Homepage / Archived News or Quarterly News / 1st Quarter 2015

1st Quarter - 2015

Charts, Bullion News & Commentary

Date Posted: 4/29/2015 @ 4:32AM

The charts analysis and bullion news links on this page are devoted to the precious metals markets during the 1st Quarter of 2015.

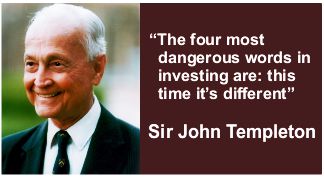

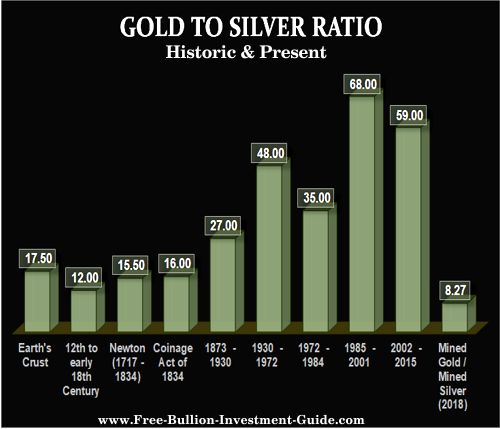

When investing in any market, a good way to judge price movement in the future is to learn from the past.

Frederick Douglass

(1818 - 1895) was a former slave who became a famous human rights leader, writer, and statesman during the abolition movement, who once stated, "Knowledge makes a man unfit to be a slave."

The combination of the charts and news (below) helps you gain "knowledge" of these markets, so you won't become a "slave" to them.

The charts below are provided courtesy of

US Dollar

Charts

1st qtr. of 2015

Bullion News

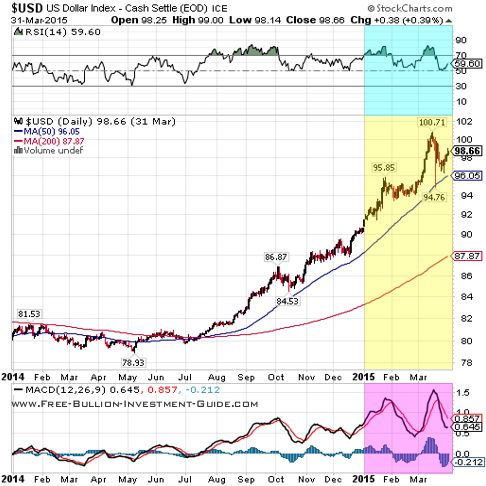

US Dollar Quarterly - Price Chart (January 1st, 2015 - March 31st, 2015)

The US Dollar Summary

During the 1st quarter of 2015, the US dollar continued its upward trend. However, like in the last quarter, the dollar has started to consolidate after each move upwards, which is healthy for any market. But, after hitting $100.71, the US dollar looks like it might be topping out.

In addition, the US Dollar's run-up to $100.71 occurred because of the Market's anticipation of the Federal Open Market Committee (FOMC) statement release.

(continued)

US Dollar 1 year - Price Chart (January 1st, 2014 - March 31st, 2015)

Bullion News

The Financial Media like to extract certain 'words or phrases' out of the Fed's statements to try to predict which way the Fed may or may not move in policy.

The words or phrases have included: "Tapering," "Considerable Time," and most recently, "Patient."

It's all Nonsense the financial media use these words to rile the markets, and sad to say, "it usually works." The Fed changed their wording this time, but they basically said they're not going to raise rates.

Instead, the Fed said it was going to watch market data for future movements in the Federal Funds Rate. After the Fed balked at raising rates, the US Dollar started to lose some of its strength.

The U.S. Dollar and Gold often move in opposite directions; you will be able to see this relationship in price movement in the Gold Analysis Section below.

US Dollar 3 year - Price Chart (January 1st, 2012 - March 31st, 2015)

Greece & How it Affects the US Dollar?

One possible area for future US Dollar strength (besides an Interest

Rate hike) has to deal with what happens to Greece's place in the

European Union and what happens to its debt. Nobody really knows what

will happen if they exit the Euro; some in the market say the Euro will

fall, which would send the dollar higher. However, others suggest that

it may not be bad for the Euro if Greece exits the currency union.

One thing does seem

certain is that Greece's current government does not favor austerity. The two infographics below have recently come out; they may help you to

understand who Greece owes its debt to and what the possible

consequences are if Greece defaults or exits the Euro.

Greece’s Debt and Who’s on the Hook in a Default

Assessing the Potential Risk of a Greek Default

US Dollar 5 year - Price Chart (April 1st, 2011 - March 31st, 2015)

Bullion News

The US Dollar, the Fed and

Interest Rates Hikes

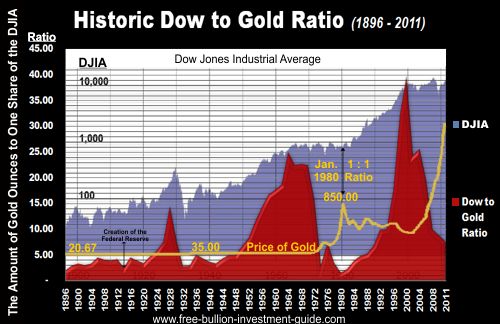

If you've been paying attention to chart analysis concerning the US Dollar, then you've probably seen the chart below.

It shows the U.S. Dollar chart breaking a thirty-year trend line in its recent rise in price, which is a very good sign for the U.S. Dollar and a very bad sign for Gold.

US Dollar breaking Trend-line

44 year US Dollar Chart courtesy of: Trading Economics

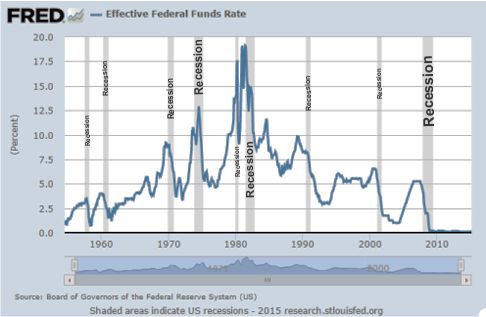

Interest Rates Hikes

The Past & Present

The chart below reveals a pattern of what has happened nearly every time the Federal Reserve has raised interest rates too high: a Recession.

The Fed's backed into a corner

If the Federal Reserve raises rates now, it may do the same as it has done in the past: cause a recession. Their hesitation makes them look scared.

Gold Price Charts

1st qtr. of 2015

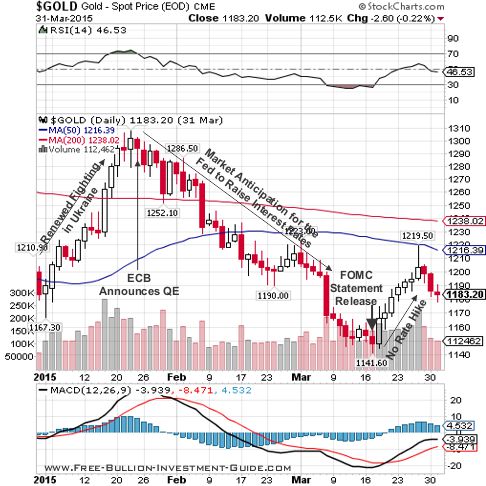

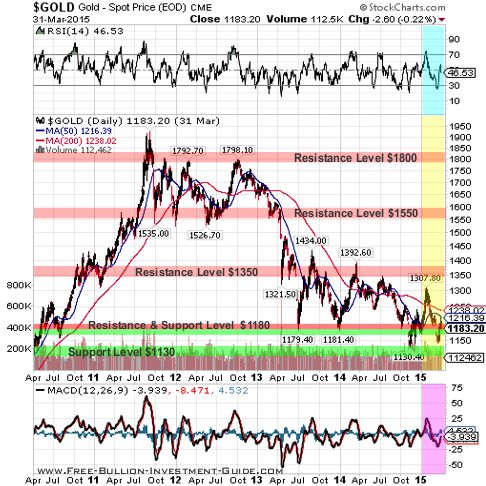

Gold Price Summary

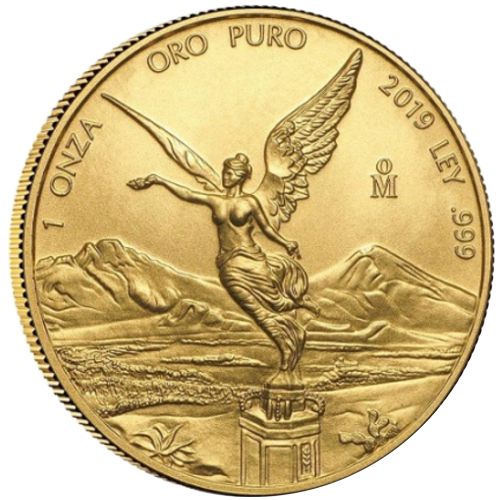

During the 1st Quarter of 2015, the price of gold moved up in the first three weeks to slightly above $1300 a troy ounce, then the price dropped over the next two months to $1140 a troy ounce.

The reasons for gold's price movement during this quarter were mostly dictated by international events and the policies of the world's central banks, the Fed and ECB in particular.

(continued...)

Gold Quarterly - Price Chart (January 1st, 2015 - March 31st, 2015)

Gold rose for the first several weeks of the quarter due to the fighting between Russia and Ukraine. Also, gold prices have historically moved up in January.

On January 22nd, the ECB (European Central Bank) announced that it was going to start its own version of QE, or Quantitative Easing. See the article here.

The Euro and gold often move in the same direction, and both often (but not always) move in the opposite direction from the US Dollar. Furthermore, even though the European Central Bank's QE program wouldn't start until March 9th, once the ECB announced the QE program, it started to bring down gold and the Euro.

Gold also sold off due to the market's anticipation of an Interest Rate hike by the FOMC (Federal Open Market Committee) at its March 2015 meeting, which will be held on the 17th and 18th of the month.

Ultimately, the Fed did not raise interest rates, even though many had previously predicted they would. In addition, the Federal Reserve Chair, Janet Yellen, repeatedly said, during her press conference, that future rate hikes would be data-driven.

continued....

Gold 1year - Price Chart (January 1st, 2014 - March 31st, 2015)

Bullion News

Gold's MACD showed by its movement (chart above) that there were signs late in the 1st quarter of 2015 that the price of gold was going to be moving upward early in the 2nd Quarter of 2015.

However, gold's RSI (upper indicator) shows that strength in the price of gold may correct or consolidate early in the next quarter.

The $1180 price level is an important level for the price of gold; it acts more as a support level because almost every time gold has broken it, the price of gold has moved back above it within a few days or a week at most.

Only when or if gold moves below $1180 and stays below it will it become a very strong Resistance Level for gold.

Gold 3year - Price Chart (January 1st, 2012 - March 31st, 2015)

Bullion News

Gold 5 year - Price Chart (April 1st, 2011 - March 31st, 2015)

ExpressGoldCash - 4.9 star - Customer Reviews

Silver Price Charts

1st qtr. of 2015

Silver Quarterly - Price Chart (January 1st, 2015 - March 31st, 2015)

Bullion News

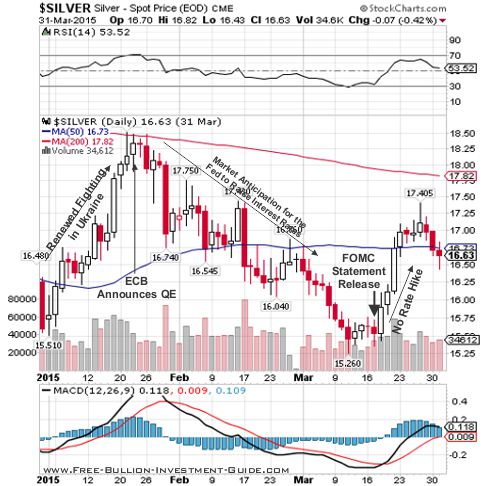

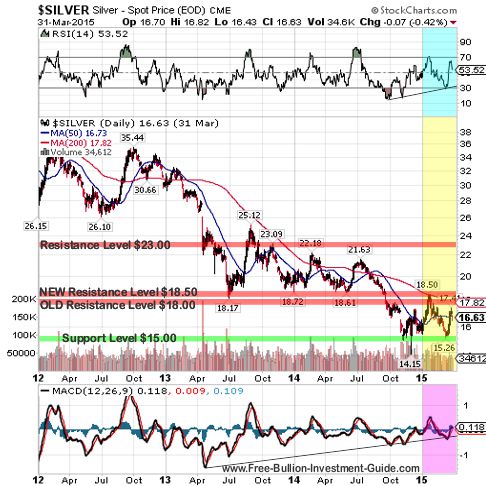

Silver Price Summary

For the 1st Quarter of 2015, silver's price chart looks almost identical in movement to that of gold's chart. Silver, like gold, is a safe-haven currency, but silver acts more as an industrial metal than a safe-haven currency like gold.

