bullion News

Highlighted in the 10-year chart below are Silver's long and short-term support and resistance levels.

Silver Price 10-year Chart - (Jan 1st, 2006 - Dec. 31st, 2015)

Bullion News

Back to Order of Analysis and Commentary

ExpressGoldCash - 4.9 star - Customer Reviews

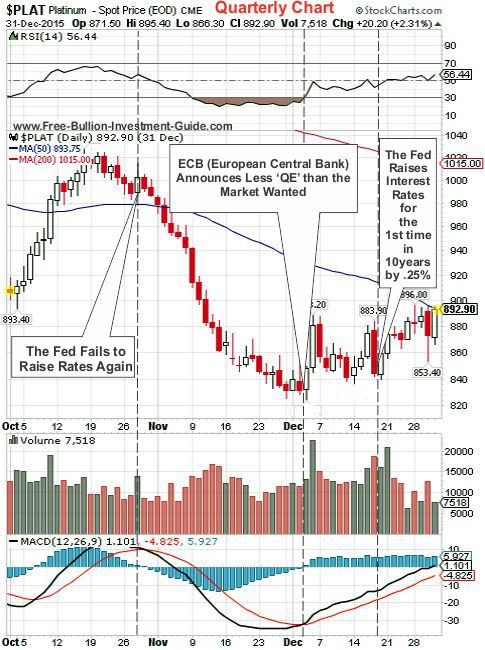

Platinum Price Charts -

4th qtr. of 2015

Platinum Price

Although Platinum and Palladium are more affected by industrial market forces than gold and silver, all the quarterly charts for the precious metals look very similar.

The reason for this has everything to do with the Federal Reserve and ECB (European Central Bank). (continued...)

Platinum Price Chart - 4t Quarter - (Oct. 1st, 2015 - Dec. 31st, 2015)

Bullion News

Although the price of Platinum moved to a high of $1020 and fell briefly below $840, it started and ended the 4th quarter of 2015 in the low $890s.

Platinum's resistance level sits at $1040 a troy ounce. In the 1-year chart (below), we see that the price of Platinum continues to make lower lows and it seems that it has not found a bottom yet.

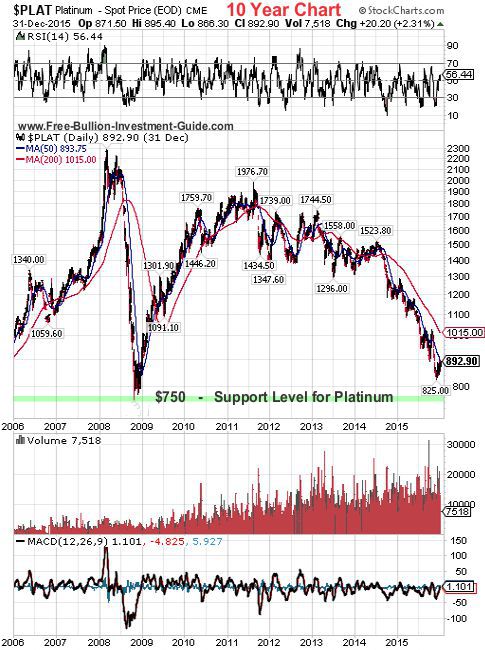

So, we need to look at a longer-term chart to find a solid support price for the price of platinum. In the 10-year chart below, Platinum's support level sits at its 2008 low of $750 a troy ounce.

Perhaps if the price of Platinum hasn't found its bottom yet, it will find it somewhere between where it is now and $750.00.

Platinum Price Chart - (Oct 1st, 2014 - Dec. 31st, 2015)

Platinum Price Chart - (January 1st, 2006 - December 31st, 2015)

Bullion News

Back to Order of Analysis and Commentary

Free Shipping on Orders $199+ | 5.0 star Customer Reviews

Palladium Price Charts -

4th qtr. of 2015

Palladium Price

The Federal Reserve and the ECB's actions, indicated in the chart below, dictated palladium's price in this quarter.

Palladium is primarily an industrial metal, which is why this movement in palladium is rare, because supply and demand factors usually affect these metals more so than monetary factors. (continued...)

Palladium Price Chart - 4th Quarter - (Oct. 1st, 2015 - Dec. 31st, 2015)

Bullion News

Palladium Price Chart - (October 1st, 2012 - December 31st, 2015)

The charts above are provided by the courtesy of StockCharts.com.

Back to Order of Analysis and Commentary

4th Quarter - 2015

Bullion News & Commentary

The Quarterly News starts with the end of the quarter articles, first.

Please note that not all of the links below work; the links are kept because the headlines provide insight into how the markets were moving at the time.

12/31/2015 - Bullion News

HAPPY NEW YEAR!

VIDEO : CNBC - Santelli Exchange: Disappointing Chicago PMI

CHARTS : McClellan Financial - Dallas Fed’s Signs of Recession

CHARTS : NIA - U.S. Dollar Finishes 2015 as World’s Second Most Overvalued Currency

Sunshine Profits - November U.S. Consumer Spending and Gold

Pension Partners - When to Fear High Yield

Dana Lyon's Tumblr - The Good, The Bad & The Ugly of 2015

INFO~GRAPHICs : Visual Capitalist - Visual Capitalist’s Top 15 Infographics of 2015

12/30/2015 - Bullion News

FXStreet - 'Fed to Rein Back on Expectations of Tightening, Could Constrain USD Strength in 2016'

CATO Institute - The War against Cash, Part II

INFO~GRAPHIC : Value Walk - Keynesian vs. Austrian Economics

Bullion Vault - Fed Goes Crackers as 2016 Begins

TECHNICAL ANALYSIS : Investing - Silver To Lead Gold In 2016

CNBC - The bond market is sending off a troubling signal

TECHNICAL ANALYSIS : Lance Roberts - Technically Speaking: 2016 Outlook

Barrons - WSJ: Are Streaming Deals Drying Up for Mining Companies?

IRD - Why The Government Hates Gold

The BRICS POST - Despite US pressure, Philippines to sign on to new China-led bank

12/29/2015 - Bullion News

Motley Fool - These Billionaires Are Betting Big on Gold in 2016

Paul Nathan - Looking Forward: 2016 A Year Of Resolution

News Fulton County - India: Love for Gold Increases with Buying Spree - India’s gold imports are set to surpass 1,000 tons, in 2015 following a slide in global prices in recent months, according to the All India Gems and Jewellery Trade Federation.

Bullion Vault - The Cost of Mining Gold Globally Can't Bear $1000 Per Ounce...

The Gold Report - 2015: A Year of Investing Perspective

SAXO Group - COT: All commodity sectors but metals sold following US rate hike

TECHNICAL ANALYSIS : Trader Dan's World - Precious Metals COTs Feature Short Covering

Daily Wealth - Junk Bonds are the Canary in the Coal Mine

Bloomberg - U.S. Companies Led the World in 2015 Debt Defaults, S&P Says

Business Insider - The Bond Market Exodus is Accelerating

Zero Hedge - The Big Short's Michael Burry Warns "The Little Guy Will Pay" For The Next Crisis

Profit Confidential - Inflation in U.S. Economy: IS a Stock Market Correction Coming in 2016?

Market Watch - Peter Lynch, 25 years later: it’s not just ‘invest in what you know’

12/28/2015 - Bullion News

Market Watch - Opinion: Fed Gradualism sets Us Up for Another Financial Crisis

Sunshine Profits - The U.S. Junk Bond Market and Gold

Money Metals Exchange - Money Metals Issues 2016 Gold/Silver Forecast

CATO Institute - The War against Cash, Part I

VIDEO : CNBC - Santelli Exchange: Manufacturing the Canary in the Coal Mine?

Alhambra Investment Partners - US Trade Data Shows Unites Foreign And Domestic Production In Recession

INFO~GRAPHIC : Fix the Debt - Washington Digs a Deeper Debt Hole

Financial Sense - Jeff Christian Offers his Thoughts on the Gold Market in 2016

The Deviant Investor - Gold & Silver or Meth & Madness

TECHNICAL ANALYSIS : The Gold and Oil Guy - When Will They Bottom? Oil, SP500, then Exxon Mobil

VIDEO : Visual Capitalist - How the U.S. Dollar Spread Across the World

Daily Mail - Gold plates and coins among valuable haul unearthed by archaeologists at 2,000-year-old royal tombs in China

Daily Wealth - Why I Forgave a Big Debt

12/27/2015 - Bullion News

TECHNICAL ANALYSIS : Decision Point - S&P 500 Q3 Earnings Results: Market Overvalued

TECHNICAL ANALYSIS : Lance Roberts - Technically Speaking: It’s Now Or Never For Santa

Zero Hedge - The Credit Crunch Is Back: Banks Scramble To Collateralize Loans To Record Levels

Forbes - The History of "Gold" Is Really The History Of The Gold/Silver Complex

Inside Futures - Silver is Giving Off Mixed Messages...

Business Standard - World Silver Council to Set Silver Standard in India Soon

FAKE GOLD ALERT : KSLA (Texas) - Texas Man sells Counterfeit Money and Fake Gold Coins on Craigslist

CoinWeek - The Platinum American Eagle: A Study in Nobility

Zero Hedge - Exclusive: "And It's Gone... It's All Gone" - The One Gold Scandal That Goes To The Very Top

CoinWorld - Top 10 Stories of 2015: Another American Eagle silver sales record

AUDIO : Financial Sense - Jim Puplava’s Big Picture: Look-Back 2015

The Daily Reckoning - What is the Impossible Trinity?

CHARTS : The Speculative Investor - Precious Metal Related - Charts of Interest

The New York Times - In Sweden, a Cash-Free Future Nears

The Independent - 13 bad habits you should break in 2016 to be more productive

12/25/2015 - Bullion News

MERRY CHRISTMAS!

12/24/2015 - Bullion News

Zero Hedge - The Fed Has Created A "Monster" And Just Made A "Dangerous Mistake," Stephen Roach Warns

GoldMoney - Why the Fed Will Never Succeed

GoldReporter.de - Russia secures gold from - Google Translation Link

VIDEO : CNBC - Rick Santelli Offers Some Insight on Commodities

TECHNICAL ANALYSIS : TheGoldandOilGuy - Closed Another Winning Trade And New Forecast

CHART : Dana Lyon's Tumblr - 140 Year Old Stock Streak In Jeopardy

CARTOON : Hedgeye - Ebenezer Screwed

Ron Paul Institute - Do We Need the Fed?

