Silver and Gold are Turning Up

in their short-term trade

Precious Metals Review and Outlook from

10/02 thru 10/13/2017

Originally Posted on 10/09/2017 @11:47 am

by Steven Warrenfeltz

Subscribe to this Blog

Hello,

Thank you for visiting the Free-Bullion-Investment-Guide's latest blog post, before we get to the precious metals review and outlook, below are some of last week's Best Bullion Market-Related News articles that were taken from this guide's home page.

The Tale of Two America's...Urban Rise, Rural Demise, Rationale to Hyper-Monetize - Econimica

Inflation and Deflation - The Federal Reserve's Great Dilemma - Viable Opposition

Palladium: The Year's Top Performer so far - International Banker

Decades Of Economic Perspective Hold Great Value - Advancing Time

Why you should add some glitter of gold to your portfolio now - Economic Times

10/05: STUNNING U.S. GOVERNMENT DEBT INCREASE IN PAST FEW DAYS…. While No One Noticed - SRSrocco Report

Best of the Week for Gold NanoParticle Cancer Research

GOLD NANOPARTICLE ~ CANCER RESEARCH: Is a cure for cancer in sight? - TheBlankpage

GOLD NANOPARTICLE RESEARCH : CRISPR-Gold fixes Duchenne muscular dystrophy mutation in mice - Berkeley News

Before we move on to this week's review and outlook, I want to address a small factor in silver and gold's trade that I've written about in the past, but haven't mentioned much of it lately.

What I'm talking about is 'who's leading who', it is common knowledge among those who follow gold and silver that silver usually leads gold in their short-term trade.

However, this year's been different, gold has been repeatedly moved ahead of silver, mostly when it's moving up, in the short-term trade.

Although I stopped writing about the trading movement, I continued to show 'who was leading who' in the 'Title Graphic' of each blog post since May 1st.

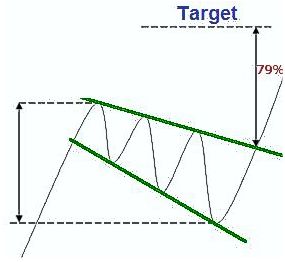

In each 'title graphic' of this blog (seen here), you'll notice that silver is leading gold to the downside and gold is leading silver to the upside, all that changed this week when silver turned up faster than gold.

The significance of this isn't quite clear at this point, but I'll let you know if anything becomes of it or if it changes.

The change in silver's trade has been represented in the graphic above.

This week's review and outlook includes Gold, Silver, U.S. Dollar, Platinum, Palladium, and Bitcoin.

All the charts on this blog are Daily Charts unless noted otherwise.

SILVER

In Review

Below is the silver outlook commentary and chart from last week.

For the week to come, in the chart below, now that silver's MACD has moved under the 'Zero-line' the indicator looks to be showing that the price should start to consolidate in the beginning of the week.

But, silver's RSI looks like it is showing that silver may still have some room to fall.

So this week we'll see some consolidation in the price of silver, then when the two bottom indicators start to agree on a bottom, we should start to see silver test the upper trend-line of its 'Falling Expanding Wedge.'

In Review - continued

As you can see in the chart below, we saw some consolidation most of the last week, then on Friday, after the dismal jobs report, silver broke the upper falling trend-line of the 'Falling Expanding Wedge' confirming the pattern.

Silver - This Week's Outlook

In the week to come, silver should continue to turn up in price, both of its lower indicators (RSI & MACD) are agreeing that this should happen.

In addition, although we may see the price rise this week, technically we'll also probably see the price of silver consolidate around the $16.95 to $17.15 level.

However, fundamentally, tensions with North Korea are back on the rise, so the price of silver (and gold) may break through its resistant levels in the week to come.

Charts provided courtesy of TradingView.com

Silver's Price Resistance &

Support Levels

Silver's Resistance Levels

$17.15

$17.00

Silver's Support Levels

$16.45

$16.15

GOLD

In Review

Below is the gold outlook from last week.

"...a 'Falling Expanding Wedge' has formed in gold's price chart, this is a positive sign for gold.

Another positive sign in the gold chart below, comes from gold's MACD and RSI, which is indicating that although the price may fall a little more, a bottom or a transition in gold's latest price movement shouldn't be too far away.

In Review - continued

In the chart below, you can see that last week the price of gold fell a little, but it mostly moved sideways.

In addition, at the end of last week, like silver, it moved up in price, but unlike silver, it still has not broken the 'Falling Expanding Wedge.'

Gold - This Week's Outlook

For the week to come, like silver, gold's MACD and RSI are both indicating that the price of gold should start to turn up at the beginning of next week.

As gold rises it will most likely start hit resistance between $1290 - $1310, so we should see some consolidation at this level.

Unless the tensions between the United States and North Korea escalates again, or some other unforeseen act happens then we may see the safe haven continually rise throughout the week. Time will tell.

Charts provided courtesy of TradingView.com

Gold's Price Resistance and

Support Levels

Gold's Resistance Levels

$1350.00

$1300.00

Gold's Support Levels

$1270.00

$1250.00

US DOLLAR

In Review

Below is the U.S. Dollar's commentary and chart from a week ago.

In the outlook chart below, a negative 'Rising Expanding Wedge' pattern has formed in the U.S. Dollar Chart.

This week, the U.S. Dollar's Candlestick price chart, MACD, and RSI are all indicating that a price pullback is in the process.

Support for the U.S. Dollar currently sits at the $92.00 level and the $92.00 level is below the bottom trend-line of the 'Rising Expanding Wedge.'