(continued...)

Silver 1 year - Price Chart (January 1st, 2014 - March 31st, 2015)

Bullion News

During the quarter, silver moved up in price, creating a new resistance level of $18.50, and then it broke below the resistance level of $18.00.

(continued...)

Silver 3 year - Price Chart (January 1st, 2012 - March 31st, 2015)

Bullion News

On the 5-year chart below, two trendlines have been drawn; a small one is seen on silver's RSI, and there is a 4-year trendline on silver's MACD.

These trendlines may be an indication that silver is going to move higher in the future; however, time will tell.

Silver 5 year - Price Chart (April 1st, 2011 - March 31st, 2015)

Bullion News

Free Shipping on Orders $199+ | 5.0 star Customer Reviews

Platinum Price Charts

1st qtr. of 2015

Platinum Price Summary

During the 1st Quarter of 2015, the price of Platinum moved in the same pattern as Gold and Silver. It was up early in the quarter, then fell in price for the last two-thirds of the quarter.

continued...

Platinum Quarterly - Price Chart (January 1st, 2015 - March 31st, 2015)

Bullion News

Although Silver and Platinum often trade in the same ways as gold, like a safe haven, their industrial demand caused the two metals to be more volatile in their movement.

Early in the quarter, the price of Platinum tried to test its new resistance level of $1295 a troy ounce, but it was unable.

Platinum 1 year - Price Chart (January 1st, 2014 - March 31st, 2015)

Bullion News

Platinum 3 year - Price Chart (January 1st, 2012 - March 31st, 2015)

Bullion News

Platinum 5 year - Price Chart (April 1st, 2011 - March 31st, 2015)

Free Shipping on Orders $199+

Palladium Price Charts

1st qtr. of 2015

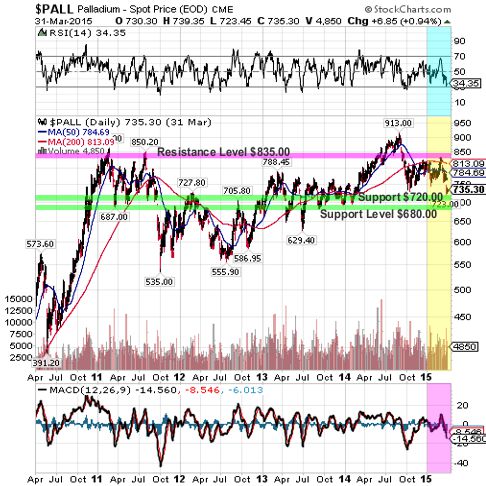

Palladium Quarterly - Price Chart (January 1st, 2015 - March 31st, 2015)

Bullion News

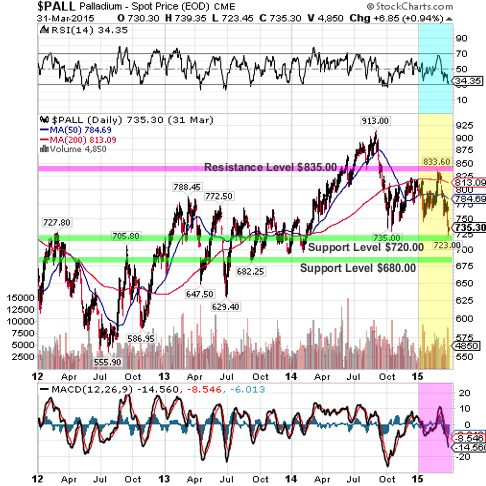

Palladium Price Summary

During most of this quarter, the movement in the price of palladium was very choppy. Although palladium is a precious metal, it primarily trades more as an industrial metal than a safe-haven precious metal like gold. This is because most of its supply is used for automobile catalytic converters.

....continued

Palladium 1 year - Price Chart (January 1st, 2014 - March 31st, 2015)

Bullion News

In early March, Russia, the world's largest supplier of the precious metal, released a Palladium Export Report. In the report, Russia showed that they exported 21,600 troy ounces of palladium in January, which was more than three times the average monthly rate from the previous year.

See the article here.

Due to this supply report from Russia, the price of Palladium moved down throughout the end of the quarter. However, the RSI (upper indicator) looked to be turning from its oversold position in the quarterly chart - above.

The MACD (lower indicator), on the other hand, continued sloping downward, but it looks to be getting over-extended to the negative.

In conclusion, in the next quarter, palladium may be higher, but only time and demand will tell where the price of palladium will go in the future.

Palladium 3 year - Price Chart (January 1st, 2012 - March 31st, 2015)

Palladium 5 year - Price Chart (April 1st, 2011 - March 31st, 2015)

The charts above are provided courtesy of

1st Quarter - 2015

Bullion News & Commentary

The Quarterly News starts with the end of the quarter articles, first.

Please note that not all of the links below work; the links are kept because the headlines still provide insight into how the markets were moving at the time.

03/31/2015 - Bullion News

ForexMagnates - The Portfolio Benefits of Investing in Gold

GoldReporter.de - Gold industry is afraid of rising oil prices - Google Translation Link

BloombergeView - U.S. Opposition to Asian Bank Is Self-Destructive

Bloomberg - Currency Market Adopts Voluntary Code to Clean Tainted Image

Zero Hedge - Gold In Fed Vault Drops Under 6,000 Tons For The First Time, After 10th Consecutive Month Of Redemptions

MarketWatch - In 20 years, the world may run out of minable gold

cnsnews - Americans Must Work Jan. 1 Through April 24 Just to Pay Taxes

Sovereign Man - Young people: here are five (OK, six) alternatives to heavily indebting yourself

msn money - The Poorest County in Each State

The Deviant Investor - Crazy Is My Middle Name

03/30/2015 - Bullion News

Institutional Investor - The Fed Seems Afraid of its Own Shadow

TECHNICAL ANALYSIS : Kitco - Gold Retreats From Resistance, Stuck In Large Range

VIDEO : CNBC - Santelli Exchange: A world awash in reserves

CMI Gold & Silver - The Stock Market is Managing the Fed

Mises Institute - Why Is the Fed Punishing My Parents?

CHARTS : dshort - NYSE Margin Debt Surged in February

The Bullion Desk - Gold dips after Fed’s Yellen hints at rate rise

Sunshine Profits - Gold News Monitor: Rising Inventory to Sales Ratio

MineWeb - China gold flows to hit Q1 record

BullionStar - This Is What The AIIB Is About

AUDIO : FSN - John Rubino – Why Are We Feeling Poorer? Is It The Reverse Wealth Effect?

TECHNICAL ANALYSIS : CFD Trading - Gold, Silver & Copper at Critical Junctures

INFO~GRAPHIC : Visual Capitalist - How America’s Middle Class Has Shrunk Since 2000

Sovereign Man - Every young person should see the Fed’s startling numbers on student debt

CoinUpdate - United States Mint 2014 Financial Results

03/29/2015 - Bullion News

MineWeb - WGC Cautions Against Common Gold Wisdoms

VIDEO : endlessmountain - Technical Analysis : Silver Market Update

CHARTS : dshort - ECRI Recession Watch: Weekly Update

TECHNICAL ANALYSIS : SOLARCYCLES - Post Equinox

AUDIO : Financial Sense - Cash Is Trash – More Bad News for Savers

POLL : Zero Hedge - What Bond Investors Are Most Concerned About

VIDEO : Fox Business - James Grant of Grant’s Interest Rate Observer discusses risk in the markets and the Fed

AUDIO : Peak Prosperity - Steve Keen: The Deliberate Blindness Of Our Central Planners

The Sovereign Investor - The Next Currency Set to Fail

The Alternative Investing Daily - Serious Investors know that Gold is not just a Fair-Weather Friend

Mises Institute - Brazil: Victim of Vulgar Keynesianism

MoneyWeek - Compared to gold, UK property is starting to look expensive

New York Post - Stock market rigging is no longer a ‘conspiracy theory’

MineWeb - Red rag to gold bulls – JPMorgan added to LBMA Gold Price banks

CoinWeek - Coins, Other Contents of Boston Time Capsule Revealed

INFO~GRAPHIC : Visual Capitalist - Everything You Need to Know About Copper Porphyries

03/28/2015 - Bullion News

The Telegraph - Fund Manager Explains Why He Invests in Gold: "I am not willing to risk my own and my clients’ capital when stock markets across the globe have been artificially inflated by QE."

Economic Policy Journal - SOLVED: The Problem of 'The Oversupply of Economic Wisdom'

VIDEO : Next Big Trade - Gold and Gold Stocks Update

Alhambra Investment Partners - Cash Flow Seems To Explain Why 5% GDP Was A Myth (Among Other Discrepancies)

The Deviant Investor - Gold & Silver Stocks Will Rise Again!

Journal Sentinel - The case for owning gold-related assets

Zero Hedge - Peak Gold? Goldman Calculates There Is Only 20 Years Of Gold Supply Left

Mish's Blog - Misunderstanding "Peak Gold"; Gold About to Run Out?

CHARTS : dshort - Median Household Income Up Slightly in February

ABCnews - Asian Infrastructure Investment Bank: Australia to sign Memorandum of Understanding to join China development fund

Xinhua.net - Chinese bank, Canadian group to jointly explore offshore RMB market

GOLD NANO-PARTICLES : engadget - Laser-activated nanoparticles are coming to clear your acne

Affiliate Ad

03/27/2015 - Bullion News

How the Fed is 'Screwed,' and What Happens Next

VIDEO : CNBC - How the Fed is 'screwed,' and what happens next (Link to Video Above)

VIDEO(s) : Zero Hedge - Santelli Stunned As Janet Yellen Admits "Cash Is Not A Store Of Value"

Bullion Star - When Will China Disclose Its True Official Gold Reserves And How Much Is It?

Perth Mint Blog - Who Buys Precious Metal?

Zero Hedge - Central Banks Are Paralyzed At The Zero Bound

GOLD NANO-PARTICLES : The Chicago Tribune - NorthWestern Student Wins $15,000 Award

CoinWorld - Congo bullion coins being issued by Kremnica Mint in Slovakia

PHOTOS : WCVB (Boston) - See the Sketches of the Suspects, from the Interstate 95 Gold Heist

GoldMoney - Market Report: FOMC minutes turned the tide

The Mess That Greenspan Made - Easing is Easy, Hiking is Hard

Profit Confidential - National Debt Balloon Bearish for U.S. Dollar, Positive for Metals

03/26/2015 - Bullion News

Solidus Center - The Fed-Wall Street Revolving Door Must Be Shut

Alhambra Investment Partners - FOMC: Not Only Is There No Recovery, Don’t Ever Expect One

CNBC - Weak Q1 GDP may delay Fed rate hike: Jim Rickards

CITY A.M. - Coining it? The case for gold bullion coins

Reuters - LME looking to restore bullion forward curve, eyes broad market restructuring

GOLD NANO-PARTICLES : nano werk - Gold nanoparticles size up to cancer treatment

BullionStar - Euronews: If China Joins The New Gold Fix, There’ll Be Less Manipulation

Acting Man - We Now Live in a “Pimpocracy”

VIDEO : ABCNews (Australia) - Extended interview with Jim Rickards

CoinWorld - Book value of United States Treasury-owned gold tops $11 billion

The Hindu - China should boost gold reserves to 5%, says WGC

Boston Biz Journal - FBI dangles $25k for information on theft of gold headed to Massachusetts

PHOTOS : MINING - Black market gold

03/25/2015 - Bullion News

VIDEO : Next Big Trade - Bull Market Top in for the US Dollar?

TECHNICAL ANALYSIS : Kimble Charting - Euro- Time for the crash to turn into a rally?