CHARTS : ValueWalk - Which President Wins the Jobs Per Debt Picture?

OP-ED : The New York Times - AMERICA’S equity markets are broken

12/23/2015 - Bullion News

TECHNICAL ANALYSIS : Notes from the Rabbit Hole - Precious Metals: A Positive Big Picture View of Risk vs. Reward

VIDEO : CNBC - Santelli Exchange: Fed's forward guidance

Doug Short - NYSE Margin Debt Rose Fractionally in November

Market Watch - Most Americans have less than $1,000 in savings

AUDIO : Jay Taylor - David McAlvany - Can We Depend on Fed Omniscience into 2016?

Bullion Vault - 2016 Team Change at the US Fed

VIDEO : Bloomberg - Wells Fargo Managing Director George Bory and HSBC Precious Metals Analyst James Steel discuss the global jewelry business and precious metals

Scrap Monster - India’s Silver bar imports surged 38% in November

AUDIO : McAlvany Weekly Commentary - Your Questions Answered 2015 – Part 3

Notes from Underground - Notes From Underground: All Quiet On The Western Front … Not

INFO~GRAPHIC : Visual Capitalist - The World’s Strangest Currencies

12/22/2015 - Bullion News

Junk Bond Crisis Starts to Metastasize w/ John Rubino

A Must See for Those Who Want to Understand

How the Junk Bond Market will Effect Us...

Sure Money Investor - Sorry, Barron’s… The High Yield Bond Rout Is Just Beginning

VIDEO : CNBC - Rick Santelli speaks to James Grant, Grant's Interest Rate Observer, about the impact of low interest rates on the economy.

VIDEO : Kitco - Why Jim Rickards Thinks The Fed Will Ease Next Year

Financial Express - India : Gold remains up on global cues, jewellers buying

The Deviant Investor - Silver: May the 100 Year Force Be With You

BullionStar - Australia Gold Export To China In August A Record 13t

CHART : SoberLook - Are US house prices once again growing at an unsustainable rate (>6% YoY)?

The New York Times - Crony Capitalism at Work - Sued Over Old Debt, and Blocked From Suing Back

Smithsonian - From Teeth to Toilets, This Dazziling Exhibit of Gold Artifacts Has the Midas Touch

BGASC - Customer Reviews link

12/21/2015 - Bullion News

PLATA - Is Bloomberg Hiding Something?

Zero Hedge - Step Aside Gold: There Is Something Else The Hedge Fund Community Hates Even More

Sunshine Profits - Is Recent U.S. Economic Data Positive for Gold?

SAXO Group - Gold jumps as hedge funds exit shorts and ETP buyers return

Hedgeye - Repeat After Me: Deflation Is Not Transitory

Non-Dollar Report - Junk Bond Crisis or Opportunity?

Numismaster - Do Grams or Ounces Win?

GOLD & SILVER NANO : Photonics - Plasmons, Confocal Microscopy Produce 3D Images of Neurons

Alhambra Investment Partners - The Confidence Game Is Ending

Hussman Funds - Reversing the Speculative Effect of QE Overnight

Dollar Collapse - The Dominoes Keep Falling: Leftward Lurches And EM Defaults

Money Metals Exchange - Republicans Deliver for Obama, Betray Sound Money Voters

Mirror - Playboy poker ace Nigel Goldman convicted of eBay gold coin con at centre of Spanish fraud probe

12/20/2015 - Bullion News

Business Insider - Here's What You Need to Know about High-Yield Bonds — and Why They're Freaking Everyone Out

VIDEO : Fox Business - Congress - the New Facilitator of QE

AUDIO : Financial Sense - Jim Puplava’s Big Picture: Back to Ground Zero

VIDEO : Yahoo Finance - Jim Rickards: The Fed made a historic mistake

AUDIO : Peak Prosperity - Dan Amerman: Financial Repression & The New Interest Rate Hike

BullionStar - The Chinese Gold Market Essentials Guide

jmydigitalfc - Temples weigh gold monetisation, but 'melting' a dampener

SoberLook - Negative Interest Rates for Canada?

12/18/2015 - Bullion News

The Felder Report - Why You Should Be Worried About The Junk Bond Rout

Sunshine Profits - Do Inflation Indicators Drive the Prices of Gold?

McClellan Financial - Fed Still Behind The Power Curve

INFO~GRAPHIC : Visual Capitalist - All of the World’s Money and Markets in One Visualization

PDF : Gold Standard Inst. - December Journal Issue of the Gold Standard Institute

Wealth Daily - Bank Welfare: The Rate Hike

RIP-OFF ALERT : 3News (Las Vegas) - New con artists find wealth in old coins

Money Metal Exchange - Silly Myths about Gold during Rising Interest Rates

Market Watch - Why Fed interest-rate hike may not melt gold

Sovereign Man - In a free country, Martin Shkreli Should be Free to Act Like a Complete Asshole.

12/17/2015 - Bullion News

The Daily Reckoning - The Market's Gamblers Are Pumping Air

TECHNICAL ANALYSIS : Kimble Charting - Fed make a mistake yesterday? This might answer that question!

VIDEO : CNBC - Cashin: The spill out from the Fed rate hike still to come

Bloomberg - The Accidental Distressed Debt Fund

The New York Sun - Rube Goldberg’s Fed?

VIDEO : ERCI - Interview on Implications of Fed Rate Hike

Wall Street on Parade - What Caused the Stock Market to Rally on a Rate Hike

The Deviant Investor - Gold Thrives, Paper Dies

SRSrocco Report - U.S. Silver Production Plunges

Casey Research - Is the “Easy Money Era” Over?

AUDIO : BullionStar - Interview Koos Jansen By Lars Schall, November 2015

GoldReporter.de - The Russian VTB Bank has agreed with the China Construction Bank co-operation, which should boost the gold trade between the countries.

CoinWeek - Bullion Sales Tax Series, State by State: Pt. 1

12/16/2015 - Bullion News

United States Mint - UNITED STATES MINT AMERICAN EAGLE SILVER BULLION COIN SALES REACH ALL-TIME HIGH

Alhambra Investment Partners - Same Institution, Different Worlds: Fed Set To Declare Full Recovery On Same Day It Declares Recession Through IP

Market Watch - Bernanke says Fed Likely to Add Negative Interest Rates to Recession-Fighting Tool Kit

Market Watch - Bernanke says Fed likely to add negative interest rates to recession-fighting tool kit

INFO~GRAPHIC : Visual Capitalist - The Properties of Money

Reuters - Gold rises more than 1 percent ahead of Fed rate hike decision

CHARTS : NIA - We Are at End of Dollar Rally – Not the Beginning!

TECHNICAL ANALYSIS : Market Anthropology - Chasing Mavericks

AUDIO : McAlvany Weekly Commentary - Rates Rise, Who Dies? Complements of Yellen

CHARTS : Advisor Perspectives - Brace Yourself: Our Latest Look at Student Debt

VIDEO : SAXO Group - Outrageous Predictions 2016: Hansen - Gold Fades in the Glare from Silver

Bloomberg - This Junk Bond Derivative Index Is Saying Something Scary About Defaults

AUDIO : Peak Prosperity - Grant Williams: The End Of The Road

CoinWeek - NGC Signs Coin Designer and Ex US Mint Chief Engraver John M. Mercanti to Exclusive Signature Label Deal

12/15/2015 - Bullion News

CoinNews - Silver Lowest Since July 2009; Silver Eagle Record Tops 46.6M

Alhambra Investment Partners - Inventory Out of Control Everywhere

AUDIO : FSN - John Rubino – Look Out Below: The Junk Bond Market is Imploding

Daily Reckoning - Tomorrow Will Be a Watershed Moment for Financial Markets

The Technical Traders - The Crash of Junk Bonds is Indicating Something that Has Yet to Happen in the Stock Market!

GoldBroker - Gold: “The Canary of the Currency Markets”

CoinWeek - Oh, Canada: Canadian Coins “Natural” Alternative to U.S. Coins, Pt. 2

MoneyBeat (WSJ) - The Government’s Financial Watchdog Just Warned Us That Another Third Avenue-Style Bond Fund Run Is Likely

Juggling Dynamite - Canada’s New Mortgage Rules Offer Teachable Moment

Zero Hedge - Foreigners Sell A Record $55.2 Billion In US Treasuries In October

CHARTS : Advisor Perspectives - The Fed's Financial Accounts: What Is Uncle Sam's Largest Asset?

VIDEO : MoneyBeat (WSJ) - The Risks Facing the Fed

The Deviant Investor - Silver: Until Paper Currencies Stop Losing Value

The Speculative Investor - Unintended Consequences

International Man - Should You Think Like an Indian?

12/14/2015 - Bullion News

Hussman Funds - Deja Vu: The Fed's Real "Policy Error" Was To Encourage Years of Speculation

The Felder Report - Owning Stocks Today Is Risking Dollars To Make Pennies

TECHNICAL ANALYSIS : Northman Trader - Get High Or Else!

VIDEO : Hedgeye - Why Raising Rates (Even One Basis Point) Right Now Is a Really Bad Idea

Sure Money - Who’s Ready for the Fed to Chicken Out Tomorrow?

CHARTS : twitter - Gold Shorts hit Extremes

Money Metals Exchange - Why Are Gold/Silver Prices Falling Despite Demand?

The Cobden Centre - Paper Money versus the Gold Standard

Reuters - India's Gold Jewelers Delay Purchases, Waiting on Fed Move

12/13/2015 - Bullion News

CHARTS : BAWERK - How Peak Debt Constrain the Fed from Moving Rates Higher

TECHNICAL ANALYSIS : Clive Maund - THE GREAT TRAIN WRECK OF 2016...

TECHNICAL ANALYSIS : Kimble Charting - Eiffel Tower pattern, could impact stocks big time, says Joe

CHARTS : GoldSeek - The Effect of a Fed Rate Hike on Precious Metals

AUDIO : Financial Sense - Jim Puplava’s Big Picture: One and Shut Up

TECHNICAL ANALYSIS : Mella - twitter : Gold - When Will You Get Out of Bed?