But, the 'Rising Expanding Wedge' pattern in the dollar's chart is very broad, so it's doubtful that the U.S. Dollar will confirm it this week, time will tell.

In Review - continued

In the chart below, you can see that the U.S. Dollar's pullback didn't last very long, instead, it has continued to move up, but it has done so inside the negative 'Rising Expanding Wedge' pattern.

U.S. Dollar - This Week's Outlook

For the week to come, nothing new has shown up on the chart.

The negative 'Rising Expanding Wedge' is still looming over the dollar so sometime this week we should see the price of the dollar start to retreat.

Charts provided courtesy of TradingView.com

U.S. Dollar's Price Resistance and Support Levels

U.S. Dollar's Resistance Levels

$94.00

U.S. Dollar's Support Levels

$93.00

$92.00

Platinum

In Review

Below is the outlook chart and commentary from the Platinum section in last week.

The positive 'Falling Wedge' in platinum's chart is still intact as the price of platinum has literally squeezed itself down into the bottom of it.

The MACD's pink, histogram, bar chart has started to retreat, from its short-term low, this is typically a sign that a price change is inevitable; if it already hasn't happened.

In addition, the $900 level is a strong support level for platinum, which coincidentally sits at the bottom the wedge, so this week we should see the 'Falling Wedge' pattern either be confirmed or denied,

In Review - continued

In the chart below, platinum did stop falling and broke out of the 'Falling Wedge' pattern, confirming it.

Platinum - This Week's Outlook

For the week ahead, no new pattern has taken any definitive shape in Platinum's price chart.

However, like gold and silver, its MACD and RSI (lower indicators) are showing that the price should turn up this week.

Charts provided courtesy of TradingView.com

Platinum's Price Resistance and Support Levels

Platinum's Resistance Levels

$965.00

$925.00

Platinum's Support Levels

$900.00

$890.00

Palladium

Below is the commentary and chart from last week's Palladium section.

In Review

For the week to come, Palladium's chart has formed a negative 'Rising Expanding Wedge' pattern.

Although this is a negative pattern, Palladium's MACD and RSI are giving the indication that the price may rise, this week.

So palladium's giving mixed messages, which isn't new to those who watch the palladium market, so adding these two factors together it looks like this week time will tell as to which way this market decides to move.

In Review - continued

Last week's assessment that palladium wasn't showing any clear direction in how it would move, turned out to be true.

Palladium started last week by confirming the 'Rising Expanding Wedge,' then after it fell through it, its price popped back up, only to end the week down again.

Palladium - This Week's Outlook

For the week to come, no clear patterns have formed in Palladium's chart since its erratic movements from last week.

In addition, no clear direction can be detected from Palladium bottom indicators (MACD & RSI), so we may see this week more of the same sideways movement that we saw last week. Time will tell.

Charts provided courtesy of TradingView.com

Palladium's Price Resistance and Support Levels

Palladium's Resistance Levels

$950.00

Palladium's Support Levels

$900.00

Bitcoin

In the bullion industry, you'll find some that love bitcoin and you'll find some that hate it; I'm indifferent to it.

I see it as a unit of exchange if it fails; "so be it," and if it doesn't, "ok."

However, I don't think it shouldn't be overlooked.

So as for those who follow this blog you know that since July at the end of each blog post I've been analyzing assets that relate to the precious metals market.

Bitcoin relates mostly to the precious metals as a safe haven, but to be honest, it has many similarities and it has many differences, but that's a discussion for another day, so let's take a look at the daily chart below.

In the Bitcoin chart, a negative 'Rising Wedge' pattern has formed.

Its hard to say when the pattern will play itself out, but I'll update you when it does.

Charts provided courtesy of TradingView.com

Full disclosure: I own some crypto-currencies, but I do not currently own bitcoin.

Music

On October 2nd Tom Petty passed away.

I've been a fan of Tom Petty since the mid-80's, but I never really had a favorite song because I liked them all.

Rest in Peace Tom Petty and Thank you for all the great songs.

Tom Petty and the Heart Breakers - I won't back down

The Traveling Wilbur - Handle with Care

Thank You for Your Time.

Have a Great Week.

God Bless, Steve

'Click Here' see all of the prior Blog posts,

Thank You for Your Time!

|

Investment/Information Disclaimer: All content provided by the Free-Bullion-Investment-Guide.com is for informational purposes only. The comments on this blog should not be construed in any manner whatsoever as recommendations to buy or sell any asset(s) or any other financial instrument at any time. The Free-Bullion-Investment-Guide.com is not liable for any losses, injuries, or damages from the display or use of this information. These terms and conditions of use are subject to change at anytime and without notice. |

|

Support this Guide & Paypal Thank You for Your Support |

|

|

| |||||

This website is best viewed on a desktop computer.

Keep this Guide Online

& Paypal

Thank You for

Your Support

with Feedly

Search the Guide

| search engine by freefind | advanced |

Premium Canadian Bullion

Give a lasting gift of the iconic Silver Maple Leaf bullion coin [More]

Free Shipping on Orders over $100 (CDN/USA)

or

From the U.K. Royal Mint

Daily

Newsletter

Updated Mintages for

American Gold Buffalo

American Gold Eagle

American Silver Eagle

2024 & 2025

Jerusalem of Gold Bullion

Coin photos

(bottom of page)

Mintages

for

2024

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

Last Month's

In No Particular Order

January 2026

All Articles were Originally Posted on the Homepage