TECHNICAL ANALYSIS : FOREX - Silver: Key Hurdles Looming for Shiny Metal

Economic Policy Journal - WSJ: The Inflation Cycle May Have Turned

GOLD NANO-PARTICLES : CNN - Fighting Cancer and Ebola with Nano-Particles

AUDIO : McAlvany Weekly Commentary - Felix Zulauf: What comes after Currency Devaluation?

SNBCHF - America Needs The Gold Standard More Than Ever

Zero Hedge - What Greece Owes, And More Importantly - When!

BullionStar - The Largest Gold Mints Of The World

The Deviant Investor - What’s Wrong With Silver?

Reuters - Fed's Evans says strong dollar 'disinflationary', possibly transitory

Zero Hedge - Don't Show Janet Yellen These 3 Charts

The Sovereign Investor - How Low Will the Dollar Go?

MarketWatch - China’s yuan may join elite money club this year

MineWeb - Kazakhstan extends gold buying spree

03/24/2015 - Bullion News

GoldReporter.de - Why the Largest Monetary Experiment of All Time will Fail - Google Translation Link

VIDEO : CNBC - BofA: Gold's going to $1,300

TECHNICAL ANALYSIS : Gold-Eagle - Gold: The Tortoise Beats The Hare

Economic Times - Platinum becomes cheaper than gold; demand up 40-50% in Indian markets in Feb-March

BullionStar - Indian Gold Import Exploding In March

GOLD NANO-PARTICLES : biotechin - Fluroescent Nano-Probes Which Light Up Tumors

CHARTS : dshort - Inflation: A Six-Month X-Ray View

Zero Hedge - This Is What The Global Economy Got For $11,000,000,000,000 In QE

Resource Investor - Wall Street losing millions from bad energy loans

Money Control - How does LBMA Gold Price fixing impact your investments

Daily Reckoning - 6 Major Flaws in the Fed’s Economic Model

TECHNICAL ANALYSIS : Market Anthropology - Old School Currency Parables

The BRICS Post - Li vows reforms to help Yuan be World’s 5th Reserve Currency

NJ.com - Recyclers try to defraud U.S. Mint with counterfeit coins from China, feds say

CDAPress (Idaho) - Treasure heist; $60,000 in gold stolen from show vendor

03/23/2015 - Bullion News

CoinNews - Gold Gains; 2015 Silver Eagles Top 11M

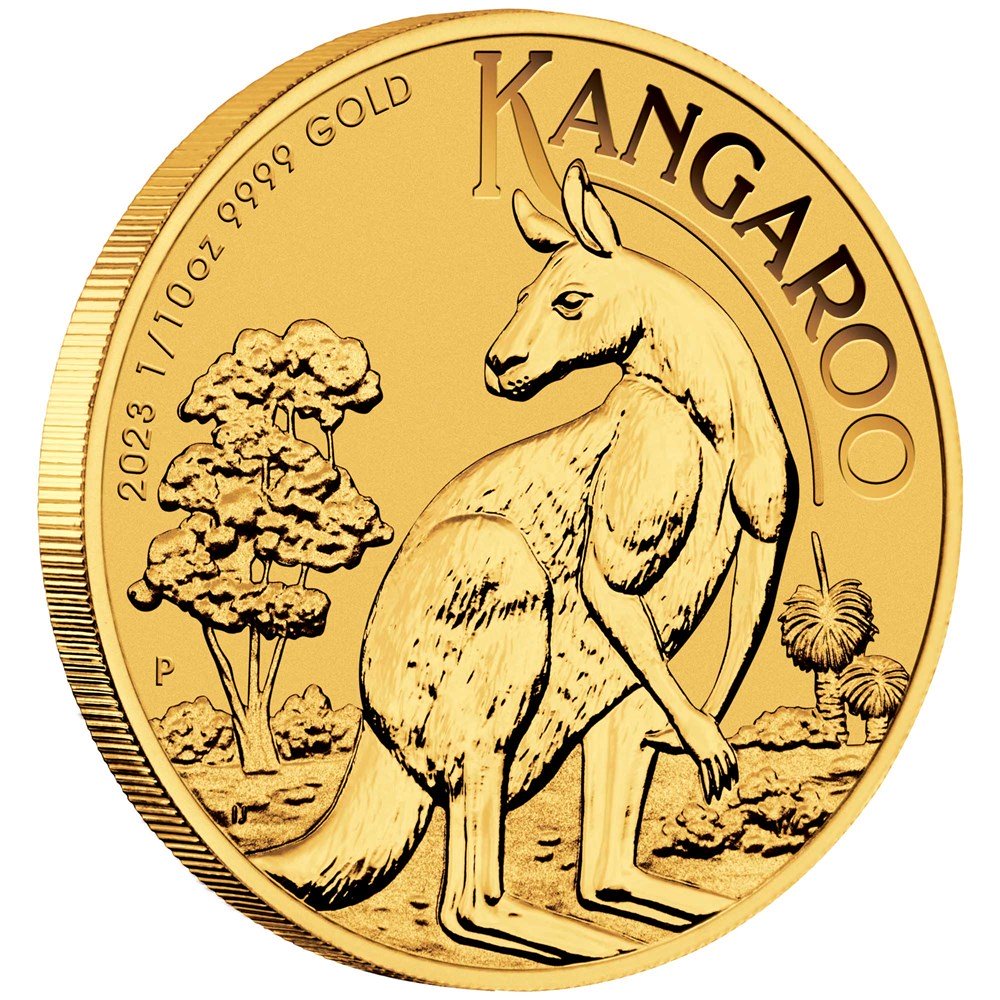

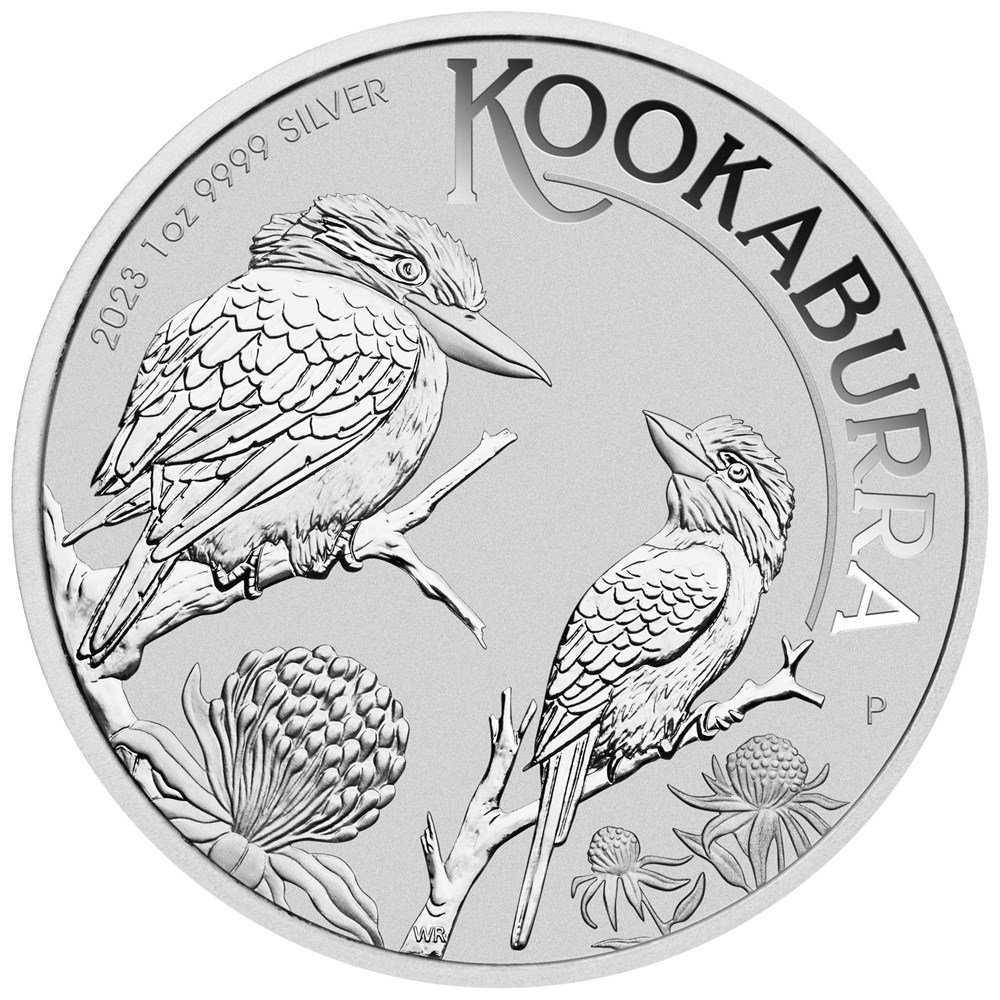

Perth Mint Blog - 2015 Australian Kookaburra 1oz Silver Bullion Coin Sold Out

MarketWatch - Gold and oil have a complicated relationship with the dollar

AUDIO : U.S. Global Investors - Frank Holmes : What’s In Store for Gold?

BullionStar - Will The Shanghai International Gold Exchange Facilitate Gold Inclusion Into The SDR?

AUDIO : Chris Martenson - Philip Haslam: When Money Destroys Nations

Thoughtful Cynic - Greece’s Choice (and why it doesn’t matter)

Alhambra Investment Partners - A Closer Look: Commodities

MotherBoard - Scientists Want to Mine Our Poop for Gold

National Inflation Assoc. - Fed’s Likely 2015 Rate Hike Cut in Half!

TECHNICAL ANALYSIS : Market Anthropology - Size Matters & Their Estimates are Still Too Damn High

SRSrocco Report - Important Gold Chart: Every Investor In The West Needs To See

Wealth Daily - How to Rig the Gold Market - Does the Electronic Gold Fix Matter?

Sputnik - The Dollar is Not a ‘Miracle Currency’ – German Financial Analyst

The Independent - Plastic £5 notes are going into circulation in Britain for the first time

03/22/2015 - Bullion News

Hard Assets Investor - Positive Long Term Growth Story For Gold

Daily Pfennig - Junk Silver: Don’t Let The Name Fool You

TECHNICAL ANALYSIS : SOLARCYCLES - End Of The Mania

Zero Hedge - The Next Move For The Fed: "Trial Balloning" QE4

VIDEO : StreetTalkLive - Fox 26: Why The Fed Won't Raise Rates This Year

AUDIO : Finance & Liberty - Emerging Markets Are the New Sub Prime? | David McAlvany

MoneyBeat (WSJ) - The Euro’s Going Down. If It Doesn’t Go Up.

True Contrarian - SINCE EVERYONE EXPECTS THE U.S. DOLLAR TO KEEP RISING, LOOK FOR THE EXACT OPPOSITE

Armstrong Economics - Monopoly Game & Single Tax Movement

03/21/2015 - Bullion News

Zero Hedge - Open Letter To Janet Yellen

U.S. Global Investors - What the Federal Reserve and the Fear Trade Do for Gold

StreetTalkLive - 5 Things To Ponder: What Hath The Fed Wrought

TECHNICAL ANALYSIS : CEO.CA - $8 Billion Gold Liquidation

Alhambra Investment Partners - Kill Debt to Make Debt

IBTimes - Gold prices could hit $1,200 next week on weak US dollar

BullionStar - Xinhua: China And Germany Deepen Financial Cooperation, Germany Joins AIIB And Supports RMB Inclusion Into SDR

Business Insider - The breakneck pace of the US dollar surge is something we haven't seen in 34 years

National Inflation Assoc. - Only America’s Top 10% Benefited from Fed’s QE/ZIRP

03/20/2015 - Bullion News

GoldMoney - Market Report: FOMC is boxed in

VIDEO : CNBC - Santelli: Currencies gang up against greenback

PHOTOS : CoinNews - The Difference Between Bullion & Un-circulated - America the Beautiful 5oz. Silver : Homestead Five Ounce Silver Coin Photos

Casey Research - Why Aren’t These Investors Worried About The Gold Price?

MineWeb - No Chinese banks in new London Gold Fixing system – yet

The New York Times - Richard Fisher, Leaves the Fed

GOLD NANO-PARTICLES : ChemistryViews - Nano Cancer Probes

The Mess That Greenspan Made - Conundrum 2.0

AUDIO : PhysicalGoldFund - The Gold Chronicles: Interview with Jim Rickards

GoldSeek - COT Gold, Silver and US Dollar Index Report - March 20, 2015

BullionStar - SGE Withdrawals 51t In Week 10, YTD 508t.