Mises Institute - Why Gold-Backed Money Doesn’t Bring Booms and Busts

The Speculative Investor - The Ridiculous and Relentless Fuss Over the COMEX Gold Inventory

AUDIO : Money Metals Exchange - Global Supply Deficit Widens Dangerously; David Smith Says Soon “Could Be Too Late to Take Advantage”

Value Walk - The Misunderstanding Of Peter Lynch’s Investment Style

12/11/2015 - Bullion News

"The Fed is Completely Screwed and in a Box it Cannot get Out of." - Peter Boockvar of The Lindsey Group

Bloomberg - Yum's Bonds Cut to Junk at Standard & Poor's on Buyback Plan

Market Watch - Why the junk bond selloff is getting very scary

CHARTS : SRSrocco Report - IMPORTANT SILVER KEY FACTORS: 3 Must See Charts

McClellan Financial - Is this 2012, or 2008?

Sunshine Profits - Does Employment Situation Report Move the Gold Price?

GoldReporter.de - Austria's Central Bank Announces Closing: 1,200 gold bars arrived

CoinWorld - China modifies weights for Panda bullion coins beginning in 2016

12/10/2015 - Bullion News

Daily Reckoning - The Fed’s Painted Itself Into The Most Dangerous Corner In History - Why There Will Soon Be A Riot In The Casino by David Stockman

Alhambra Investment Partners - A Very Disturbed Global ‘Dollar’

PDF : Leuthold Weeden - DJ Transports: Still Sounding Broad Market Warning

CARTOON : Hedgeye - Over The Cliff?

Bloomberg - JPMorgan: The Fed Could Trigger a 'Massive Stop Loss Order' in the S&P 500 if Liftoff Goes Awry

CoinNews - US Mint Sales: Saratoga Quarter and Coin Products Debut

Diamond World - India - IBJA to launch first physical gold exchange by next year

GoldMoney - The Indian government made headlines recently with its attempts to obtain possession of the gold held by its citizens

CHARTS : Advisor Perspectives - What Would It Take for the Prime U.S. Workforce to Fully Recover?

12/09/2015 - Bullion News

U.S. Global Investors - An Illustrated Timeline of the Gold Standard in the U.S.

Gold-Eagle - Rising Interest Rates? Watch for Higher Gold Prices

Sunshine Profits - U.S. Senate Agrees on Highway Bill. Will It Affect Gold?

CHARTS : Zero Hedge - Carnage In Currency-Land - Dollar Dump Sparks Stock Slump

Dana Lyons - Good News: Gold Speculators Haven’t Been This Gloomy In 13 Years

VIDEO : Bloomberg - Credit Worries: The Divergence Between Stocks, High Yield

CoinNews - Gold Edges Up; 2015 Silver Eagles Pad Record Atop 45.7M

CHARTS : Perth Mint Research - China Accelerates Gold Reserves Accumulation

TECHNICAL ANALYSIS : The Street - One Chart Reveals a Possible Positive Future for Gold

AUDIO : McAlvany Weekly Commentary - Marc Faber: Precious Metals represent the Best Value Today

Deviant Investor - Dishonest Money Will Die – I Hope

Mises Institute - Government Debt Is Not Like Private Debt

Zero Hedge - The IMF Just Entered The Cold War, Forgives Ukraine's Debt To Russia

12/08/2015 - Bullion News

CoinWeek - U.S. Mint May Now Change Coin Silver Composition Thanks to New Law

CoinNews - US Mint to Stop Making 90% Silver Coins

TECHNICAL ANALYSIS : Kimble Charting - Double Top in the S&P 500 in play, repeating 2000 & 2007 pattern?

GOLD~NANO : dvids - Camouflaged Nano-Sniper Targets Deadly Toxins

GoldReporter.de - Perth Mint Gets Competition

Reuters - Indian industry group to launch first physical gold exchange

NewsMax - US Mint Silver Bullion Coin Sales Sets New Record

Peak Prosperity - The Screaming Fundamentals For Owning Gold

Numismaster - Avoid Scams, Know Options

CoinWeek - United States Wins 2016 Coin of the Year Award

12/07/2015 - Bullion News

Market Watch - The Fed’s Argument for Higher Interest Rates Doesn’t Add Up

CHARTS : Hambone's Stuff - Federal Deficit Spending, Fed Funds Rates + QE, & Recessions

Hussman Funds - From Risk to Guarded Expectation of Recession

Kitco - For The Second Consecutive Week, Hedge Funds Hold Record Short Bets In Gold – CFTC

Zero Hedge - BIS Warns of ‘Uneasy Calm’ in Markets Before Possible Debt Storm

GOLD~NANO : Imperial College - Scientists are investigating whether microscopic gold beads could make chemotherapy more effective, and reduce side effects for patients.

Notes from Underground - Unemployment Report Spot-On and Meaningless; Draghi Doesn’t Disappoint

VIDEO : CNBC - Santelli Exchange: China's bleeding FX reserves

GoldReporter.de - China increased gold reserves in November on strong

BullionStar - China’s Gold Army

International Man - Weimar Greece - The Effects of a Currency Collapse

COOL : Controlled Environments - GOLD NANO~PARTICLES : Stained Glass Could Change Colors at Flip of a Switch

12/06/2015 - Bullion News

Thoughtful Cynic - The Central Bankers are Doubling Down, either on Stupid or on Malicious

CHART : twitter - Eric Pomboy : Gold - Largest Short Covering Episode on Record

TECHNICAL ANALYSIS : Decision Point - Is Gold Starting New Rally...?

Wall Street on Parade - Junk Bonds Having Worst Year Since 2008 Crisis: Three Red Flags

CHART : NIA - U.S. Corporate Debt Crisis

Zero Hedge - "Hollow Markets"

CARTOON : Hedgeye - The Little Engine that Should'nt

TECHNICAL ANALYSIS : Trader Dan's World - Gold …The Why Behind the Pop .

Global Financial Intelligence - Interview with Jim Rogers - I'll buy gold before the bubble bursts Dollar - Google Translation Link

Reuters - Uneasy calm in markets about upcoming U.S. rate increase, BIS says

The Guardian - Holy Grail of Shipwrecks Caught in Three-Way Court Battle

Free Shipping on Orders $199+ | 4.9 star Customer Reviews

Affiliate Ad

12/04/2015 - Bullion News

Gold-Eagle - Cash & Gold: The Next Best Investments

CHARTS : Juggling Dynamite - Friday Funnies

The Telegraph - Gold has lost its lustre over the past couple of years, but some professional investors are hanging on – here they explain why

CoinWorld - Demand drives silver American Eagle to new heights, new record

Liberty BlitzKrieg - Indian Government Fails to Get Citizens’ Gold, So it Shifts Focus to Temple Stash

Profit Confidential - Interview with SilverGoldBull Managing Partner - Mihali Belandis

GoldReporter.de - Representatives of Islam are planning jointly with the World Gold Council, a new legal framework for the Sharia-compliant use of gold as part of investments and financial transactions

TECHNICAL ANALYSIS : Market Anthropology - Connecting the Dots - 12/4/15

BullionStar - Renminbi Internationalization And China’s Gold Strategy

VIDEO : Kitco - Adding Chinese Yuan To SDR Basket Is A ‘Mistake’ By IMF Says Professor

Wealth Daily - China Hits the Big Time

12/03/2015 - Bullion News

Money and Markets - ECB’s Draghi Fails to Deliver Enough Monetary Drugs; What Next for Markets?

INFO~GRAPHIC : Visual Capitalist - How are Silver and Gold Bullion Premiums Calculated?

CHARTS : McClellan Financial - Positive Signs in Gold's Dreary Charts

BUSTED : Santa Monica Mirror - Santa Monica Company (Merit Gold and Silver/ Merit Financial) Busted For Tricking Customers Into Buying Overpriced Coins

CoinNews - Gold and Silver Bounce from Multi-Year Lows

VIDEO : ABCnews (Australia) - Extended interview with Jim Rickards about China, SDRs and Gold

Market Watch - Bill Gross thinks Fed, ECB are ‘casinos’ printing money

GOLD~NANO : Light 2015 Blog - Radiation and Gold Nanoparticles Working Together for the Image-Guided Radiotherapy

The Deviant Investor - Silver: We NEED it!

AUDIO : McAlvany Weekly Commentary - Your Questions Answered 2015 – Part 2

VIDEO : CNBC - Rick Santelli discusses the latest action in the bond market, and the U.S. dollar after the ECB's announcement on QE and interest rates.

CHART : Perth Mint - November 2015 - Monthly Sales

Numismatic News - Big Changes for Mint bullion coin sales

China - A Woman Accused of Trying to Smuggle Thousands of Gold and Silver Commemorative Coins from Hong Kong into Shanghai

12/02/2015 - Bullion News

Sunshine Profits - Will It Be a Volatile Week for Gold?

VIDEO : Hedgeye - The Astonishing Audacity of Central Planners

Market Watch - Yellen moves Fed to brink of December rate hike - She said Fed officials would review all of the data released up until the meeting starts. But she nonetheless left little room for doubt that she will support an interest-rate increase.

ECRI - Macroeconomic Sightings

GoldCore - Gold Is Real Money That Protects The Wealth of Nations

TECHNICAL ANALYSIS : Clive Maund - Latest Gold COTs MOST BULLISH FOR 14 YEARS, and call for a sizeable tradable rally soon...

The Sovereign Investor - Prepare for Negative Interest Rates With Gold

CANCER RESEARCH : Science Newsline - Liquid Metal 'Nano-terminators' Target Cancer Cells

Bloomberg - Dollar Risks Grow as Hedge Funds Make Greenback Most Favored Bet

CNBC - Companies' mad dash for debt hitting record levels

BullionStar - Silver Maple Leaf Sales Surge 76 % Y/Y

Perth Mint Research - Gold and silver coin sale diverge

Reuters - Indian Government official floats idea of national gold exchange

Mirror - 'Murder' mystery of mother and son found dead just weeks after inheriting a $500,000 gold bar

12/01/2015 - Bullion News

CoinNews - Gold Dips, Saratoga 5 Oz Bullion Coin Sells Out

CoinWorld - Mint sells last of 2015 American Eagle 1-ounce gold bullion coins

VIDEO : CNBC - Santelli Exchange: How raising rates is like melting ice cream

BullionVault - Western Gold & Silver Investment Turns Asian

Kitco - CFTC Data Show Funds Still Adding Short Positions; Analysts See Short-Covering Potential

GOLD~NANO : NanoScale Research Letters - Gold Nanoparticle Conjugates as Potential Therapeutic Agents for the Treatment of Acute Myeloid Leukemia

The Deviant Investor - NEW Fiction: Who Killed Doctor Silver Cartwheel?

