October 2023

Monthly Newsletter

Hello,

I hope you and your family are doing good.

Thank you for subscribing to receive this newsletter from the Free Bullion Investment Guide.

Updates to the Guide...

Over the last month I've been trying to make some pages more easy for you to navigate.

For instance, updates have been made to the "bullion coin sections" on all the government mint/bullion coin pages.

You can see what I mean by viewing the following pages:

- U.S. Bullion (Here's a comparison link to see how U.S. Bullion page used to look like)

- Canadian Bullion

- Mexican Bullion

- Australian Bullion

- U.K. Bullion

- Austrian Bullion

- Chinese Bullion

- Russian Bullion

- South African Bullion

- Israel Bullion

The sitemap on the Free Bullion Investment Guide has also been updated with smaller font sizes to make it easier to navigate.

The World Bullion Buying Guide

page has also been re-edited and update, and I'll be working on the

other buying guides during the next several weeks to bring them more

up-to-date.

My Take on the Markets

For the last newsletters,

I've been saying Gold and Silver's trading is "Range Bound," Gold's

price has been stuck trading between $2080.00 - $1885.00, and Silver's

been stuck between $26.00 - $22.00 price levels.

But

now that the lows in both precious metals have been broken by traders

selling their precious metals holding for liquidity to cover where they

are loosing their ass(ets) in other investments, we may see both

precious metals make lower lows as this process continues.

It's

a little known fact that risk-on / speculating investors regularly park

a portion of their money in gold and silver, so when times get tough in

the broader markets, precious metals see short-term extreme drops in

price when speculators run for where they know they have money stashed

for that rainy day.

I think there will be more rainy days to come, like we saw during gold's recent fall in price from $1925 to $1825.

The Fed's attempts to restrain inflation by raising the Federal Funds

rate higher than the inflation rate is not working because the Biden

Administration continues to cause the cost of energy to rise, which

totally defeats the purpose of raising Federal Funds rate.

But now we

have interest rates rising across the bond markets, which is pulling

more liquidity out of the market. The combination of these factors is

over taxing everyday person through higher energy prices and investors

through higher bond prices.

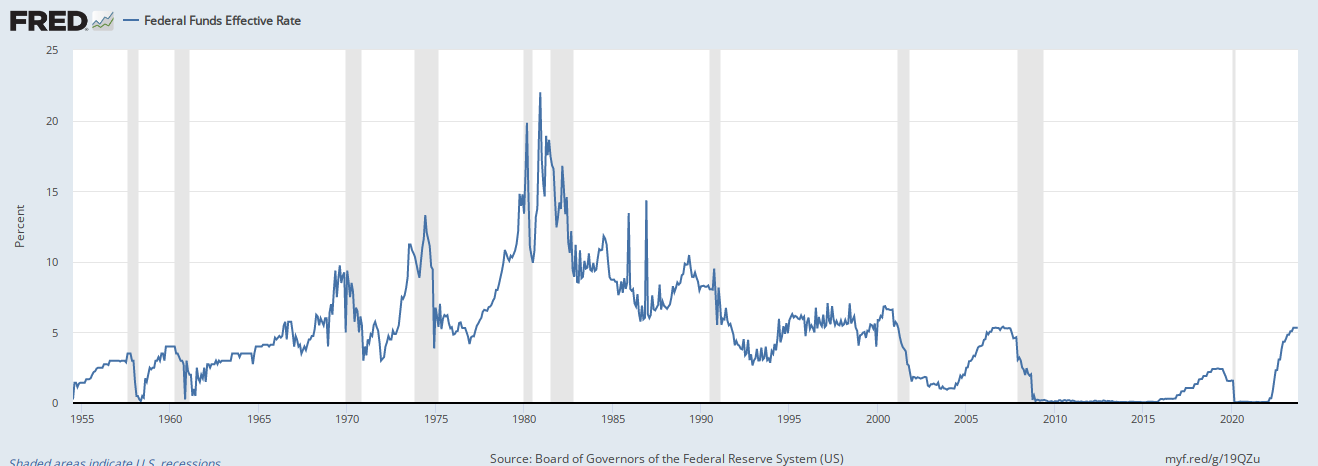

You can see what has happened whenever the Federal Funds Rate has been

too high for too long on the American People, a Recession (shaded

areas).

It won't matter what the labor department

reports on the job market; recession is likely to happen over the next

few months, and when the initial drop in the markets occurs, precious

metals will suffer too in the short-term.

It

is for this reason why I think we may see gold and silver hitting lower

prices; posted in the Gold and Silver Charts (below), I've indicated

where their Support and Resistance levels currently sit according to my

analysis.

Sign up for this newsletter (here) to see original chart at size 857x490

Affiliate Specials

Deals & Specials from

Apples of Gold - 10% OFF for the MILITARY - USE DISCOUNT CODE: "MILITARY ONLY" at CheckOut

Express Gold Cash - Cash for Precious Metals/Jewelry

Survival Frog - Survival Equipment

The Royal Mint (United Kingdom)

TradingView - Interactive Investment Charts

One Last Thing...

No matter what age you are, no matter where you are in life, the best thing you can do is get your heart and soul right with God = Jesus Christ, the son of God.

God, the Father, gave all authority to his son, Jesus Christ, after his resurrection from the dead.

Jesus died on the cross to save mankind

from sin and rose from the dead to save mankind from eternal death by

giving all those who believe in him eternal life. For God so Loved the World that he gave his one and only Son, that

whoever believes in him shall not perish but have eternal life. John 3:16

We all know that this life will not last forever, Jesus defeated death to give you eternal life all

you have to do is believe to receive this awesome gift. Learn about

Jesus Christ and how he died and defeated eternal death through his

resurrection so that you too can have eternal life - here.

Jesus answered, "I am the way and the truth and the life. No one comes to the Father [God] except through me. John 14:6

Until next month, Thank you for your time and for your support.

Take Care & God Bless,

Steven Warrenfeltz

www.free-bullion-investment-guide.com

For Bullion Market News...

Visit the Homepage

Notice:

The charts, commentary, and information on the Free-Bullion-Investment-Guide.com are in no way an endorsement of how you should invest or divest.

|

Support this Guide & Paypal Thank You for Your Support |

|

|

| |||||

This website is best viewed on a desktop computer.

Keep this Guide Online

& Paypal

Thank You for

Your Support

with Feedly

Search the Guide

| search engine by freefind | advanced |

Premium Canadian Bullion

Give a lasting gift of the iconic Silver Maple Leaf bullion coin [More]

Free Shipping on Orders over $100 (CDN/USA)

or

From the U.K. Royal Mint

Daily

Newsletter

Updated Mintages for

American Gold Buffalo

American Gold Eagle

American Silver Eagle

2024 & 2025

Jerusalem of Gold Bullion

Coin photos

(bottom of page)

Mintages

for

2024

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

Last Month's

In No Particular Order

January 2026

All Articles were Originally Posted on the Homepage