Arabian Money - Gold is going to take over from the US dollar as the next favorite currency for speculators

Daily Reckoning - Contagion Deja Vu by Jim Rickards

Sovereign Man - Justice Department rolls out an early form of capital controls in America

03/19/2015 - Bullion News

Things That Make You Go Hmmm - Much Ado About Nothing

GoldSeek - Why the Fed can’t raise interest rates - part 2

E-Piphany - I wonder how many times the Fed needs to be more dovish than expected before investors realize that this is a dovish Fed?

Market Watch - The dollar’s meteoric rise may be just about over

Economic Times - The way gold prices are set is changing forever

Reuters - China to allow more firms to trade gold, may impose curbs if needed

The Bullion Desk - UBS named fifth participant in new ICE gold price benchmark

The Deviant Investor - The Titanic Sinks At Dawn

PDF : U.S. Global Investors - The Optimistic Investor in a Pessimistic World

StreetTalkLive - 10 Investment Quotes To Live By

CHARTS : McClellan Financial - Global Temps Call for 2015 Yield Bottom

The Spokesman Review - Former coin shop owner gets 6 months in jail

Economic Policy Journal - The 10 Most Overlooked Tax Deductions

03/18/2015 - Bullion News

CHARTS : BARRON'S - Why Gold Will See $2,000

VIDEO : Bloomberg - Gold Demand in Asia Seen Doubling as ANZ Sees Record Prices

TECHNICAL ANALYSIS : King One Eye - Like a Thunderbolt, the U.S. Dollar Falls!

Perth Mint Blog - Perth Mint Satisfies Platinum Demand with 2015 Australian Platypus coin

IBTimes - Gold supported near five-year low ahead of change of bullion fixing system

GoldSeek - Debt, Deflation, The Dollar & Gold

MoneyBeat (WSJ) - Fed’s Covert Foray Into FX Policy Risks Wider Currency War

AUDIO : McAlvany Weekly Commentary - The U.S. Dollar Carry Trade Nightmare

GoldReporter.de - Jim Rogers is gold in wait - Google Translation Link

TECHNICAL ANALYSIS : Next Big Trade - Majority of CNBC Viewer's Expect the Dollar to Go Higher

CHARTS : CEO.CA - 4 Charts: The Fed Isn’t Hiking Rates Any Time Soon

Sovereign Man - It’s happening: more US allies join the anti-dollar alliance

GOLD NANO-PARTICLES : R&D - Improved Method for Coating Gold Nanorods

VIDEO : CNBC - Forget 'patience,' QE 4 is coming: Peter Schiff

03/17/2015 - Bullion News

MarketWatch - A Key Part of the Gold Market Will See a Major Shift Friday

Reuters - Platinum hits 5-1/2 yr low; gold eyes Fed

LiveMint - Jewellers in India jump online for $22 billion e-commerce pie

VIDEO : RT - Dragon Rising: China backed intl-bank sparks US outrage

CHARTS : Zero Hedge - Something Strange Is Going On With Nonfarm Payrolls

VIDEO : HedgEye - Is the Fed More Dovish Than Consensus Realizes?

Bullion Vault - Deflation Not Going Away

VIDEO : The Mess That Greenspan Made - Bernanke and Yellen are to Lucy as...

Daily Pfennig - Let the Fed begin...

CNBC - A shadow banking sector has gotten 65 times larger

Sovereign Man - The important lesson I learned from my Thai taxi driver

Wealth Daily - Gold Cannot be Stopped!

Daily Mail - $50,000 worth of cash and gold coins stolen from LA mansion of Grammy-winning Madonna and Beyonce songwriter

03/16/2015 - Bullion News

Economic Policy Journal - US Hits Debt Limit

National Inflation Assoc. - Domestically Held % of US Public Debt Falls to Record Low

TECHNICAL ANALYSIS : Forbes - Is Gold About To Plunge To $1,000 Or Even Lower?

The Sovereign Investor - The Markets Need to Quit Yellen

Perth Mint Blog - NEW RELEASE Australian Funnel-Web Spider Silver Bullion Coin

MoneyWeek - This simple economic principle could be huge for gold over the next few years

GOLD NANO-PARTICLES : COSMOS - A gold Trojan nano-horse that fights cancer

VIDEO : HedgEye TV - Jim Rickards Reveals What He Does Differently in Exclusive Interview With Keith McCullough

The Telegraph - Currency wars threaten Lehman-style crisis

Casey Research - 50 Shades of Gold: How to Diversify Your Gold Holdings

BullionStar - China, Gold, SDRs And The Future Of The International Monetary System

VIDEO : Kitco - Dollar Due For A Correction, All Eyes On Fed - Frank Holmes

GoldSeek - Irish Finance Minister Dumps Stocks to Buy Gold

Fairfield Citizen (CT) - Gold, Silver Bars, Guns Stolen in $200K Home Burglary

CNBC - Billionaire teams up with NASA to mine the moon

03/15/2015 - Bullion News

The Mess That Greenspan Made - The Long-Term Dollar Index

TECHNICAL ANALYSIS : The Daily Gold - Short-Term Bounce but Danger Looming

TECHNICAL ANALYSIS : CEO.CA - Gold Miners Pushed to the Brink

GoldSeek - COT Gold, Silver and US Dollar Index Report

PDF : The Gold Standard Institute - Monthly Newsletter - Issue #51

Thoughtful Cynic - Fighting the Buggers: A Defense of Gold Bugs

GoldBroker - Deutsche Bank (And Its €55 Trillion In Derivatives) Fails Fed's Stress Test

Nomi Prins - The Volatility / Quantitative Easing Dance of Doom

VIDEO : Zero Hedge - Inside The Federal Reserve: "Money For Nothing" - The Full Movie

TECHNICAL ANALYSIS : SOLARCYCLES - ZIRP vs Solar

The Corner - The dollar’s unsettling upsurge

TECHNICAL ANALYSIS : StreetTalkLive - 5 Things To Ponder: Return To Reality

IBTimes - Precious metals wrap: Dollar rally pushes platinum to six-year low, gold and silver near five-year lows

BullionStar - SGE Withdrawals 45t Week 9, YTD 456t

Sputnik - Venezuela Seeks To Monetize Its Gold Reserves Amid Severe Cash Crunch

03/13/2015 - Bullion News

TECHNICAL ANALYSIS : Next Big Trade - Is the Dollar Entering Into a Major Bear Market?

TheGoldandOilGuy - THE NEXT FINANCIAL CRISIS – Part I : Protecting Yourself with Gold, Oil and Index ETF’s

VIDEO : Silver Slacker - 2014 Perth Mint Final Lunar Mintage Numbers Released!!!

Finance and Economics - Alasdair Macleod : An Austrian Take on Inflation

The New York Times - Paul Krugman : Strength Is Weakness

Zero Hedge - Debt Ceiling Drama Is Back: Two Days Until US Borrowing Capacity Is Exhausted

Bloomberg - Surprise: U.S. Economic Data Have Been the World's Most Disappointing

Sovereign Man - Et tu, Britain? United Kingdom to join China in the anti-dollar alliance

GoldSilverWorlds - Gold To Profit From The Coming Dollar Correction

GoldCore - Gold Up 11% Euro This Year As Currency Wars Intensify

National Inflation Assoc. - Slack is Gone, Wages Begin to Rise – Massive Consumer Price Inflation is Ahead!(?)

GoldReporter.de - Euro membership cost Lithuania 1.6 tons of gold - Google Translation Link

VIDEO : Bloomberg - Gold Heads for the Longest Slump in 17 Years

MINING - These are the most bullish gold price charts you'll see today

BullionStar - Chinese Banks as direct participants in the new LBMA Gold and Silver Price auctions? Not so fast!

GOLD NANO-PARTICLES : Azonano - Light and Targeted Gold Nanoparticles Can Be Used to Activate Non-Genetically Modified Neurons

03/12/2015 - Bullion News

CHART : Financial Sense - Financial Stress and Major Market Peaks

Casey Research - Don’t Fret Gold’s Seasonal Decline

GroundReport - Palladium Set to Keep Top Performer Status among Precious Metals in 2015

GOLD NANO-PARTICLES : MedicalPhysicsWeb- Gold Nanotubes Sizzle Cancer Cells

GoldSeek - Will the Shanghai Fix fix the gold market?

Thoughtful Cynic - Did QE Really End? And Does it Really Matter?

Alhambra Investment Partners - Can We Finally Admit There Is A Serious Problem?

Contra Corner - Why The Dollar Is Rising As The Global Monetary Bubble Craters

The Deviant Investor - Silver Projection, Dollar Correction

CoinWorld - No Philadelphia Mint labels on certified 2015 American Eagle silver bullion coins without documentation

BullionStar - The Mechanics Of The Chinese Gold Market

The BRICS Post - China-IMF talks underway to endorse yuan as global reserve currency

sify - Why monetising gold might not prove easy

MINING - The stunning collapse of gold production in South Africa

03/11/2015 - Bullion News

TECHNICAL ANALYSIS : GoldSilverWorlds - The US Dollar Is Topping. When?

CoinNews - Gold Drops to 4-Month Low; US Mint Gold Sales Surge

The Gold Report - The Simple Test Tocqueville's John Hathaway and Doug Groh Use to Determine if Gold Is at a Bottom

AUDIO : FSN - Jim Rogers – Nothing Ever Really Changes

The Telegraph - Global finance faces $9 trillion stress test as dollar soars

AUDIO : Zero Hedge - Which States Have The Most Student Debt

AUDIO : McAlvany Weekly Commentary - Nothing is Permanent…Beware the Consensus!

GOLD NANO-PARTICLES : ACS - A Gold Nanoparticle-Enabled Blood Test for Early Stage Cancer Detection and Risk Assessment

CHARTS : McClellan Financial - The Real Relationship Between Dollar and Stock Market

Business Standard - Silver marks record imports in 2014

The Wealth Watchman - The Newest Casualty in the Bankers’ War on Gold and Silver

Daily Pfenning - China To Begin Gold Fixing On March 20...

BloombergView - China's Plan for Winning the Currency Wars

Inquisitr - John Schnabel: ‘Gold Rush’ Patriarch Returns To Television After Beating Cancer, Handing Off Family Business To Grandson Parker

03/10/2015 - Bullion News

VIDEO : Bloomberg - Rickards: FED Has Major Conundrum - Link to Video Above

Rick Ackerman - Why the Fed Cannot Tighten

TECHNICAL ANALYSIS : Market Anthropology - The Dollar's Perfect Storm

Bloomberg - Investors Sell Gold Holdings for 9th Day on Rate Outlook

Alhambra Investment Partners - Rational Expectations or Bubbles

VIDEO(s) : Solidus Center - Greenspan’s Insulting Admission of Fed Culpability

Investing - Who's Who Of Gold Investing

The Deviant Investor - Silver and Gold: Shelter From the Storm

VIDEO : Daily Reckoning - Avalanche Ahead: How to Survive the Monetary Collapse

INTERACTIVE GRAPHIC : The Telegraph - From bust to boom: How the world became addicted to debt

The Hindu - The India Bullion and Jewellers Association may receive ‘Gold Council’ status with the Prime Minister’s Office...

The BRICS Post - Putin signs law ratifying BRICS Bank

03/09/2015 - Bullion News

Monetary Metals - Monetary Metals Supply and Demand Report: Gold & Silver

CNBC - Is the dollar losing its clout among EMs?

MineWeb - Knives are out for gold and silver – again

CoinNews - Gold Marks First Gain in March; US Mint Gold Sales Jump

Profit Confidential - Why Ugly Inflation Is Showing Up Everywhere Except in CPI Numbers

CHARTS : Casey Research - Gold Manipulation: The “London Bias,” 1970-2014

The Union (California) - After counterfeit gold arrest, Nevada County residents hurry to verify gold, silver

TECHNICAL ANALYSIS : Acting Man - Gold and Gold Stocks Break Down Again – What to Look For

TECHNICAL ANALYSIS : Kimble Charting - King Dollar: Longest Monthly Winning Streak in History! What's Next?

VIDEO : CNBC - Does QE trigger currency chaos?