CHARTS : NIA - Warning Signs are Showing Up on Some Economic Charts

News Moving Markets - Puerto Rico Avoids Defaulting On Guaranteed Debt, But "Claws Back Revenues Pledged To Specific Bonds"

Bloomberg - Five China Bond Deadlines to Watch

Brookings - China's Gold Star - in this essay by Ben Bernanke he reveals some weaknesses that could arise in the U.S. Dollar, if things don't go as he thinks

Finance Magnates - Chinese Yuan a Few Steps Closer to Global Reserve Currency Status

BullionStar - What Happened To The Shanghai International Gold Exchange?

11/30/2015 - Bullion News

SAXO Group - Read Your History – The Dollar Will Fall After the Hike

munKNEE - Once Gold & Silver Bottom Which Will Be the Better Investment?

CoinNews - Gold, Silver Plunge in November; US Mint Coin Sales Surge

VIDEO : CNBC - Rick Santelli explains what Today's Chicago PMI by the Numbers Mean

The Felder Report - Margin Debt-to-GDP Rises Back To The Level Of Prior Bull Market Peaks

CHARTS : Doug Short - NYSE Margin Debt Rose in October

Notes from Underground - All My Words Come Back To Me

The Speculative Investor - The Fed’s Massive and Unprecedented Shift

CEO.CA - Gold Futures Speculators Capitulate

The Economist - CHINA’S Domestic Bond Market has Never Been Riskier

Bloomberg - U.S. Junk Bonds See Highest Distressed Ratio Since '09, S&P Says

CoinWeek - The Coin Analyst: The American Silver Eagle Turns 30

Money Metals Exchange - Treasury Secretary Makes Sad Admission about Coinage Devaluation

Reuters - IMF gives China's currency prized reserve asset status

The New York Times - With Shipwreck Treasure Easier to Reach, a Duel Is On

11/29/2015 - Bullion News

BAWERK - Unintended Consequences of Lift-Off in a World of Excess Reserves

AUDIO : ValueWalk - How Paul Volcker Beat Inflation Of The 1970s - Includes a Interview with Volcker

CHARTS : Alhambra Investment Partners - Bond Complacency

CHARTS : NIA - Record Low Bond Market Liquidity

CHART : The Short Side of Long - Next Move For US Treasury Rates

VIDEO : Gordon T. Long - FALSE PERCEPTION OF LIVING IN A WORLD OF INFINITE CREDIT - FRA w/Alasdair Macleod

The Buffalo News - Ellicottville Artist’s Image for 'America the Beautiful' Coin chosen by U.S. Mint

AUDIO : Financial Sense - Felix Zulauf and Marc Chandler Weigh in on Currency Wars and the Chinese Devaluation

CNBC - IMF expected to include yuan in SDR currency basket

Perth Mint Research - The Beer Economy

Casey Research - The World’s First Cashless Society Is Here - A Totalitarian’s Dream Come True

Market Watch - Should I convert my traditional IRA to a Roth?

11/27/2015 - Bullion News

The Speculative Investor - Stealing Deflation

Zero Hedge - Gold Plunges Below "Crucial Level", Lowest Since Oct 2009 On $2 Billion Notional Flush

What Investment - Why we have bought 'a little bit of' gold for our portfolios, by veteran investor

CHARTS : Doug Short - Market Cap to GDP: A Fractional Decline in the Buffett Valuation Indicator

Market Watch - A tribute to Richard Russell, who edited Dow Theory Letters for 57 years

GoldReporter - India: record gold imports expected from 1,000 tons

AUDIO : Money Metals Exchange - Special David Morgan Interview on Manipulation, Fiat Money Unraveling, and Silver

11/26/2015 - Bullion News

Zero Hedge - Giving "Thanks" To The Fed - Holiday Dinner Has Never Been More Expensive

CHARTS : McClellan Financial - Debt vs. Equity

MoneyBeat - Why 2015 Might Be Like 1937 for Stocks

TECHNICAL ANALYSIS : COMMERZBANK - PDF : Bullion Market Technical Analysis

Cobden Centre - Money supply versus money demand

GOLD-NANO : Medical Daily - Using Enzymes Attached To Nanoparticles, New Technology Could Diagnose Stroke In 10 Minutes

CHARD - 19 Ways to Identify a Fake Coin

FXEmpire - Gold, Silver & Platinum Fundamental Analysis – November 26

SRSrocco Report - Silver Eagle Sales To Hit Record… U.S. Mint 2015 Production To Halt Dec 11th

Royal Canadian Mint - Royal Canadian Mint Bullion and Numismatic Sales Continue to Drive Business Line Profits in the Third Quarter

AUDIO : McAlvany Weekly Commentary - Your Questions Answered 2015 – Part 1

Reuters - Indian gold demand seen falling to eight-year low in festive quarter

MINING - Platinum, palladium prices break fall

11/25/2015 - Bullion News

Library of Economics & Liberty - The Fed is Above the Law

EconMatters - The Federal Researve - A Break-down of its Current Situation

VIDEO : Hedgeye - McCullough: What QE Actually Did Was Pay The Few And Crush The Many

VIDEO : The Daily Bell - Dysfunction at the Fed

VIDEO : CNBC - Rick Santelli says "Fed Policy Needs an Upgrade"

Zero Hedge - Atlanta Fed Slashes Q4 GDP Forecast

GOLD~NANO : HNGN - Researchers Develop Breakthrough Sensors For Artificial Skin That Can Heal Itself

CoinWorld - 1996 American Eagle silver coin popular, now: Making Moderns

CoinNews - 2015 Proof Platinum Eagles on Dec. 3, No Bullion Edition

PHYS.org - A New Form of Real Gold, Almost as Light as Air

Money Morning - The Best Way to Buy Gold Coins

Action News Now - Scammers trying to sell fake gold in San Francisco Bay Area

11/24/2015 - Bullion News

CoinNews - 2016 American Silver Eagle Release, Last 2015’s for Record

Bullion Vault - The Myth of Gold Standard 'Deflation'

AUDIO : CoinWeek - CoinWeek Podcast : Mexican Libertad Gold and Silver Bullion Coins of 2015

CHARTS : NIA - Fed vs. ECB Shadow Rate

Cobden Centre - Zero Hedge: What Will Happen To Corporate Profits If The Fed Hikes In December

The Deviant Investor - You Can’t Eat Gold or a Debt Sandwich

TECHNICAL ANALYSIS : Clive Maund - PM SECTOR BIG GREEN LIGHT and LOW RISK ENTRY SETUP...

Bullion Star - Switzerland Gold Export China October 29t, +34% m/m

MINING - Most copper producers in Chile barely breaking even

Bloomberg - R.I.P. - Richard Russell, Publisher of Dow Theory Letters, Dies at 91

Real Time Economics (WSJ) - Should Treasury Ditch the Penny? It’s Under Review

The Daily Mail - A very decadent treat! Gold leaf Kit Kats to go on sale, costing $16 PER FINGER (but you have to live in Japan to taste one)

11/23/2015 - Bullion News

Dana Lyons' Tumblr - Global Shipping Rates Run Aground

Sunshine Profits - Baltic Dry Index and Gold

CHARTS : McClellan Financial - Housing Starts - Lumber’s Message

VIDEO : Juggling Dynamite - Commodities Slump as Greenback Ramps

Zero Hedge - Swiss Bank "Goes There", Applies Negative Rates To Retail Deposits

CoinNews - Gold, Silver at Multi-Year Lows; US Mint Coin Sales Robust

CHNGC - Analysis Edition Panda gold and silver commemorative coins 2016 outlook - Google Translation Link

New York Post - Fed’s ‘expedited meeting’ sends shivers through Wall Street

VIDEO : CNBC - Rick Santelli discusses the impact normalization could have on private and public markets.

Hussman Funds - Dispersion Dynamics

Adam H Grimes - Don't be This Guy...Pissing in the Wind

Bloomberg - Hedge Funds Are Back to Bearish on Gold as Price Slump Deepens

GoldReporter - Russia 18 tonnes of gold only treat in October - Google Translation Link

BullionStar - Reuters Spreads False Information Regarding The Chinese Gold Lease Market

The Daily Mail - Cops Search Property for Dead Body, Instead Discover $220,000 Fortune in Silver Bullion Bars and Coins

11/22/2015 - Bullion News

TribuneLive - Sketchy Bullion Retailers Pray on Un-Knowlegable Buyers

PDF : The Gold Standard Institute - Journal - November 2015

The New York Times - Eastern Gold Investing and The Glow of 24-Karat Gold Jewelry

GoldSeek - COT Gold, Silver and US Dollar Index Report - November 20, 2015

Yahoo Finance - Earnings haven't done this since the financial crisis

Zero Hedge - Here Is The Complete Scenario In Which The Fed Hikes Rates, Starts A Recession, And Launches QE4

BAWERK - What a Negative SWAP Spread Really Means

CoinNews - Gold Falls for 5th Week; US Mint Gold Sales Hit 12-Week High

Wealth Daily - Inflation and the Fed

Sunshine Profits - Is the Yield Curve a Driver of Gold Prices?

dna India - At paltry Rs 150 crore, gold bonds scheme fails to glitter

Numismatic News - Quarter, Tenth Bullion Gold Eagles Gone

VIDEO : Yahoo Finance - Gold and silver mines drowning: Silver Wheaton CEO

11/20/2015 - Bullion News

Reuters - Euro (and Gold) Weakens vs Dollar as Comments from ECB's Draghi Weigh

The Sovereign Investor - Prepare for the Bear

CHARTS : The Short Side of Long - Charts Gundlach Thinks Fed Should Worry About

VIDEO : CNBC - Rick Santelli Discusses the Impact of Jobs on the Bond Market with the Lindsey Group Chief Market Analyst Peter Boockvar

ECRI - Flashback to “Simple Math: ½% + ½% = 1%”

The Felder Report - Leveraged Loans Betray The Rally In Stocks

The Daily Bell - Egon von Greyerz on The Great Hiking Debate

VIDEO : RT - Interview with James Rickards on China, SDR and the End of the Business Cycle

Zero Hedge - Subprime Auto Lending Soars As Fed Report Shows Spike In Loans To Underqualified Borrowers

Sovereign Man - It’s happening: more US allies join the anti-dollar alliance

India RealTime - Modi’s Drive to Monetize Gold Doesn’t Shine

The Speculative Investor - Gold’s “commercial” traders are different because gold is different

U.S. Global Investors - 5 World Currencies That Are Closely Tied to Commodities

11/19/2015 - Bullion News

CoinNews - Gold Posts Gains; US Mint Gold Sales Continue Rally

MineWeb - Silver is Finding it Impossible to Decouple From the Pressure Experienced by Gold and Industrial Metals

VIDEO : Fox Business - Recon Capital CIO Kevin Kelly, Hedgeye Risk Management CEO Keith McCullough and FBN’s Dagen McDowell on the economy, markets and Federal Reserve policy.

