Mixed Signals

are in the

Gold and Silver Markets

Originally Posted on 12/04/2016 @2:09pm

by Steven Warrenfeltz

Before I get into the subject of this week’s post, I wanted to share with you something that happened to this me, last week.

Last week's blog post was titled ‘Trump’s QE,’ in it I discussed why the Trump rally is based on expectations and words, and not much else.

For the last month or so, I’ve been sharing my blog post’s with some 'like-minded' forums.

Last week, I stepped out of my norm, and I shared ‘Trump’s QE’ with a stock-market forum I've visited in the past.

To say they didn’t like it would be an understatement, in fact, they didn’t like it so much; they banned me from the forum. To be honest, I expected a harsh reaction to the post, but I expected to debate the subject matter, I didn’t expect to get banned.

Their response to my post didn’t bother me, I just opened a new account in that forum, and I’ve been questioning their thought processes ever since.

So far, I've found out that my past assessments of market traders haven't been that far off the mark – which is why they hated my post last week.

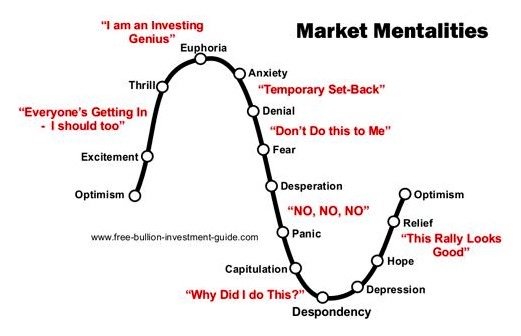

From just the past week of

daily interactions on different stock forums, I can tell you that we’ve reached

the ‘Euphoria’ mark in the chart of 'Herd' Market Mentalities, and I'm also starting to sense some hints of Anxiety.

Mixed Signals

This week, there are positive and negative technical patterns showing up in the charts.

However, there are also economic factors that'll be in the news that trumps (no pun intended) what the technical indicators are showing.

|

Economic Factor #1 - On Sunday, December 4th, Italians will go to the polls to vote on Prime Minister Renzi’s Referendum to give him more control over the government. The polls currently show that it will be a 'No' vote, if this is the way Italians vote, it won’t be good for Italian banks or the Euro. When the Euro falls, so does gold and silver, because it gives strength to the U.S. Dollar. This InfoGraphic from SAXO Group can also help you to understand the implications of an NO vote. |

|

Economic Factor #2 - On Thursday, December 8th, the European Central Bank will be meeting to announce whether or not they will continue their bond buying program past March 2017. If they say that they will continue to purchase bonds past March, it will hurt the Euro, but if they state that it will stop in March, then it will help the Euro, gold, and silver. |

|

Economic Factor #3 - The other item looming on the horizon is the Federal Reserve’s meeting on December 14. But until the meeting occurs and the Federal Reserve gives their announcement along with their outlook, it will continue to hold down the prices of gold and silver. |

In the charts below, I give minimal analysis because the economic factors described above could swing the prices of the assets below from the directions that their technical patterns indicate.

GOLD

In the Gold chart this week I’ve outlined an expanding wedge.

But, to give credit where credit is due, I first saw this pattern in this article from the Street.com, it was the top post on this guide’s 'homepage news' on Nov. 29th.

The Street- Why Gold's Lost Sheen Should Be Temporary

Charts provided courtesy of TradingView.com

Gold's Price Resistance &

Support Levels

Gold's Resistance Level

$1225.00

$1200.00

$1180.00

Gold's Support Levels

$1150.00

$1125.00

$1100.00

SILVER

Like gold, silver is also showing an expanding wedge in its chart, but it is also showing an inverse head and shoulders in its charts. Both are bullish signals.

Charts provided courtesy of TradingView.com

Silver's Price Resistance and

Support Levels

Silver's Resistance Level

$17.25

$17.10

$16.85

Silver's Support Level

$16.15

$15.90

$15.65

US DOLLAR

For the last month, the U.S. dollar has been on a tear, after the election it broke its long-term resistance level of $101.00.

It has now created a head and shoulders top, which is a bearish indicator, but if the news this week goes against the euro, it may not matter. Time will tell.

Charts provided courtesy of TradingView.com

U.S. Dollar's Price Resistance and Support Levels

U.S. Dollar's Resistance Level

$102.00

$101.00

U.S. Dollar's Support Level

$100.20

$99.75

Music

While I was writing this post, I listened to an acoustic station on the free side of PANDORA.

Before yesterday, I’ve never heard of this artist or the song, but I found a live performance of the song I heard; he’s a talented musician named Eliot Bronson and the song’s title is 'You Wouldn't Want Me If You Had Me.'

I’ve looked up his other songs, and I'm surprised he doesn’t have a bigger name.

Here’s a playlist of his I found; Eliot Bronson Playlist (link updated)

Note: this website is not affiliated with Pandora.

Thank You for Visiting the Free Bullion Investment Guide

This

Guide Gives a Portion of Every Sale to St. Jude Children's Research

Hospital, Please Help Us Give to those who are Battling Cancer

by Supporting our Affiliates

(Every Advertisement on the Guide is from one of our Affiliates)

'Click Here' see all of the prior Blog posts,

Thank You for Your Time!

|

Support this Guide & Paypal Thank You for Your Support |

|

|

| |||||

This website is best viewed on a desktop computer.

Keep this Guide Online

& Paypal

Thank You for

Your Support

with Feedly

Search the Guide

| search engine by freefind | advanced |

Premium Canadian Bullion

Give a lasting gift of the iconic Silver Maple Leaf bullion coin [More]

Free Shipping on Orders over $100 (CDN/USA)

or

From the U.K. Royal Mint

Daily

Newsletter

Updated Mintages for

American Gold Buffalo

American Gold Eagle

American Silver Eagle

2024 & 2025

Jerusalem of Gold Bullion

Coin photos

(bottom of page)

Mintages

for

2024

Gold & Silver Mexican Libertad

|

Gold Libertads |

Chinese Gold Coin Group Co.

& Chinese Bullion

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

Last Month's

In No Particular Order

January 2026

All Articles were Originally Posted on the Homepage