The Mess That Greenspan Made - The Jobs “Recovery”

Alhambra Investment Partners - Who Is Selling Treasuries?

QUARTZ - Can Modi unlock $1 trillion worth of gold stashed away in India’s lockers?

CEO.CA - Apple's Gold Demand is Almost Exaggerated as Much as the iWatch

03/08/2015 - Bullion News

Thoughtful Cynic - It’s (Still) Precious Metals Time

Business Insider - RAY DALIO: 'You Can't Make Money Agreeing with the Consensus View'

FOFOA - The Big Picture

TECHNICAL ANALYSIS : SOLARCYCLES - State Of The Markets

BullionStar - How The World Is Being Fooled About Chinese Gold Demand

AUDIO : GoldSeekRadio - GoldSeek Radio's Chris Waltzek talks to analyst Louise Yamada

The Telegraph - Austria is fast becoming Europe's latest debt nightmare

AUDIO : Peak Prosperity - Commissioner Bart Chilton: Price Discovery In The Commodities Markets

Sober Look - Debate Around the 2015 Rate Hike Intensifies

biiwii - King Dollar Tipping Point

CHART : Contra Corner - Fed Faces Tsunami Of Maturing Treasuries For Next 10 Years

eCommerceBytes - Coin Facts - Mint Marks

Free Shipping on Orders $199+ | 5.0 star Customer Reviews

03/06/2015 - Bullion News

TECHNICAL ANALYSIS : CFD Trading - USD Strength to Force Gold (XAU/USD) to $1000...???

Market Watch - Gold-Market Investors I Follow are Now 100% in Cash

TECHNICAL ANALYSIS : CEO.CA - Gold Takes the Elevator Down

TECHNICAL ANALYSIS : Nifty Charts - Gold Needs to Stay Above $1130 to Keep From Falling Further

Zero Hedge - Who Knew What When In Gold & Stocks This Morning?

VIDEO : Investing News - Rick Rule: 'Gold Doesn't Need to Win the War Against the US Dollar'

Solidus - Sound Money and the Ring of Truth

The Corner - Global indebtedness: the new bubble

VIDEO : CNBC - Former Federal Reserve Chairman Alan Greenspan, talks about the impact of QE on the U.S. economy and interest rates

Sputnik - Chinese Gold Fixing to Have ‘Decisive Influence’ on Global Prices

GoldSeek - The new London gold fix and China By Alasdair Macleod

SRSrocco Report - CRITICAL REASON TO OWN SILVER: Shown In This Chart

TECHNICAL ANALYSIS : GoldSeek - Clive Maund : Preparing for the Crash as Earnings Crumble and Buybacks Exhaust Themselves

Economic Policy Journal - HERE WE GO AGAIN Lew to Congress: Debt Limit Needs to be Raised ASAP

Mirror - North Korean diplomat arrested after 'attempting to smuggle £1m gold bullion into Bangladesh'

03/05/2015 - Bullion News

Futures Magazine - Oil-Gold ratio: Dial down deflation concerns

CoinNews - Gold Drops to 2-Month Low; US Gold Eagles Rise

TECHNICAL ANALYSIS : StreetTalkLive - 3 Things - New Highs, Dollar Rally, Margin Debt

TECHNICAL ANALYSIS : King One Eye - Chart of the Day -- US Dollar and Gold

The Bullion Desk - Gold price holds up well considering dollar strength

SRSrocco Report - FY 2014 Silver Eagle Dollar Sales Surpass Gold Eagles By Wide Margin

321gold - Merk Insights : Is Japan Zimbabwe?

AUDIO : FSN - Best Way To Solve A Debt Problem Is To Issue 4 Times More Debt, Right? | John Rubino

Juggling Dynamite - ECB guns for inflation or bust (further bust)

The Deviant Investor - Mr. Ponzi – Patron Saint

MineWeb - Russian palladium exports to Switzerland jump

NY Fed - From the Vault: Tracking Subprime Auto Loans

BullionStar - Chinese Gold Financing Deals Explained

GoldSilverWorlds - Ted Butler: More Evidence Of JP Morgan’s Manipulation Scheme In COMEX Silver

AUDIO : CATO Institute - Mark A. Calabria discusses auditing the Federal Reserve on Bloomberg Radio

03/04/2015 - Bullion News

CEO.CA - Gold grades declining rapidly: Dundee

Reuters - Gold market open to wide-ranging OTC trade reform: LBMA

Darien Times - Rickards: A Central Banker’s Worst Nightmare

Bullion Vault - Tilting at Gold Bugs

The Times of India - India's Finance Minister Finds Out that Monetising Gold Looks Easier Said Than Done

GoldSeek - An Ocean of Money and No One wants Gold?

CHART : Perth Mint Blog - The Perth Mint's February 2015 Gold & Silver Sales Chart

VIDEO : Technical Traders - Chris Vermeulen Gives His Technical Analysis on the Markets : S&P 500, US Dollar, Gold, Oil, etc...

GoldReporter.de - Gold investment scams? Raid on Berlin BWF Foundation - Google Translation Link

Sovereign Man - The Chinese have put out billboard ads announcing the renminbi as the new world currency

SilverCoins - Home Prices in Silver – Ounces per House

VIDEO : CNBC - Car Loans at Record High

Sober Look - The Eurozone: on the road to recovery with a lingering risk

Business Insider - The Bank of Canada is warning people to stop drawing Spock on their money

03/03/2015 - Bullion News

BloombergView - Rip Van Winkle's Bond Nightmare

CoinNews - Gold Slips for Second Day; 2015 Silver Eagles Top 9M

Alhambra Investment Partners - Swirling ‘Dollars’

AUDIO : abcNews - 911 call released in $4 million gold heist on I-95 in Wilson County

WKZO - Barclays gives information to U.S. precious metals probe

TECHNICAL ANALYSIS : Deviant Investor - The Silence of the Lambs

VIDEO : Kitco - Silver Is Headed To This In 2015 - David Morgan

SilverCoins - How to Hide Silver & Gold Coins – (Ideas)

GOLD NANO-PARTICLES : RedOrbit - Nano-Device can Eliminate Drug Resistance in Cancer Cells

AUDIO : Talk Digital Network - What is the Direction of the S&P and Commodity Markets? Interview with Chris Vermeulen founder of AlgoTrades and the TheGoldAndOilGuy.com

GoldReporter.de - How much gold is stashed in Switzerland - Google Translation Link

Profit Confidential - These Three Events Pushing U.S. Dollar Higher, but Not for Long

CHARTS : dshort - The Market Moves Higher into Overvaluation Territory

Daily Reckoning - Acronym Hell: Q4 Obliterates QE and ZIRP

Economic Policy Journal - Another Example That "There is No Price Inflation...."

03/02/2015 - Bullion News

U.S. Global Investors - FRANK TALK : Could Apple Buy a Third of the World’s Gold?

Daily Reckoning - Why the U.S. is Letting China Accumulate Gold

The Royal Mint - The Reveal of the Queen’s Fifth Coin Portrait

Casey Research - What Top Hedge Fund Managers Really Think About Gold

LiveTradingNews - Traders, Jewelers And Consumers Return To India’s Gold Market

Sunshine Profits - Gold News Monitor: China Cuts Interest Rate

Alhambra Investment Partners - Optimism/Pessimism: Stocks At Record Highs While Savings Rate Jumps

GOLD NANO-PARTICLES : nanotechweb - “Nanorattles” Reduce Tumour Size

Zero Hedge - $4 Million in Gold Bars Stolen in 11th Largest Heist in History

CoinNews - US Mint Bullion Sales Softer in February

The Corner - Concerns voiced over ECB’s QE programme

Daily Sabah - German finance chief softens tone, says Greece ‘needs time'

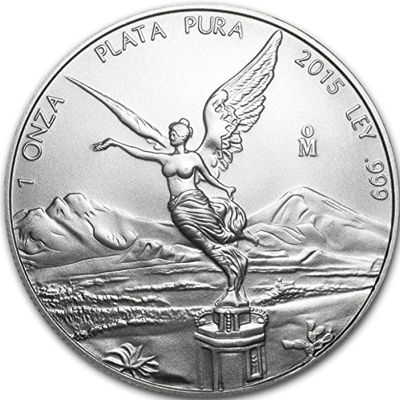

SRSrocco Report - MEXICO: World’s Number One Silver Producer Slips In 2014

Economic Policy Journal - Milton Friedman Turning Over in His Grave: Oakland's Minimum Wage Goes Up to $12.25 Today

TECHNICAL ANALYSIS : SOLARCYCLES - Saturation Again

03/01/2015 - Bullion News

OWNING GOLD - Umbrellas Cost More When It’s Raining. And So Does Gold.

PDF : Wizzen Trading - Technical Analysis : The Precious Metals are Trying to Find A Trend...

Inside Futures - Key Levels for Silver

AUDIO : Peak Prosperity - Grant Williams: Why The Smart Money Is So Nervous Now

BullionBullsCanada - Negative Interest Rates and Precious Metals

AUDIO : Larry Kudlow Show - Review of Friday's Meeting between Fed Chair Janet Yellen and Hard Money (Gold Standard) Economists (Review Starts @78:20 & Ends @95:51) Interview with Two of the Participants of the Meeting

INTERNATIONAL BUSINESS TIMES - India Budget 2015: Gold monetisation scheme in the works

ZAWYA - India's new gold scheme may hit Qatar market

GATA - 1968 magazine article shows how control of gold is main mechanism of imperial power

AUDIO : Financial Sense - Jim Puplava’s Big Picture: Popular Delusions and the Madness of Bankers

VIDEO : The Royal Mint (UK) - A brief history of monarchy on coins - On the 2nd of March, 2015, the Royal Mint will unveil the fifth definitive coinage portrait of Her Majesty The Queen

Bullion Star - The Bank of England and the London Gold Fixings in the 1980s

02/27/2015 - Bullion News

SafeHaven - Debt, huh, yeah; What is it good for? Absolutely nothing, uh-huh, uh-huh

Economic Policy Journal - AND IT BEGINS: Moody's Downgrades Chicago

Profit Confidential - Massive U.S. Debt ($57k+ a Person) Will Force Interest Rates Higher

CHARTS : dshort - NYSE Margin Debt Declined in January

TECHNICAL ANALYSIS : CFD Trading - Gold & Silver Moving Off Support, U.S. CPI Print In Focus

CNBC - China plans yuan-denominated gold fix this year - sources

Alhambra Investment Partners - Harmonized Inflation

MidasLetter - How Quantitative Easing Fuels Deflation and Fails to Stimulate

CEO.CA - Is Deflation Bullish for Gold?

TECHNICAL ANALYSIS : Market Anthropology - Looking Towards the Ides of March

MineWeb - HK January gold exports to China confirm strong demand

Monetary Metals - A Salvo in the Battle for the Gold Standard

Bullion Vault - Silver? Watch Gold & Base Metals

Munknee - Gold Measurements “Troy” & “Karat”: What Do They Mean?

02/26/2015 - Bullion News

TECHNICAL ANALYSIS : TheGoldandOilGuy - Money Will Rotate Into These Dead Investments

VIDEO : GoldBroker - Alan Greenspan Likes Gold: Listen up!

CHARTS : McClellan Financial - 2-Year T-Note Shows Path For FOMC

Bloomberg - Major Firms Are Saying the Stage Is Set for Another Crisis in the Bond Market

INFO~GRAPHIC : Sovereign Man - Someone please show this to Warren Buffett (Gold vs. the Financial System)

GoldSeek - Do You Have a Gold and Silver “Seat Belt”?

The Bullion Desk - Precious metals evenly grouped – gold price looks well placed

SRSrocco Report - MAJOR FACTOR FOR OWNING GOLD: The Collapse Of Gold’s EROI

Alhambra Investment Partners - New Home Sales Confirm Resales; New Home Prices Confirm Bubble

CANCER RESEARCH : Science Simplified - Graphene Oxide Neutralizes Cancer Stem Cells

MetalMiner - Platinum Dives to 5-Year Low, Global Uncertainty Produces No Rise in Precious Metals

The BRICS POST - India follows Russia, ratifies $100 bn BRICS Bank

Peak Prosperity - Time To Toss The Playbook

321gold - Merk Insights : Is Gold Risk Free?