Bloomberg - Money Managers Now Have a Record Proportion of Their Portfolio Dedicated to Corporate Bonds

Zero Hedge - "This Isn't Going To End Well" - Junk Bonds Under Pressure

Reuters - Modi's gold deposit scheme attracts only 400 grams so far

GOLD~NANO : News Medical - Simple MicroRNA Sensor Holds Promise for Prognosis, Treatment of Pancreatic and Other Cancers

GRAPHIC : ValueWalk - Most Americans Hit “Peak Income” More Than 15 Years Ago

Bloomberg - Chinese Savers Turn to Gold as Rest of the World Exits Holdings

McAlvany Weekly Commentary - Tragedy in Paris & Our Crucial Response

The Deviant Investor - Gold and the Reverse Goldfinger Effect

TECHNICAL ANALYSIS : Market Anthropology - Connecting the Dots

VIDEO : Sprott Global - Tekoa Da Silva Interviews GoldMoney's James Turk

Coin Update - Behind the Scenes at the U.S. Mint: “You Are There!”

11/18/2015 - Bullion News

CoinWorld - 2015 American Eagle Tenth-Ounce Gold Bullion Coin Sells Out

CoinNews - Gold Little Changed; US Mint Gold Sales Soaring

CHART : ECRI - Multiple Jobholders Boost “Full-time” Employment

VIDEO : Hedgeye - McCullough: Fed Needs An Economic Reality Check

Zero Hedge - FOMC Minutes Show Fed Is All-In For December Rate Hike (But Depends On Data)

CHART : Business Insider - GUNDLACH: This Could Be 'The Beginning of Something Big'

GOLD~NANO : AZO NANO - Gold Nanoprisms Based Sensor Can Detect Early-Stage Pancreatic Cancer

GoldReporter.de - Largest Gold Fund: These Big Banks Bought Vigorously

VIDEO : CNBC - Rick Santelli & James Grant : Rate Hike & Your Savings

The Deviant Investor - A Half-Century of Gold, War, and Costs

The Daily Reckoning - The Fed Will Not Kill Gold

TECHNICAL ANALYSIS : CEO.CA - A Seasonal Trade In Silver

The Fiscal Times - Americans Now Owe $1 Trillion in Car Loans

Vanguard - Gold Coins and Golden Hoofs Found in 2,000-yr-old Tomb

BBC - Hoard of precious clippings shaved from silver coins by 16th century crook found in Gloucestershire

11/17/2015 - Bullion News

VIDEO : CNBC - David Stockman tells CNBC what He thinks about the Markets

The New York Sun - The Yellen Letter Her letter is whiny, inaccurate, and threatening all at once, evincing an “it’s my ball and you can’t play with it” attitude.

CoinNews - Gold, Silver Hit Lows After Inflation Data

NIA - Stocks vs. Gold During Fed Rate Hike Cycles

ValueWalk - The Poisonous Cocktail Of Main Street Woes And Federal Reserve Liftoff

The Felder Report - History Rhymes: A Look At A Pair Of Popular Stock Market Analogs

11/16/2015 - Bullion News

The Daily Reckoning - The Shadow Rate Casts Gloom

VIDEO : CNBC - Jim Steel, Chief Commodities Analyst, HSBC : Gives His Analysis on Gold

FAKE BULLION ALERT : CoinWeek - Australia 2012 Year of the Dragon Silver Dollar

CoinNews - US Mint Limits Weekly Silver Eagle Sales to 900,000

Juggling Dynamite - Executives using buybacks to ‘exit stage left’

Bloomberg - Debt Market Distortions Go Global as Nothing Makes Sense Anymore

Zero Hedge - The Last Time Bond Bears Were This Short, Treasury Yields Collapsed

CoinNews - Gold, Silver Bounce from Lows; US Mint Bullion Sales Climb

BullionStar - SGE Withdrawals Break Yearly Record. World Gold Council Continues To Hide Insatiable Chinese Gold Demand.

Money Metals Exchange - Undeniable Truths about Precious Metals (Don't Forget These...)

GoldReporter.de - Discussed gold standard on Fed Meeting

The Guardian - How and Why we're flushing £13m of Gold Down the Plughole Each Year

Visual Capitalist - The Psychology of Prices

11/15/2015 - Bullion News

BAWERK - How the Fed gave away its independence – Interest Rate Sensitivity at ZLB

Hussman Funds - The Bubble Right In Front Of Our Faces

CoinWorld - Saratoga 5-ounce silver quarter dollar bullion coins next up

ECRI - 2008 Flashback: The Risk of Redefining Recession

Sunshine Profits - Do Credit Spreads Move the Gold Price?

Zero Hedge - What Hath The Fed Wrought?

TECHNICAL ANALYSIS : SOLARCYCLES - Approaching Resolution

The Non-Dollar Report - U.S. Dollar - Undeniably Strong… but for How Long?

The Telegraph - Gold Remains the Best Insurance for a Crisis

Reuters - China's yuan takes leap toward joining IMF currency basket

Bloomberg - What the Rise of the Yuan Means for the Global Economy

The New York Post - Raising minimum wage would cost a million people their jobs

11/13/2015 - Bullion News

CoinNews - 2015 $10 American Eagle Gold Bullion Coin Sells Out

CHARTS : Advisor Perspectives - ECRI Weekly Leading Index: "The Case of the Wage Inflation Deception"

VIDEO : CNBC - Rick Santelli speaks to Chip Dickson, Discern Investment Analytics, about global growth, central bank policy around the globe and consumer spending

VIDEO : CNBC - Cashin: Fed may have missed window mightily

CARTOON : Hedgeye - (Blind) Eye of the Storm

GOLD~NANO : Bentham Science - VIDEO : Nuclear Targeting of Gold Nanoparticles for Improved Therapeutics

Perth Mint Blog - WGC Reports Surge In Gold Demand During Q3 2015

VIDEO : CoinWorld - Here's what 1.7 million ounces of gold looks like

VIDEO : Gordon T Long - WHAT TO EXPECT FROM THE FED w/ Charles Hugh Smith & Rick Ackerman

TECHNICAL ANALYSIS : Market Anthropology - Connecting the Dots

VIDEO : CNBC - Rick Santelli : The Fed's Quandary

The Economist - The world is entering a third stage of a rolling debt crisis

11/12/2015 - Bullion News

Silver Coins Today - 2015 American Silver Eagle Bullion Sales Continue at Record Pace

Business Insider - Gold coin sales haven't been this high since the financial crisis

Zero Hedge - The Amazing Chart Showing What All The Debt Issued This Century Has Been Used For

Daily Reckoning - Four Market Signals That the Crack-Up’s Begun

GoldSilverWorlds - Jim Rickards: What Will The Fed Decide in 2016?

The Deviant Investor - Another Day Older and Deeper in Debt

VIDEO : CNBC - THIS indicator is signaling a recession

GoldReporter.de - Jim Rogers: The next crash will be worse than ever

The Telegraph - Gold price fall and market panic sparks bullion 'buying spree' in China

BullionStar - Record UK Gold Export To China In September, Chinese Gold Import Reaches 156t

CEO.CA - Second in a series: Currency printing and why a flash default is the way to go

Numismaster - Deceptive fake coin, holder identified

Daily Mail - Anyone need change? TWO MILLION copper coins weighing a whopping 10 tonnes found inside 2,000-year-old tomb

11/11/2015 - Bullion News

CoinNews - Gold Ends at 5-3/4-Year Low, Silver Marks 11-Week Low

AUDIO : McAlvany Weekly Commentary - Fed’s Next Interest Rate Move, Deadly Decoy?

Market Watch - Sheep-like thinking over a Fed move could send investors over a cliff

South China Morning Post - SDR Inclusion Far from Enough to Increase Yuan’s Allure to Investors

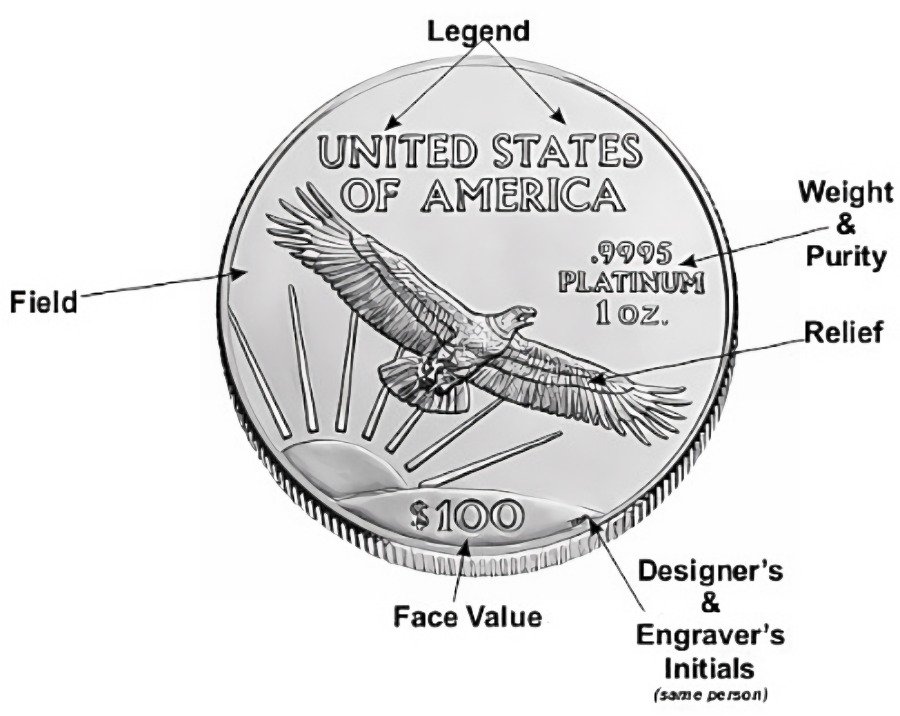

CoinWorld - How does the bullion market work?: Precious metals basics

GOLD~NANO : LUND University - The Effect of Protein Corona on Gold Nanoparticles Aggregation

BullionStar - Largest Ever Chinese Gold Deposit Has Been Found 2,000m Undersea In Shandong

CoinWorld - Positive case being made for gold in current precious metals market

The Sovereign Investor - Has Gold Hit a Bottom?