INFO~GRAPHIC : GoldCore - EU Warns of “Macroeconomic Imbalances” and Debt Dangers in EU Economy and Ireland

Kitco - Increase In Eurozone Gold Reserves Not From New Purchases – Macquarie

PLATTS - China's 2014 spot gold trade volume soars near 60% on year to 18,486 mt

The Bullion Desk - Chinese imports of gold from HK at net 72 tns in January

Bullion Star - 1973 EU CB’s Traded Gold In Secret At Free Market Price

CHARTS : dshort - A Long-Term Look at Inflation

02/25/2015 - Bullion News

Numismaster - Any Competitors for Silver Eagle Bullion Coins?

INFO~GRAPHIC : Visual Capitalist - The Silver Series: Who Controls The World’s Supply? (Part 2 of 4)

VIDEO : CNBC - Jim Grant: The 'virus' of radical monetary policy

The Corner - Central bankers waiting to see who will jump first

Bullion Star - Austria Expresses Concern Over Their Gold At BOE

Perth Mint Blog - Elegant New Card Coming For Kangaroo Minted Gold Bars

CoinWeek - State of the Mint – U.S. Mint Coin Sales...

AUDIO : McAlvany Weekly Commentary - Controlled Interest Rates: The NEW Weapon of Theft

Zero Hedge - Ukraine Enters Hyperinflation: Currency Trading Halted, "Soon We Will Walk Around With Suitcases For Cash"

CATO Institute - Ukraine Hyperinflates

GoldCore - 12 Reasons Why Ritholtz and Many Experts Are Mistaken On Gold

The Economic Collapse - Why Does Maryland Have The Most Millionaires Per Capita? The Answer Might Make You Angry

Sovereign Man - Chinese reduce their holdings of US Treasury bonds for the fourth consecutive month

02/24/2015 - Bullion News

National Inflation Assoc. - Shocking Disney World Price Inflation

CoinNews - Gold Falls for Third Session; US Coin Sales Rise

VIDEO : RT - Jim Rickards on Fed Chair Janet Yellen and The Strong Dollar

Dollar Collapse - Lowest Interest Rates EVER

VIDEO : Kitco - It's Clear Why Gold Should Be Better - Jim Grant

Market Watch - U.S. probing big banks over pricing of gold, other metals

BloombergView - Metal Manipulation and Negative Rates

Deviant Investor - Gold: The Good, Bad, and Truly Ugly

CHARTS : Futures Magazine - Why bad news is good news in Europe — 7 charts showing you what you really need to know

MineWeb - Kazakhstan adds gold for 28th straight month

Reuters - India seizes record haul of smuggled gold outside airport

02/23/2015 - Bullion News

CoinNews - Gold Slips, 2015 Silver Eagles Top 8M

CHART : GoldSilverWorlds - COMEX Gold Analysis – Has Gold Bottomed?

VIDEO : CNBC - A Bottom in Gold?

TECHNICAL ANALYSIS : CEO.CA - This is the Key to the Next $100 Move in Gold

CATO Institute - Does Fed Leverage and Asset Maturity Matter?

Mish's Blog - Beggar Thy Taxpayer: Currency Wars, QE Strain Life Insurers and Pension Plans; Negative Returns With 4-7% Promises

GoldBroker - Alan Greenspan: Gold Price Will Be “Measurably Higher”

The Standard - Gold link on track - direct trading of gold between Hong Kong and Shanghai should kick off as early as June this year

Bullion Star - SGE Chairman: India Will Become SGE’s Largest Partner

VIDEO : Sprott Money - Ask The Expert - Hugo Salinas Price

FXStreet - Kicking The Can Down The Road

Market Watch - 10 reasons U.S. stocks may see a 10%-20% correction by July

Mlive - Confederate treasure in Lake Michigan? Despite skeptics, divers pursue fantastic story

Sputnik - Bankers Rally Against ‘Audit the Fed’

02/22/2015 - Bullion News

Business Insider - The US dollar is the most crowded trade in the world

PDF : Wizzen Trading - Technical Analysis : Stocks Rocking While Metals Stay In Downtrends

International Man - What You Need to Know About Russia, Putin, and Gold

GOLD NANO-PARTICLES : R&D - Shape-shifting groups of nanorods release heat differently

VIDEO : The Daily Coin - Weight For It: Sizing Up The RCM Silver Animal Series

Reuters - South African gold miners rescued after a fire at Harmony Gold

The New Indian Express - 12 Arrested for Duping Women of Gold, Silver

02/21/2015 - Bullion News

Zero Hedge - "The Smart Money Is Selling, Not Buying" Goldman Warns With Valuations In The "99th Percentile"

Institutional Investor - Daily Agenda: The Week Ahead February 23rd - 27th, 2015 - Fed chairwoman Janet Yellen testifies before Congressional committees; three key U.S. housing market data points on deck.

Federal Reserve Bank of NewYork - Household Debt Continues Upward Climb While Student Loan Delinquencies Worsen

Gold-Eagle - U.S. dollar net longs shrink to smallest since late December -CFTC, Reuters

Ahead of the Herd - Duck Quacks and Golden Echo’s

AUDIO : Library of Economics & Liberty - Benn Steil on the Battle of Bretton Woods

Bullion Vault - Greek Bankruptcy Hits Neocolonial Finance

Forbes - Why Gold Is Looking Lustrous Once Again

Bloomberg - Russia Stops Gold-Buying Spree After Prices Soared in January

VIDEO : The Telegraph - Watch: Divers find huge hoard of 1,000-year-old coins on Israel sea bed

GoldCore - Gold Bars In France Worth EUR 450,000 Robbed From Pensioner By Fake Cops

NGC - Rare Mint Error Found on a 2015 Silver Eagle Bullion Coin

CoinNews - 2016 Red Book of U.S. Coins Available March 26

02/20/2015 - Bullion News

U.S. Global Investors - Mind-Blowing: China Consumes More Gold Than the World Produces

sify - India's Gold Imports May Rise to 35-40 Tonnes in February

NFTRH - Gold and Silver CoT

Profit Confidential - Derivatives: The $563-Trillion Reason to Look at Gold

Zero Hedge - Why The "1%" Hates The Gold Standard

VIDEO : Vision Victory - Gold and the Dollar are at War - Rick Rule Interview

Reuters - Platinum reaches biggest discount to gold in nearly two years

GOLD NANO-PARTICLES : Bio Optics World - Hybrid gold nanoparticles could pair cancer imaging, therapy

Sovereign Man - Meet the bureaucrat who had the courage to tell the truth (and probably won’t have a job tomorrow)

Dollar Collapse - Greece Is Fixed! Oh, Wait...

AUDIO : TF Metals Report - A2A with Patrick Heller of Liberty Coin Service

The Economist - The Royal Mint : Coining it

SRSrocco Report - AMAZING SILVER CHART: Investors Overwhelming Prefer Physical Over Paper Silver

MINING - Here's one hedge fund not bailing on gold

02/19/2015 - Bullion News

McClellan Financial - Architecture Billings Index Flashes Warning

Peak Prosperity - How Many More “Saves” Are Left in the Central Bank Bazookas?

The Bullion Desk - Reserve Bank of India Scraps Ban on Gold Coin Imports

TECHNICAL ANALYSIS : Nifty Charts - GOLD Daily at golden ratio

TECHNICAL ANALYSIS : CFD Trading - Technical Picture In Gold Outshines Silver & Platinum

MoneyBeat (WSJ) - March Date Set For Gold Fix Switch

VIDEO : Stefan Molyneux - A Conversation with G. Edward Griffin, author of "The Creature from Jekyll Island"

GOLD NANO-PARTICLES : nano werk - Near-Perfect Anti-Bacterial Nano-Materials

Fox Business - Gold Rises Amid a World Full of Risk and Uncertainty

AUDIO : Gordon T Long - Gordon T Long Inteviews Marc Faber

Bullion Star - SGE Withdrawals 59t in week 6, YTD 374t: Chinese Gold Soap Extended Another Season

Deviant Investor - Silver and Gold: Why Now?

AUDIO : McAlvany Weekly Commentary - The Greeks: Is it a Game of Chicken or a Forfeit?

GoldSeek - Gold: The Dollar Reigns Supreme . . . But For How Long?

02/18/2015 - Bullion News

CoinNews - Gold Bounces from 7-Week Low After Fed Minutes

Zero Hedge - FOMC Minutes Show Patient-er-For-Longer, "Foreign Risks"-Fearful Fed

Business Insider - The Fed is worried about what happens when everyone rushes for the exit

Economic Policy Journal - The Crony Meetings of Fed Chair Janet Yellen

CoinNews - 2015 Homestead 5 Oz Silver Bullion Coin Launches

VIDEO : GoldSeek - GoldSeek Exclusive Video Syndication: The Real Cost of Mining Gold: Part 1

MineWeb - Global silver production up 3.8% in 2014

TECHNICAL ANALYSIS : DailyFX - Palladium Consolidates as a Demand Surge Counters Mining Recovery

AUDIO : Talk Digital Network - Interview with David Morgan about his New Book for Silver Investors : "Silver Manifesto"

Gold-Eagle - Gold And Russia

INFO~GRAPHIC : Visual Capitalist - The 10 Countries With the Most Gold Reserves

AUDIO : GoldCore - Gold Essential “Safe Haven” Due to Greece … Spain, Italy, Ukraine, Lehman and “Bad Stuff”

TECHNICAL ANALYSIS : Market Anthropology - Markets on Wire

The Mess That Greenspan Made - How Non-Housing Debt Has Changed

Forbes - Social Security Could Be In Worse Shape Than We Thought

02/17/2015 - Bullion News

TECHNICAL ANALYSIS : Kitco - Gold Plunges, Heading Toward Key "Line In The Sand"

Market Watch - 7 Charts that Suggest the Rising Stock Market May be Wrong

Bullion Star - Koos Jansen vs WGC/GFMS/CPM Update

GoldSeek - SWOT Analysis: China is Effectively Consuming all of the World’s New Mined Gold Supply

PDF : Gold Standard Institute - The Gold Standard - Issue #50

AUDIO : PhysicalGoldFund - The Gold Chronicles: February 9, 2015 Interview with Jim Rickards

GOLD NANO-PARTICLES : nano werk - Plasmonic Nano-Crystals for Combined Photo-Thermal and Photo-Dynamic Cancer Therapies

Bloomberg - Greek Banks Need More Emergency Funds

The Deviant Investor - Silver and Gold: Why Now?

AUDIO : FSN - Chris Vermeulen – Gold Still in a Bear Market, but Don’t Lose Hope

PDF : World Platinum Investment Council - Platinum Supply & Demand - Platinum Quarterly

Juggling Dynamite - Assault on democracy: big banks controlling ‘journalists’

GRAPHIC & VIDEO : New York Fed - Change in Home Prices

Fox News - Largest trove of gold coins in Israel unearthed from ancient harbor

02/16/2015 - Bullion News

Acting Man - Misconceptions About Gold

TECHNICAL ANALYSIS : CEO.CA - Silver Heading for Major Test

CNBC - Greece defies creditors, seeking credit but no bailout

Zero Hedge - The Greeks Are Running Towards Gold As The Retail Demand Increases By 123%

TraderPlanet - Resolved: The Fed's QE Polices Were Bad For Business … And Everybody Else

Cayman Financial Review - The GSEs, the financial crisis and the Dodd-Frank Act - Excellent Read

AUDIO : The Daily Gold - Interview with Palisade Radio

NANO-PARTICLES : SPIE - Colloidal Nanoparticles for Heterogeneous Catalysis

Daily Reckoning - Attention to Deficits Disorder

TECHNICAL ANALYSIS : Action Forex - XAU/USD Manages To Cross Resistance At 1,230

Casey Research - Dear Harry Dent: Wanna Bet?

VIDEO : Gordon T Long - Gordon T. Long has a Market Discussion w/ Lacy Hunt

GoldSeek - Thoughts from the Frontline: Mamas, Don’t Let Your Babies Grown Up to Be Pension Fund Managers

The Daily Coin - Ted Butler: A Remarkable Proposition

02/15/2015 - Bullion News

Juggling Dynamite - The Myth of Black Swan market events

VIDEO : TraderPlanet - Technical Analysis of the US Dollar, Gold and Currencies

AUDIO : Peak Prosperity - David Stockman: The Global Economy Has Entered The Crack-Up Phase

South China Morning Post - Gold demand forecast to rebound in 2015

CNN Money - Here's what to really fear about the stock market...