The Corner - Now comes the really hard part for Greece

The Telegraph - End QE now or risk a new financial crisis, warn Germany's 'Wise Men"

WolfStreet - We’re in the Early Stages of Largest Debt Default in US History

11/10/2015 - Bullion News

Bloomberg - Goldman Sachs Says Corporate America Has Quietly Re-levered more than Double Pre-Crisis Levels.

VIDEO : CNBC - Rick Santelli shares his view of Federal Reserve monetary policy based on current economic data

Wealth Daily - Chinese Exports and Gold Reserves

twitter - Magic Words for Metal Longs

(Hint: Do the Opposite of what this Man says...)

CoinWorld - Mint sells most of American Eagle silver coin allocation Nov. 9

CNSnews - $944,143,000,000: Social Security Administration Spending Hit Record in FY2015; $6,345 For Every American With a Job

GOLD~NANO : AL.com - Big demand for UAH undergraduate paper about disease detection device

Bloomberg - Goldman Contrarian Joins Chorus Warning on Bond-Market Liquidity

Casey Research - Why Higher Rates Could Kill the Bull Market in Stocks

The Deviant Investor - Silly Season and Silly Fiscal Policy

Monetary Metals - Gold Price Drop of 6 Nov: Drilling Down

The Speculative Investor - Martin Armstrong botches a critique of Austrian Economics

The Guardian - The Long Read : Inside the Bank of England

11/09/2015 - Bullion News

Hussman Funds - Psychological Whiplash

Wall Street Examiner - Debt Star! US Debt Is Over 3 Times What You THINK It is!

CoinNews - US Mint Limits Weekly Silver Eagle Sales to 1.1 Million

Bloomberg - China to Allow Direct Conversion Between Yuan and Swiss Franc

VIDEO : Bloomberg - James Grant "The Federal Reserve is a Relic"

BullionStar - COMEX Deliveries vs SGE Withdrawals

Perth Mint Research - Indian Gold Monetisation Schemes

Money Metals Exchange - Key Indicator of Future Commodity Demand Turns Up

Sovereign Man - Astonishing report from the Fed says US banks are not “sound”

CHARTS : Visual Capitalist - Japan Officially Gets Leapfrogged by the Four Asian Tigers

11/08/2015 - Bullion News

Dr. Ed's Blog - The Grand Delusion

GoldSeek - COT Gold, Silver and US Dollar Index Report

TECHNICAL ANALYSIS : Investing - Bull Box In The Gold Market

TECHNICAL ANALYSIS : CEO.CA - Gold Breaches Support After Positive U.S. Monthly Employment Report

The Telegraph - UN Wants New Global Currency to Replace Dollar

BullionStar - The LBMA Conference And The ‘Confusion’ About Gold Round Tripping

Zero Hedge - China Buys Another 14 Tons Of Gold In October As FX Reserves Unexpectedly Rebound

Reuters - Chinese trade disappoints, clouding economic outlook

Business Standard - India : All that glitters is paper gold

Affiliate Ad

11/06/2015 - Bullion News

Sunshine Profits - Does Bond Market Drive the Gold Price?

Reuters - Gold's medium-term outlook brightens on China, India

SafeHaven - Strong Payroll Bounce +271,000; December Rate Hike Likely

CARTOON : Hedgeye - Ready For Liftoff?

AUDIO : Money Metals Exchange - Exclusive Interview with Frank Holmes on Forces Moving Gold Market, Global Economy

VIDEO : Bloomberg - Are Markets Leading the Federal Reserve?

Casey Research - The Fed Says Negative Interest Rates are “On the Table”

Perth Mint Blog - LBMA Grants The Perth Mint A Full Member

World Mint Blog - UK Launches 2016 Range of Britannia Bullion Coins

Wealth Daily - National Debt Disgrace

Market Watch - Fed's Brainard: 'Greater caution than normal' needed on interest-rate policy

CNBC - Transcript: Federal Reserve Bank of Chicago President Charles Evans Speaks with CNBC

Reuters - Treasury's Lew, China's Wang discuss yuan joining IMF currency basket

11/05/2015 - Bullion News

Reuters - Yellen and the Fed are Playing Fire a.k.a Confidence

MoneyBeat (WSJ) - Market Falls In Line With Yellen, But Now Fed Credibility at Stake

Kitco - Gold Market To Eye U.S. Nonfarm Payrolls For Next Clue On Fed Monetary Policy

JM Bullion - JM Bullion tops Dallas 100 ranking of fastest-growing companies

Market Watch - The Real Impact of a Decade of Low Interest Rates

CARTOON : Hedgeye - Rate Shock Ahead?

TECHNICAL CHARTS : Northman Trader - Charts Indicate a Change is Coming...

CHART : Perth Mint Blog - Perth Mint - October 2015 - Gold & Silver Sales Chart

The Deviant Investor - The Discipline of Silver

TECHNICAL ANALYSIS : Market Anthropology - Yen/Nikkei : Gold/Yen : Silver to Gold Ratio

Business Insider - This is how a central bank could kill off cash and bring in negative interest rates on your savings

Reuters - Modi calls on Indians to mobilize idle gold, cut imports

CHART : Inside Futures - GOLD COMPARED TO EUROFX

Zero Hedge - There Are Now 293 Ounces Of Paper Gold For Every Ounce Of Physical As Comex Registered Gold Hits New Low

INFO~GRAPHIC : Visual Capitalist - The World’s Most Famous Diamonds

11/04/2015 - Bullion News

CNBC - Santelli Exchange: Fed Supervision

Notes from Underground - ECB = Every Corrupt Banker

Zero Hedge - Yellen Says Negative Rates On The Table "If Outlook Worsened"

Money Metals Exchange - Rock, Paper, Scissors: Why Gold and Silver Will Always Prevail

CoinWeek - The Coin Analyst: 2016 Panda Coins and the Switch to Metric Weights

AUDIO : McAlvany Weekly Commentary - On this Week: Druckenmiller and his “modest” $300 million dollar gold purchase, Italian bonds pay negative interest rates & Paper gold ratio to real gold hits 231:1 in October!

First Post - India's New Gold Scheme has A Lot of Obstacles to Overcome...

Casey Research - Why the U.S. Debt Ceiling is a Farce

CARTOON : Hedgeye - Rate Hike Off the Table?

AUDIO : Library of Economics & Liberty - Michael Matheson Miller on Poverty, Inc

11/03/2015 - Bullion News

Perth Mint Blog - 1oz Australian Kookaburra Bullion Coin Available From Today

Newswire - United States Mint to Launch America the Beautiful Quarters® Program Coin Honoring Saratoga National Historical Park Nov. 17

Notes from Underground - The King of Hearts Syndrome Dominates the Markets

BARRON's - How Low Can Gold Go?

Bullion Star - Why Austria Is Repatriating Gold From London

The Deviant Investor - The Circle of Gold

11/02/2015 - Bullion News

The Felder Report - Bond Market To Stocks: “Last Call!”

Hussman Funds - Last Gasp Saloon

Bloomberg - These Charts Suggest the Market May Have Had Enough of Share Buybacks

The Daily Reckoning - Ignorance is Far less Dangerous than False Knowledge

CoinNews - American Silver Eagle Sales Limit Rises for Second Week

TECHNICAL ANALYSIS : King One Eye - Will Gold Retest Its Uptrend? Odds Favor It

AUDIO : FSN - John Rubino – Can the Us Raise Rates When Everyone Else is Cutting Them?

Bloomberg - Here's How Much QE Helped Wall Street Steamroll Main Street

CEO.CA - The big print: 18 trillion reasons to fire up the presses

The Gold Report - Four Reasons Investment Strategist Joe McAlinden Likes Hard Assets, Especially Gold

SilverSeek - Is Martin Armstrong Both Right and Wrong About Gold & Silver Manipulation?

11/01/2015 - Bullion News

StarTribune - Interest rates: There's a Looming Problem with the Fed's Way of Thinking - Good Read

FXEMPIRE - Precious Metals Fundamental Analysis – November 2 – November 6, 2015 Forecast – Gold, Silver & Platinum

CoinNews - Gold, Silver Soar in October; US Mint Bullion Sales Weaken

What Investment - Why I am buying gold for portfolio right now, by manager of £1 billion of assets

GOLD~NANO : Dovepress - Tumor-Targeted and pH-Controlled Delivery of Doxorubicin Using Gold Nanorods for Lung Cancer Therapy

GoldSeek - COT Gold, Silver and US Dollar Index Report - October 30, 2015

CHART : McClellan Financial - COT Data For Gold At Topworthy Level

TECHNICAL ANALYSIS : Trader Dan's World - Silver COTs Downright Scary…Trick or Treat?

GoldMoney - Fiat Money Quantity Update

Bloomberg - Bonds Send Same Ominous Signs No Matter Where in World You Look

TECHNICAL ANALYSIS : SOLARCYCLES - Selective Rally

Myhighplains - Firms Vying to Help Texas Build Gold Depository

10/30/2015 - Bullion News

Bullion Vault - The Fed Really, Really Means It This Time!

TECHNICAL ANALYSIS : Kitco - A Longer-Term Examination of Gold from a Fibonacci Perspective

NewsMax - United States Mint Silver Bullion Sales Headed for New Record

CHARTS : BAWERK - The Yield Curve and GDP – a Causal Relationship?

CHART : Hedgeye - Disappointing U.S. Data Eerily Reminiscent Of 2006-2007

AUDIO : Money Metals Exchange - Congress Gives Obama Unlimited Debt, Author Tom Woods Discusses War on Savers and Gold Standard

GOLD~NANO : Science Alert - New electronic sensor can detect ovarian cancer in your breath

The New York Sun - Santelli Wins the Debate

Market Watch - Opinion: A bottoming of gold prices might be closer than you think

CoinWorld - U.S. Mint's American Eagle bullion coins: Precious metals basics

Times of India - Gold bonds on sale from Nov 26

BullionStar - Russia’s VTB Bank Joins As SGE Member. Chinese Direct Gold Imports Increase

Nikkei Asian Review - Chinese demand propping up soft gold prices

The Union - Plea agreement accepted in counterfeit gold case

10/29/2015 - Bullion News

Investment Week - US Rate Hike in Doubt as GDP Growth Slows to 1.5%

CHARTS : dshort - Visualizing GDP: A Closer Look Inside the Q3 Advance Estimate

CHARTS : dshort - Market Cap to GDP: The Buffett Valuation Indicator Eases a Bit

Dana Lyons' Tumblr - No Silver Lining As Smart Money Heavily Short This Precious Metal

Silver Phoenix 500 - Higher Silver Prices: The Fundamental Case

Perth Mint Blog - GFMS Gold Survey Q3 2015

The National - India gold monetisation move to be launched ahead of Diwali

The Deviant Investor - Gold Analogue: Then and Now

TECHNICAL ANALYSIS : Yahoo Finance - USD Struggles to Hold Fed-Driven Rally as GDP, Home Sales Disappoint

VIDEO : Kitco - Austrian Mint Tour: Inside Look At The Vienna Philharmonic Coin

CEO.CA - Interview: Jim Rogers on gold, Wall Street and the “backwater” of finance

Mish Shedlock - Courage to Act; Reflections on Fed Hubris; What if Whatever it Takes is Not Enough? Fed Troika?

AUDIO : McAlvany Weekly Commentary - Zimbabwe Hyperinflation: “How We Survived”

Market Watch - Man reportedly saves half a million pennies over 40 years

10/28/2015 - Bullion News

VIDEO : Hedgeye - Replay : Fed Day Live with Keith McCullough

CNBC - Comparing Fed Statements - What Changed in the New Fed Statement

MINING - Gold price drops $30 after Fed

Wall Street Examiner - Why Are We Speculating About When The Fed Will Raise Rates When The Real Issue Is How – Revisited

CHARTS : The New York Times - The Fed's Economic Projections

Midas Letter - Fed Holds Steady – No Date Given for Rate Rise

Sunshine Profits - Is U.S. Heading for Recession?

GOLD~NANO : NATURE - RESEARCH : Finding Tumors with Florescent Gold Nano-Particles

VIDEO : Modern Wall Street - Jim Rickards: Recession will force Fed to ease in 2016

SNL Conference Chatter - Gold Demand Robust and Rising

Investing - Russia And China Increase Gold Holdings

VIDEO : BullionStar - Torgny Persson, CEO, on Gold Trends & The New Gold Rush

MINING - These Countries are Winning at Gold Mining

Financial Review - Venezuela selling gold to cover bond payments

PHYS.org - Cleaning up the Precious Metals Industry

10/27/2015 - Bullion News

Bullion Vault - China Gold Demand 'Not So Bleak', US Fed 'More Important'

Bonner & Partners - The Latest (and Dumbest) Central Bank Fraud

AUDIO : The Korelin Economics Report - Rick Ackerman commenting on today’s stock markets: “Even the rubes can smell the hoax!”

The New York Times - Ex-Goldman Banker and Fed Employee Will Plead Guilty in Document Leak

Reuters - Gold demand rises in Q3 on surge in coin, bar buying - GFMS

Acting Man - Can the Fed Print Money?

TIME - Ireland Is Doing Away With the Penny

Sputnik News - Iran Planning to the Abolish Cash, Introduce Electronic Payment Systems

The Deviant Investor - Green Light Silver – Part 2

GoldReporter.de - Saving behavior of the Germans: 15 percent rely on precious metals

The Telegraph - Buying motorbikes, art, gold and fossils - loopholes used by the wealthy to avoid tax

Western Daily Press - US 1794 'penny' coin found in plastic bag in Dorset sells for 1.7 MILLION times more than a cent

VIDEO : Daily Reckoning - Ron Paul : The Benefits of Buying Gold

10/26/2015 - Bullion News

Money Metals Exchange - Big News This Week on the Fed, Debt Ceiling, and Physical Silver Premiums

CoinWorld - Counterfeit Detection Advances

CoinWeek - Chinese Panda Coins- A Weighty Decision

CHARTS : Acting Man - Where Is All The Gold Going?

SAXO Group - COT: Bulls bet on precious metals, energy slumps

Kitco - Large Speculators Raise Gold Net Long To Highest Level Since February—CFTC Data

twitter - James Rickard's Thoughts on the Capital Markets

GOLD~NANO : Nature - Three dimensional imaging of gold-nanoparticles tagged samples using phase retrieval with two focus planes

VIDEO : GoldBroker - Bill Holter: The Fed, The Dollar and Gold

MineWeb - Gold – a better investment than cash?

McKinsey & Company - Are share buybacks jeopardizing future growth?

Mauldin Economics - Someone Is Spending Your Pension Money

NewsMax - Marc Faber: China Has Credit Bubble of 'Epic Proportions'

RED MEAT : News Medical - Scientific Evidence Does Not Support Causal Relationship Between Red Meat and Cancer Risk

10/25/2015 - Bullion News

Market Watch - Fed set to remain on pause as GDP data expected to show slowdown

GoldSeek - COT Gold, Silver and US Dollar Index Report

Monetary Metals - Little Change to Supply and Demand Report 25 Oct, 2015

CoinWorld - Check your 1998 American Eagles; they might be on wrong planchet - The Only American Silver Eagle Bullion Error Coin Sells for $50,000

NDTV - PM Modi on Mann ki Baat: Gold Monetisation Scheme to be Ready in Coming Weeks

VIDEO : Zero Hedge - Overstock Holds 3 Months Of Food, $10 Million In Gold For Employees In Preparation For The Next Collapse

TECHNICAL ANALYSIS : zentrader - Euro Weakness = Dollar Strength

VIDEO : U.S. Global Investors - The “Oprah Effect” and Gold

The New York Times - The Central Bank Skeptic Who Helped Give Birth to the Fed

10/24/2015 - Bullion News

Wealth Daily - The CPI vs. Real Inflation

TECHNICAL ANALYSIS : Inside Futures - The Silver Chart Looks Interesting

Bloomberg - What Will It Mean If the Yuan Gets Reserve-Currency Status?

The New York Sun - Whitewashing the Fed

AUDIO : Financial Sense - Bull Markets – It’s All About Liquidity

BAWERK - The Great Unwind

AUDIO : Money Metals Exchange - Analyst John Rubino: Explosive Demand Factors Setting up Possible "Perfect Storm" in Silver

GoldSilverWorlds - How Much Paper Gold Is Being Traded Daily?

Zero Hedge - You Know It's Bad When...

Free Market Cafe - Pity Goldman Sachs

Profit Confidential - U.S. National Debt: As It Rises, This Investment Will Soar

Sovereign Man - What your high school chemistry teacher never taught you about gold

10/23/2015 - Bullion News

VIDEO : Money Show - A Perspective on Gold vs. Gold Mining Shares

TECHNICAL ANALYSIS : Live Trading News - Technical Look A Gold Pattern: A Bullish Flag Breakout Targets 1200+

TECHNICAL ANALYSIS : King One Eye - US Dollar -- Breakout or Fakeout?

Armstrong Economics - Quantitative Easing & the Nightmare It Has Created

TECHNICAL ANALYSIS : Trader Dan's World - "Funny isn’t it how we have Seen Our Entire Global Financial System Reduced to a Barrage of Words Coming Out of the Mouths of Central Bankers" “PATHETIC” is more like it.

VIDEO : CNBC - Rick Santelli speaks to Peter Eliades, Stock Market Cycles Management, about his bearish technical view on the market.

Notes from Underground - Mario Draghi Declares War On German Economic Policy

INFO~GRAPHIC : Visual Capitalist - The U.S. Debt Ceiling has Risen No Matter Who is in Office

Bloomberg - IMF Said to Give China Strong Signs of Reserve-Currency Nod

NewsMax - US Mint's Gold-Bullion Coin Sales Rebound

Market Watch - Silver bullion coins are scarce, but prices don’t show it

The Daily Reckoning - Don't Follow the Crowd, Lead the Way

10/22/2015 - Bullion News

Mish's Blog - As Draghi Hints at More QE, German Bond Yields Hit Record Low Negative Yields; Economic Madness

VIDEO : Bloomberg - Video of Mario Draghi's Remarks

GoldReporter.de - Goldman Sachs sees "risks" that the price of gold continues to rise

MINING - Venezuela ready to dump 80 tonnes of gold

Money Metals Exchange - The Seven Biggest Lies Told (and Believed) about Gold

GOLD~NANO : NanoTechnology Now - New Step towards Smart Treatment of Breast Cancer by Gold Nanoparticles

CoinNews - Gold Dips, Silver and US Mint Silver Eagles Gain

Zero Hedge - Auto Loan Market "Reminds Me Of What Happened Right Before The Crisis", Top Regulator Warns

NIA - IS - Putin Preparing for Russian Gold Standard?

SRSrocco Report - 2015 RECORD SILVER INVESTMENT RATIO: 1% = 30%

The Bullion Desk - China Construction Bank joins London gold price auction

Zero Hedge - Finance Professor "Invests" In Jim Cramer's "Buy Right Now" Portfolio, Loses Money On 72% Of Stock Picks

SD Bullion - 4.8 star Customer Reviews

10/21/2015 - Bullion News

Market Realist - LBMA Conference Projections... Part 1 thru 5

SAXO Group - Tocqueville Gold Strategy Investor Letter Third Quarter 2015

SAXO Group - Markets jittery before Draghi tomorrow, Poloz first

Bloomberg - These Are the Fed's Three Weapons If the Economy Falters

Mint News Blog - A Look at Cumulative U.S. Mint Bullion Sales

GoldReporter.de - First Indian gold bullion coin: Here are the details

VIDEO : Kitco - HSBC Remains ‘Cautiously Bullish’ On Gold, Calling For $1,205 Year-End Price

TECHNICAL ANALYSIS : The Deviant Investor - Dollar Decline Cycle

DISCOVERY - HOW MUCH GOLD DO YOU REALLY OWN?