The Corner - Swedish central bank: “The sins of the father”

Bullion Star - The IMF’s Gold Depositories – Part 2, Nagpur and Shanghai, the Indian and Chinese connections

CoinDesk - Bitcoin ATM Selling Gold and Silver Goes Live in Singapore

Laissez Faire - URGENT: Sell Everything, Buy… Nickels?

02/13/2015 - Bullion News

The Daily Bell - Fed Under Attack Again – This Time From One of Its Own

TECHNICAL ANALYSIS : Market Anthropology - Sizing up the next moves in the Market

Numismatic News - Will Uncle Sam get your IRA? by Pat Heller

GoldMoney - Unemployment and Group-Think

GOLD NANO-PARTICLES : PHYS.org - Gold nanotubes launch a three-pronged attack on cancer cells

Market Watch - Dollar sinks for third week in a row

Dollar Collapse - Gold In A Negative Interest Rate World

Perth Mint Blog - Indispensable Silver

Bullion Star - SGE Withdrawals 59t in Week 5, YTD 315t. What is China Up To With All This Gold?

Reuters - Valuations of Chinese gold miners surge, defying dull gold price

Kitco - The U.S. Dollar Is Not A Safe Haven – Jim Rogers

Silver Doctors - THIS IS THE WOMAN REVOLUTIONIZING PRECIOUS METALS

itv - Largest ever 'perfect' 100-carat diamond worth £16 million arrives in London ahead of spring auction in New York

02/12/2015 - Bullion News

GoldSilverWorlds - Central Banks Purchase Gold To Diversify From The US Dollar

TECHNICAL ANALYSIS : McClellan Financial - Crude Oil Leads the Euro

TECHNICAL ANALYSIS : Bullion Star - Is The $/Yen About To Take A Swan Dive?

Gold-Eagle - Dollar Weakening After Disappointing Economic Reports

Alhambra Investment Partners - When ‘Deflation’ Reveals ‘Inflation’

VIDEO : CNBC - Summers: Why the Fed Should Not Raise Rates

Zero Hedge - "Fed" Or "Fundamentals" - You Decide

The Daily Bell - What the Price of Gold Says About Central Bankers

Economic Policy Journal - WOW India Passes China to Become Fastest-Growing Economy

CommodityHQ - Palladium Flying Under the Radar

Bullion Vault - Gold Mining 'Peaks, Will Plateau in 2015' on Low Margins, Spending

AUDIO : FSN - David Morgan – Precious Metals Still Make Sense

Casey Research - Doug Casey on ISIS, Gold, Oil, and What to Expect in 2015

CoinWeek - The Royal Canadian Mint Has a New “Master” and Board Chair

02/11/2015 - Bullion News

Alhambra Investment Partners - The Reality of ‘Flow’

Bloomberg - Swiss Bank Says Investors Favor Gold Amid Charges on Cash

Money Week - Technical Signal Not Seen Since 2009, is Now Showing Up on Gold's Monthly Chart

Bullion Vault - China's Silver Demand 'Peaked 2013, Not 2010'

FOFOA - Confessions of an Erratic Marxist

GOLD NANO-PARTICLES : FBIG - 2nd Cancer Research Update

GOLD NANO-PARTICLES : World Bulletin - Egypt researchers claim to treat cancer with gold

SRSrocco Report - 2015 SILVER EAGLE INVESTMENT DEMAND: Continues To Be The Big Winner

Mining Weekly - Fuel cells, cleaner fuel to create new platinum demand

CNBC - Fisher floats Fed changes to fix New York, Washington bias

Project Syndicate - An Accidental Currency War?

VIDEO : Sprott Thoughts - Eric Sprott: Expect Physical Gold Backing of Currencies Within Next Decade

The Diplomat - China, India To Lead World By 2050, Says PwC

Fun Times Guide - What Are Error Coins? How Much Are Coin Mistakes Worth?

02/10/2015 - Bullion News

Daily Reckoning - Unprecedented Central Bank Policies Call for a “Barbell Strategy”

Scrap Monster - Indian Trade Ministry solicits drastic tax cut on gold imports

VIDEO : Talking Numbers - Two Different View Points on the Gold Market's Future

CEO.CA - The Only Chart of Gold You Need

VIDEO : Zero Hedge - This Man Will Never Be Invited Back On CNBC

MoneyBeat (WSJ) - The Missing Wage Jolt

Business Insider - These countries own most of US foreign debt

GOLD NANO-PARTICLES : FirstWorld MedTech - Nanovectors Combine Cancer Imaging and Therapy

The Deviant Investor - Silver and Gold Truth Versus Fiat Lies

AUDIO : Talk Digital Network - Silver Oversold at Record Level

Bullion Star - The Keys to the Gold Vaults at the New York Fed – Part 3: ‘Coin Bars’, ‘Melts’ and the Bundesbank

Project Syndicate - The Greek Austerity Myth

Provident Metals - Millions Worth of Gold and Silver Down the Drains?

The Independent - Largest hoard of Anglo-Saxon coins found in recent years goes on display at British Museum !

02/09/2015 - Bullion News

VIDEO : MoneyBeat (WSJ) - Interview with Richard Dobbs of McKinsey & Co. - Turning on the Gas: Global Economies Add $57 Trillion in Debt

VIDEO : Gordon T Long - MACRO ANALYTICS - The Next Peg To Fall - w/ Charles Hugh Smith

Bullion Vault - QE's Special Sauce

VIDEO : CNBC - Santelli eyes key level in EURUSD=X

Zero Hedge - Fearing Grexit, Greeks Turn To Gold Again

Bloomberg - Six Countries Where Inflation Is Surging

Bullion Star - Second Thoughts On US Official Gold Reserves Audits

VIDEO : Algo Trades - Chris Vermeulen Market Update

02/08/2015 - Bullion News

02/08: Sprott Thoughts - Rick Rule: Gold Is Beginning to Lose Less Badly Against the US Dollar

Investor Intel - In Memory of Gene Arensberg: the “Vulture King” : Founder of the Got Gold Report

VIDEO : Forex Video Zone - Technical Analysis : Gold Market Trend-Lines to Watch this Week

VIDEO : TraderPlanet - Technical Analysis : US Dollar, Gold & Currencies...

GoldSeek - COT Gold, Silver and US Dollar Index Report - February 6, 2015

Sober Look - Improvements in the euro area credit conditions should not be ignored

OilPrice - Palladium : Is This Crisis Metal Today's Best Resource Opportunity?

INFO~GRAPHIC : GoldSilver - Why the Dollar May Not BE All-Powerful

PHOTOS : MINING - Dump trucks hoisted, frozen, tipped and sunk

02/07/2015 - Bullion News

02/07: Bloomberg - America's Dollar, the World's Problem

TECHNICAL ANALYSIS : StreetTalk - 5 Things To Ponder: Intriguing Erudition

Gold Reporter.de - Silver Trading: CME Group raised margins again - Google Translation Link

VIDEO : Economic Policy Journal - The Fed Manipulated Boom is On: January 2015 is the First Positive Economic Confidence Index Number in at Least Seven Years

The Reporter - Consumer debt jumped last month

China Daily - China, EU aim to increase investments in ICT markets

BBC - Bank of England holds rates at 0.5%

REWIND : VIDEO :

TECHNICAL ANALYSIS : SOLARCYCLES - Not So Different After All?

TheGoldandOilGuy - The S&P 500 Is Going Lower . . . Sooner Rather than Later

02/06/2015 - Bullion News

Daily Reckoning - The Dollar Will Die with a Whimper, Not a Bang

- by James Rickards

MINING - Jobs Report Hammers Gold

Economic Policy Journal - Breaking: Janet Yellen Testimony on Capitol Hill Coming

CNBC - Fed 'Running Out of Excuses' for Zero Rates

Brisbane Times - Gold Bug Peter Boehringer Lifts Lid on Germany's Missing Bullion

Mises Institute - Is Russia Planning a Gold-Based Currency?

GOLD NANO-PARTICLES : nano werk - Nanovectors Combine Cancer Imaging and Therapy

The Business Times - China's 2014 gold demand slides 25% after 'extraordinary' year

Bullion Star - Total SGE Withdrawals 255t In January, Up 4 % y/y

Gold Market Macro - Central Banks can’t stimulate demand and will ruin their currencies trying

Alhambra Investment Partners - Gold Turned Upside Down

Bloomberg - Currency Devaluations Are an Undeclared War

VIDEO : DailyFX - Technical Analysis : Which Has More to Lose/Gain Between Dollar and SPX?

CoinNews - US Mint 2016 24K Gold Coins to Celebrate 1916 Designs

02/05/2015 - Bullion News

McKinsey & Company - Debt and (Not Much) Deleveraging - Seven years after the bursting of a global credit bubble resulted in the worst financial crisis since the Great Depression, debt continues to grow.

Zero Hedge - Dollar Tumbles On Sudden Stop Hunt

Gold-Eagle - Gold-Silver: Long-Term Relationship Challenged

MoneyNews - Buffett Says Tough for Fed to Lift Rates Given Strong Dollar

TECHNICAL ANALYSIS : Market Anthropology - Traders: Sell Stocks & Bonds - Buy Gold & Silver

The Diplomat - Kazakhstan and the Emerging Market Gold Rush - Astana, Moscow and Beijing are among those buying gold in reaction to a thriving dollar.

Hussman Funds - Market Action Suggests Abrupt Slowing in Global Economic Activity

The Gateway Pundit - Gallup CEO: Number of Full-Time Jobs as Percent of Population Is Lowest It’s Ever Been

Bullion Star - Belgium Denies To Repatriate Gold From The UK

Zero Hedge - Spot The Gold One Out

Perth Mint Blog - China To Support Silver Market In 2015

Bloomberg - Gold Imports by India Said to Surge This Year as Curbs Scrapped

Sun Sentinel (Florida) - Four precious metal businesses banned from trading

CoinNews - Perth Mint Bullion Sales Mixed in January

Market Watch - Chinese herdsman stumbles onto a 17-pound gold nugget

02/04/2015 - Bullion News

Alhambra Investment Partners - The Hard Work Of Strong Dollars

The Gold Report - What the Aden Sisters Are Watching Before Jumping Back into Natural Resources

TECHNICAL ANALYSIS : CME Group - Oil-Gold Ratio: Dial Down Deflation Concerns

GOLD NANO-PARTICLES : Health Canal - Gold nanoparticles show promise for next generation anti-arthritic drugs

AUDIO : McAlvany Weekly Commentary - Fed: “Let’s Penalize Unspent Cash”

VIDEO : Wall Street Pit - Fed Would Be Crazy to Raise Rates Now

VIDEO : CEO.CA - This hedge fund heavyweight could be holding US$6 billion in gold

CHARTS : dshort - Market Valuation Overview: Lofty, But a Bit Lower Than Last Month

TECHNICAL ANALYSIS : SOLARCYCLES - The Old Rules

Zero Hedge - Bulls Beware: Dennis Gartman Just Flip-Flopped To Bullish... Again

02/03/2015 - Bullion News

Zero Hedge - Rates Don't Matter - Liquidity Matters

My Budget 360 - The largest bracket of tax payers in the United States is made up by those making $15,000 a year or less

Economic Policy Journal - US Government Interest Costs are Poised to Surpass Defense and Non-Defense Discretionary Spending

GoldReporter.de - Why gold will win the currency war! - Google Translation Link

Sovereign Man - Three Slides That Will Challenge Everything You Think About Investing

TECHNICAL ANALYSIS : Kimble Charting - Dollar & Euro ripe for reversals due to this

CNBC - 'Currency war' to be 'lose-lose' game: Strategist

Daily Reckoning - Lies, Damned Lies, and Central Bank Forecasts - by James Rickards

PIMCO - New Neutrals, Fat Tails and Distorted Markets

Deviant Investor - Exponential Explosions in Debt, the S&P, Crude Oil, Silver and Consumer Prices

GoldBroker - Five Reasons to Buy Gold and Silver in 2015

Resource Investor - No Transparency in New Gold Fix

AUDIO : Midas Letter - Interview with Rick Rule

Bullion Baron - Reserve Bank of Australia & The Missing Bar Numbers

02/02/2015 - Bullion News

Alhambra Investment Partners - Less Than Zero

Daily Reckoning - James Rickards : Nine Years on, People Forget How Nasty a Rate Increase Can Be

NFTRH - Gold & US Banks; a Critical Juncture

TECHNICAL ANALYSIS : King One Eye - Important Charts of Silver and Gold

CoinNews - US Mint Bullion Coins Rally in January Sales

VIDEO : CNBC - Rick Santelli & Charles Biderman Discuss the 'No-Growth' Economy

The Gold Report - Contrarian Economist John Mauldin: How to Position Your Portfolio to Win in the Currency Wars

Market Watch - ICE Benchmark Administration to Administer the LBMA Gold Price from March 2015; LBMA Gold Price to replace the London Gold Fix

Bloomberg - Chinese Banks in Talks to Take Part in Gold Fix Replacement

Rick Ackerman - Fed Managing Expectations of Only the Gullible

Zero Hedge - That Feeling That Something Dramatic Is About To Happen

VIDEO : CNBC - Venezuela's Debt Crisis : A View of What Happens When the Government Attempts To Take Total Control of Your LIFE

Perth Mint Blog - Are Analysts Overly Pessimistic About Gold And Silver in 2015?

INFO~GRAPHIC : Visual Capitalist - With Investing, Little Things Make a Big Difference

AUDIO : GoldSeekRadio - Interview with Steve Forbes

02/01/2015 - Bullion News

Gold-Eagle - A Look At Gold And Silver For 2015 And Beyond

PDF : Wizzen Trading - Technical Analysis : Beautiful Gold Action

Bullion Star - GFMS Reports Chinese Gold Trade Volume Incorrect By 100%

Economic Policy Journal - Becoming Professionally Estranged: From Samuelson to Friedman to Mises and Rothbard

Daily Reckoning - How Capitalism Dies

GOLD NANO-PARTICLES : Future Medicine - Laser-Induced Explosion of Gold Nano-Particles: Potential Role for Nano-PhotoThermolysis of Cancer

Bullion Star - Federal Reserve New York Gold Withdrawal Numbers 2014 Don’t Match Dutch-German Repatriation Claims

Project Syndicate - Nouriel Roubini : An Unconventional Truth

AUDIO : Financial Sense - Jim Puplva’s Big Picture: The Risk of a Rising U.S. Dollar

E-piphany - Crazy Spot Curves – Orderly Forwards

AUDIO : Peak Prosperity - Nomi Prins: The Sinister Evolution Of Our Modern Banking System

Gold-Eagle - Red Gold Called Copper…The ‘Dark Horse’ Among Precious Metals

Global Financial Intelligence - Mexico 2014: Demand Fell Ounces of Silver - Google Translation Link

01/31/2015 - Bullion News

TECHNICAL ANALYSIS : The Daily Gold - Impending US$ Peak Should be Catalyst for Gold

Monetary Metals - Monetary Metals Brief 2015 by Keith Weiner

CoinWorld - Royal Canadian Mint releases Hawk and Cougar bullion coins

Gold Chat - Repatriation Update

Sprott Thoughts - Jayant Bhandari: Don’t Expect India’s Gold Imports to Surge on Tariff Cuts

VIDEO : Bloomberg - Margin Debt Levels: A Good Market Indicator?

Sputnik - China Passes US to Become World's Top Foreign Investment Destination

The New York Times - The Dangerous State of Americans’ Savings

MyWebTimes - Treasure in Pocket Change

Wealth Daily - Where to Find Yield - The Fed Has Made it Tough

The Telegraph - What was the SS Central America - or 'Ship of Gold' - and why did it sink?

NBC29 - VA Senate Panel OKs Tax Break for Bullion Buyers

01/30/2015 - Bullion News

Cayman Financial Review - Gold and Silver are Alternative Assets

Forbes - When Even the Fed Is Confused About Gold, We Still Have Some Work To Do

GoldReporter.de - Silver Trading: CME Group requires greater security - Google Translation Link

TECHNICAL ANALYSIS : Nifty Charts - SILVER Support and Resistance levels

GoldSilverWorlds - Gold: COT Report Flashes Yellow Flag

NANO-PARTICLES : City of Hope - Destroying Brain Tumors with Nano-Particles

Economic Policy Journal - Disability Trust Fund Will Run Out of Money By the End of 2016

Zero Hedge - Janet Yellen Now Advises Democrats What The Fed's Monetary Policy Plans Are

Bloomberg - Bullard Warns of Asset Bubble Risk If Fed Keeps Rates Too Low

Zero Hedge - What Happens When The Markets Realize This...?

Bullion Star - BOOM: SGE Withdrawals Week 3, 2015: 71 tonnes!

Reuters - CME Raises Margins for Platinum

CoinWeek - The Coin Analyst: Collectors Crying Over Milk-Spotted American Silver Eagles

VIDEO : Stack Smart - Silver Stacking for beginners - 4 tests to check if a silver coin is a FAKE!

01/29/2015 - Bullion News

CHART : McClellan Financial - Dollar Is Wandering Off Track

TECHNICAL ANALYSIS : Kimble Charting - U.S. Dollar Towers Above its 200 Day Moving Average

TECHNICAL ANALYSIS : GoldSilverWorlds - Gold Price Pulls Back And Tests 200 Day MA

VIDEO : RT - Sprott's Rick Rule on Natural Resources

Bloomberg - Gold Caps for Biggest Drop Since 2013 as Silver Plummets

MineWeb - U.S. 10 month Gold Mine Output Falls 7% y/y

RADIO-WAVE THERAPY & NANO-PARTICLES : Nature India - Graphene Tames Drug-Defying Blood Cancer Cells

CHARTS : Advisor Perspectives - Forecasting Q4 GDP: A Look at the WSJ Economists' Collective Crystal Ball by Doug Short

VIDEO : Bloomberg - Fed Must Change Rate Hike Rhetoric Soon: Ellen Zentner

VIDEO : CNBC - David Stockman: Fed Made Up of 'Cowards'

VIDEO : Kitco - Currency Wars: “I Am very Worried” – Jim Wyckoff

The Blaze - When ‘Quantitative Easing’ Causes Uneasiness

CATO Institute - Pentagon Spending and Bureaucratic Bloat

Market Update - Russia in 2014 was the largest buyer of gold - Google Translation Link

CoinNews - NASA Space-Flown Gold Sells for $1,373 Per Oz

01/28/2015 - Bullion News

Economic Policy Journal - 'Two Percent Inflation' and The Fed's Current Mandate

The Globe and Mail - Invest like a legend: Seymour Schulich - Co-Founder of Franco-Nevada

TECHNICAL ANALYSIS : Action Forex - XAU/USD Increase Limited By Resistance At 1,290

VIDEO : Cambridge House - Rick Rule : Gold is in a War with the US $Dollar

Marc to Market - Too Quick to Exaggerate SWIFT Data - The use of the yuan surpassed the Australian and Canadian dollar to move into fifth place, but the yuan's share is only 2.17% of global payments by value.

Reuters - Palladium to outperform in 2015 as platinum deepens losses: Reuters poll

CHARTS : StreetTalkLive - The Market is Currently a "Bug in Search of a Windshield"

Bullion Vault - Gold Manipulation? 'No Sign, Case Closed,' Says Germany's BaFin

VIDEO : CNBC - Will the Fed drive gold higher?

TECHNICAL ANALYSIS : SOLARCYCLES - Charts Updates

Market Watch - Why negative bond yields are good news for gold

Zero Hedge - Jeff Gundlach Warns "The Fed Is About To Make A Big Mistake" (& That's Why Bond Yields Are Crashing)

Bullion Star - The Keys to the Gold Vaults at the New York Fed – Part 1

Bullion Star - The Keys to the Gold Vaults at the New York Fed – Part 2

AUDIO : GoldSeek Radio - Interview with Commodities Guru - Jim Rogers

01/27/2015 - Bullion News

U.S. Global Investors - There’s More to the Gold Rally Than European Market Fears.

King One Eye - Don't Panic! Today's Must-See Charts on Earnings -- And How to Save Your Sorry Hide

Bloomberg - Stronger Dollar Punishes U.S. Earnings From P&G to DuPont

Numismatic News - New Tactic Used To Combat Fake ENGELHARD Bars

VIDEO : Smart Stack - Technical Analysis : Silver Price Analysis 27/012015 - Brilliant Brittanias - Golden Greeks

Market Realist - Why You Should Own Gold: The Diversification Angle

Dollar Collapse - This Is What It Means To Lose A Currency War

Mauldin Economics - Income Inequality? American Savers Treated Like Dogs

CHARTS : The New York Times - The Shrinking American Middle Class

The Mess That Greenspan Made - The Increasingly Unequal States of America

INFO~GRAPHIC : Visual Capitalist - The Cost of Living Around the World

SRSrocco Report - U.S. GOLD EXPORTS TO HONG KONG & CHINA : Doubled In October

Bullion Star - Netherlands Did Not Increase Gold Holdings In December

The Bullion Desk - Thailand to launch physical gold exchange

Profit Confidential - Two Factors to Continue Pushing Gold Prices Higher in 2015

01/26/2015 - Bullion News

CoinNews - Gold Slips, Jan 2015 Silver Eagle Sales Top Jan 2014

TECHNICAL ANALYSIS : Nifty Charts - GOLD Trend update

TECHNICAL ANALYSIS : Edge Trader Plus - Gold And Silver – Around The FX World In Charts

Market Realist - Why Gold Out-Performed Other Assets Recently

The Hindu - Swiss Bullion Exports to India Nearly Treble

TECHNICAL ANALYSIS : GoldSilverWorlds - Why Gold Is Set To Move Higher

GOLD NANO-PARTICLES : Korea IT Times - Attracting Cancer Cells by Using Innocuous Gold or Silver Nano-Particles

GOLD NANO-PARTICLES : PHYS.org - Nano scale research could yield better ways to identify and track malignant cells

TECHNICAL ANALYSIS : CEO.CA - Gold in Euro Terms Set for Correction

CHART : King One Eye - Today's Must-See Chart #1: King Dollar

TECHNICAL ANALYSIS : Acting Man - Gold at an Interesting Juncture

CHART : The Mess That Greenspan Made - The Fed’s “smooth, fully anticipated, glide path towards a June lift off” now in doubt

Bloomberg - CME Starts Gold Futures in Hong Kong in Price-Benchmark Race

Coin Update - New Effigy of Queen Elizabeth II To Be Unveiled March 2nd

Affiliate Ad

01/25/2015 - Bullion News

Cyprus Mail - Oil, Gold and Debt

PDF : Wizzen Trading - And Just Like That, It All Changed

The Guardian - Devaluation and discord as the world’s currencies quietly go to war

VIDEO : StackSmart - Technical Analysis : Surging silver - Cracking Kilo Kooks

Gold-Eagle - Grandmaster Putin’s Gold Trap: Russia Is Selling Oil And Gas In Exchange For Physical Gold

AUDIO : Peak Prosperity - Axel Merk: Why Asset Prices Must Return To Lower Levels

VIDEO : Zero Hedge - "This Is A Race To The Bottom Where No Fiat Currency Wins"

The New York Times - The Strong Dollar Is Always Good, Except When It Isn’t

Bloomberg - America's Losing the Currency War

VIDEO : BNN - Marc Faber : Feckless Central Banks to Underpin Gold

TECHNICAL ANALYSIS : Juggling Dynamite - Copper Cracks

VIDEO : Bloomberg - Bill Gates: QE Helps Debtors at Savers' Expense

01/24/2015 - Bullion News

CoinNews - Gold Advances on Week; US Mint Bullion Coin Sales Slower

TECHNICAL ANALYSIS : The Daily Gold - Gold Maintains Strength while Large Miners Reach Resistance

TECHNICAL ANALYSIS : Inside Futures - Where Are Silver Prices Going

VIDEO : The Wall Street Journal - Zulauf says the Federal Reserve will not increase interest rates, and the bond rally will continue.

The Telegraph - Mark Carney warns of liquidity storm as global currency system turns upside down

Acting Man - Mainstream Financial Press Promotes Economic Illiteracy

Contra Corner - Meet Bloomberg’s Latest Idiot: Shobhana Chandra On Why Falling Prices Cause Hungry People To Starve

GoldSeek - COT Gold, Silver and US Dollar Index Report - January 23, 2015