Reuters - Platinum fails to fill breach left by gold in South Africa

Sputnik News - Russia is on Course to Global Platinum Domination

EconoTimes - Russian Central bank increases its gold reserves by 34 tons in September

VIDEO : USA Watchdog - Negative Rates for Next 10 Years-Buy Gold-Axel Merk

CoinWorld - Patriotic printers: Paul Revere, silversmith and 'Midnight Rider'

10/20/2015 - Bullion News

The Felder Report - The Latest Margin Debt Figures Send An Ominous Signal For Stocks

AUDIO : Sovereign Man - Dr Ron Paul on why the Fed's days are numbered

The Telegraph - One of the causes of the financial crisis is finally being tackled

Plata - The Fundamental Flaw of 'Mainstream Economics' by Hugo Salinas Price

GOLD~NANO : dvids - Fantastic Journey: Transporting Life Saving Drugs by Micromotors

VIDEO : Kitco - Austrian Central Bank Addresses Gold Repatriation

TECHNICAL ANALYSIS : Acting Man - Gold – A Rally No-One Really Believes in

Bloomberg - LBMA Considers Handling All Precious Metals on Regulatory Change

iStockAnalyst - The Return Of The Debt-Ceiling Follies In Washington

Sprott Money - Confusing Inevitable with Imminent - Jeff Thomas

CoinNews - 2015 US Mint Coin Production Highest Since 2007

MOTHERBOARD - How an Obsessed Billionaire Finally Bought Gold.co.uk After Seven Years

10/19/2015 - Bullion News

CHARTS : dshort - NYSE Margin Debt Is Now 11% Off Its April Record High

CHART : GoldSilverWorlds - Gold: Third Time’s The Charm? Amazing Chart

CoinNews - US Mint Sets Silver Eagle Allocation Lower to 970,000

Money Metals Exchange - Gold Shows Strength as Debt Ceiling Showdown Approaches

TECHNICAL ANALYSIS : Kimble Charting - Dow Jones – Not a good place for it to run out of gas!

VIDEO : CNBC - Treasury Secretary Jack Lew: Raise the debt limit

Zero Hedge - Traders Are Panic-Selling T-Bills After Jack Lew Warns Of "Terrible" Debt Limit Accident

Bloomberg - London Gold Market Under Scrutiny as Bullion World Gathers

Reuters - China mounts gold liquidity grab as London market reforms

Sputnik News - Self-Indebted: US-Based Investors Buyout Treasury Bonds Dumped by China

International Man - The Next “Greece”

Gold-Eagle - Bullion Billionaires Who Like GOLD

Casey Research - Find Out What Doug Casey Is Buying Today

AUDIO : Midas Letter - Quantum Funds Co-Founder Jim Rogers on Gold, Russia-U.S. Proxy War, U.S. Dollar

10/18/2015 - Bullion News

The Daily Bell - Why Most Gold Stocks Are Bad Investments

ValueWalk - Will Gold Finish 2015 With A Gain? by Frank Holmes

Calculated Risk - For Confidence Sake : Goldman Sachs (Hopes) Expects "Fed Liftoff" in December

CHARTS : BAWERK - US Dollar – the modern day Bancor

CHARTS : Visual Capitalist - Gold: Off to the Races, or Just Another False Start?

TECHNICAL ANALYSIS : ZenTrader - Welcome To Bear Market Stage 6

International Man - How to Survive the “Deep State” by Doug Casey

GoldSeek - COT Gold, Silver and US Dollar Index Report

Market Watch - Lack of economic muscle? U.S. at mercy of China, strong dollar

Mises Institute - Sanders, Trump, and John Maynard Keynes

AUDIO : Money Metals Exchange - Negative Interest Rates Signal Escalation in War on Cash

CARTOON : Zero Hedge - "We're Out Of Yellow Bricks"

10/17/2015 - Bullion News

MoneyBeat (WSJ) - Will Treasury Ever Go Negative?

Mish's Blog - Can the Fed Really Print Money? What Would Negative Interest Rates Do?

TECHNICAL ANALYSIS : King One Eye - Bombs Away in US Dollar Index -- Up Goes Gold!

TECHNICAL ANALYSIS : Market Pulse - Gold – Bullishness Grows as Fed Hike Priced Out

Coin Update - Tips for Selling Coins and Paper Money on eBay

BDlive - Fed rate delay adds to bullion price puzzle

The Peoples Bank of China - 2016 Gold & Silver Pandas - Change in Weight from Ounces to Grams - Google Translation Link

BullionStar - SGE Withdrawals At Record High 1,958t YTD

Xinhua - News Analysis: China's push to add renminbi to SDR basket nearing finish line

VIDEO : BNN - BitGold transforms into GoldMoney

GoldMoney - Silver as Money

Zero Hedge - "Its Not The Economy Stupid, It's The Dollar"

The Telegraph - Britain's biggest banks to be forced to separate retail banks from investment arms

10/16/2015 - Bullion News

SAXO Group - The Monetary Policy Dead End

PDF : Gold Standard Inst. - Gold Standard Institute - October Journal

Numismaster - Silver Eagle shortage eases a bit

TECHNICAL ANALYSIS : FXStreet - Gold Analysis : Weakness to persist, eyes 1170 on upbeat US data

Reuters - China adds more gold to reserves in September

GOLD NANO-PARTICLES : PuppyUp - Gold Nano-Particles used to Fight Prostate Cancer in Dogs

CHARTS : dshort - Deconstructing the Consumer Price Index

Daily Reckoning - Inflation Headlines vs. Reality Reveals Outright Government Fraud

AUDIO : Notes from Underground - "Gold's Inflection Point and Asset Allocation with John Butler"

Notes from Underground - The Stock Market Says, “I Think Icahn, I Think Icahn”

Alhambra Investment Partners - Gold(man) Simplicity

Perth Mint Research - China will save us

CoinWeek - FRAUD ALERT : Counterfeit Cashier’s Checks being used to by Gold

USNews - Appeals court again considering fate of rare seized Double Eagle gold coins worth $80M or more

10/15/2015 - Bullion News

CoinWeek - The Silver Shortage Hits, U.S. Mint Blank Supplier, Sunshine Minting

CoinNews - Gold Notches 4-Month High; 2015 Silver Eagles Top 38M

VIDEO : CNBC - Surprising Fed paper drops a dovish bombshell

CHARTS : StreetTalkLive - 3 Things: The Fed Is Screwed

Casey Research - The One Asset to Own When Things “Go to Hell”

Midas Letter - All Hail the Return of the Bull Market for Gold and Precious Metals

VIDEO : USA Watchdog - Financial Collapse to Wipe Away All the Lies-Rick Ackerman

Bullion Vault - Gold's Hottest Rumour at LBMA Conference 2015

VIDEO : CNBC - Commodities have found bottom: Expert

Reuters - Platinum price forecasts for 2016 lowered after third quarter plunge: poll

Bloomberg - Charting the Markets: Burberry and Bonds Not as Good as Gold

AUDIO : Sovereign Man - Yes, the US government really is bankrupt. Here’s proof...

INFO~GRAPHIC : Visual Capitalist - China vs. United States: A Tale of Two Economies

GOLD RUSH : Inquisitr - When Does Discovery's "Gold Rush" Return? and What to Expect When it Does...?

10/14/2015 - Bullion News

VIDEO : CNBC - Santelli & Art Cashin get real on the Fed

The Sovereign Investor - Good News for Gold

AUDIO : McAlvany Weekly Commentary - When Bad News is Called Good News: Think for Yourself

Bloomberg - Dollar Can't Get a Break as Economic Reports Lead to 3-Month Low

Reuters - Gold hits 3-1/2 month high on talk of delay in Fed rate rise

Free Market Cafe - The Golden Hour Is Here

VIDEO : CNBC - Santelli: Retail Sales Numbers 'Not Kind'

CHARTS : Zero Hedge - Gold Soars Into Green Year-To-Date, Breaks Above Key Technical Level

Kitco - More Market Turmoil As Fed Experiment Ends Badly Will Drive Gold Higher - Tocqueville

VIDEO : MINING - Gold Fever: 5 Surprising Uses for Gold

10/13/2015 - Bullion News

The Silver Institute - Silver Bullion Coins on Allocation at Major National Mints

Bloomberg - Silver Advances a Third Day Amid Signs of Increasing Coin Demand

CoinNews - Perth Mint Gold and Silver Sales Soar in September

Money Morning - Why You Need to Buy hard Assets

Notes from Underground - A Few Things Before the Financial Ship Sails

Bullion Desk - Gold reverses higher as dollar weakness persists

AUDIO : PhysicalGoldFund- Interview with Jim Rickards

OfTwoMinds - Where Is the First Helicopter Drop of Money Likely to Land?

CHARTS : biiwii - Gold vs...

The Deviant Investor - Gold Prices Will Rise Because...

Reuters - Shanghai Gold Exchange to name new chairman ahead of benchmark launch

dshort - Household Incomes: The Decline of the "Middle Class"

Kimble Charting - What’s It Mean When Everyone Expects A Black Swan Event?

The Washington Post - A high-society soccer dad lived a luxurious life. Now he’s going to prison.

10/12/2015 - Bullion News

CHARTS : SAXO Group - The Increasing Tyranny of King Dollar

MarketWatch - Chinese Finance Minister says U.S. Shouldn't Raise Rates

TECHNICAL ANALYSIS : The Short Side of Long - US Dollar & Emerging Markets

AUDIO : Daily Reckoning - Fed Governor's Comments Are Causing Market Mayhem

TECHNICAL ANALYSIS : Gold-Eagle - Update On The Gold Silver Ratio

TECHNICAL ANALYSIS : GoldSilverWorlds - Green Light For Silver

Money Metals Exchange - Move over ZIRP... Here Comes NIRP!