Homepage / Bullion Security : Vault Storage Brokers

Updated on 03/02/2024

Vault Storage Brokerages

of Gold, Silver, and Platinum

Vault Storage Brokerages work much in the same way a stock brokerage does.

Stock brokerages offer you stocks to buy; when you buy them, the brokerage stores those stocks in your personal segregated account, and when you want to trade or sell those stocks, you use their system to do what you want, with minimal overhead costs

The one difference is that with all stock brokerages, getting a physical stock certificate doesn't happen anymore because stock brokerages have turned to digital record-keeping.

Whereas getting the physical bullion from a vault storage broker is commonplace and, in many cases, expected.

Vault Storage Brokerages trade digital precious metals; you make trades like the professionals on the COMEX into wholesale LBMA Gold and Silver Good Delivery Bars.

Low Cost Precious Metals

Low in Cost, in regards to buying precious metals with low premiums.

In most cases, when you buy precious metals on the secondary market, there are premiums added to the intrinsic value of the metal.

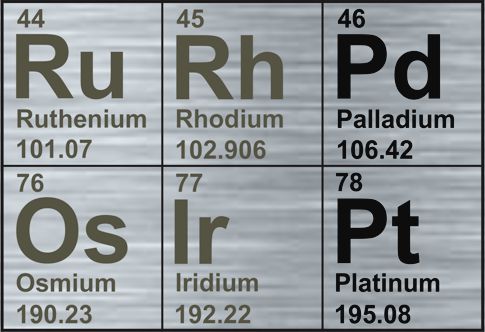

Vault Storage Brokerages trade in LBMA 400 troy oz. "Good Delivery" gold bars, 1,000 troy oz. Silver bars, and kilogram Platinum bars.

When a person trades with a Vault Storage Brokerage and places an order to buy, depending on the order, they are buying either a fractional part of a Good Delivery Bar or a full bar.

The fact that these brokerages trade in large wholesale bars is what allows their customers to buy any amount of gold, silver, or platinum at professional market prices.

What to Know

This page will review two of the Top Vault Storage Brokerages based on their customer reviews while helping you understand common terms used in this industry.

|

|

Minimum to Start an Account

|

Free to Open Account

Read Bullion Vault's page about how to "Get Started" in opening an account here. |

|

Free to Open Account

Read OneGold's page about "How it Works" here. |

Segregated, Allocated Accounts

When you make your first purchase of precious metal from one of these brokerages, the amount of the metal you purchase no longer appears on the brokerages' balance sheet.

When you open an account with a Vault Storage Brokerage, you are setting up a contract or custody arrangement that creates a segregated, allocated account of gold, silver, and platinum.

Vault storage companies act as custodians of your bullion. When a person opens an account with a company that trades and stores bullion, they are in a "Bailment" Agreement.

A Bailment is a legal relationship between two entities involving tangible assets, in this case, the person who buys the bullion and the vault storage brokerage.

The Vault Storage Brokerage is the custodian or "bailee," and the person who buys and owns the bullion is known as the "bailor."

The bullion is not part of the company's balance sheet because it is not their property; it is now in the buyer's name, and the brokerage is storing it for them.

Even in the case of the bankruptcy of the "Bailee's," creditors cannot claim your bullion as theirs because of the Bailment Agreement.

International Storage

International Storage Advantages:

- Global Diversification of Assets

- Insurance companies rate international gold vaults as the most secure locations on earth.

- Reduce the risk that you have at home (crime or natural disasters).

- Keeping assets in a country politically and socially stable

- Keeping assets in countries that have favorable personal property laws (Switzerland, Singapore, Cayman Islands)

- Keeping assets in countries that don't have a history of confiscation

- Keeping assets in countries that haven't had issues with internal government turmoil

|

Fully Segregated / Allocated Accounts in Zurich, CH London, U.K. Singapore New York, U.S.A. Read Bullion Vault's written explanation about their Allocation of Bullion here. |

|

In U.S., U.K. & Switzerland Fully Segregated / Allocated Accounts for Gold, Silver, and Platinum Canada

- Royal Canadian Mint

Fully Segregated / Allocated Accounts for Silver Canada - Royal Canadian Mint Pooled Un-Allocated Accounts for Gold Read OneGold's page about Allocated Accounts here. |

Vault Storage

Facilities & Auditing

Storage Facilities

The Bullion Vault and OneGold use security facilities that are under the respected VIA MAT INTERNATIONAL, part of Mat Securitas Express AG of Switzerland, one of Europe's largest and oldest armored transport and storage companies.

|

Bullion Vault uses the following independent professional Vault Storage operators and LBMA security transport companies. Read Bullion Vault's page about their bullion storage here. |

|

OneGold uses these independent professional Vault Storage operators and LBMA security transport companies. Read OneGold's page about their bullion storage here. |

Auditing

|

Everyday Bullion Vault publishes a Daily audit online, which explicitly reconciles the customer's gold, silver, and platinum. Read Bullion Vault's daily audit here. See a Video about how Bullion Vault shows their customers how to find their bullion on the daily audit here. |

|

OneGold Inventory Audit shows investors that their assets are backed by physical metal and are in one of OneGold's four storage locations.

Read more about OneGold's audit and see the uploads and other information here. |

Vault Storage

Fees

Storage Fees

|

Gold, Silver, Platinum and Palladium Monthly Storage Rates (includes insurance)

Unlike Bank Deposit Protection, your Bullion Vault insurance (included) protects you to the full value of your bullion with no cap. Bullion Vault Insurance Issuers include Malca-Amit, Chubb European Group SE, and Lloyds of London. Read Bullion Vault's Storage Fees here. |

|

Storage Fees Charged per Year Billed Quarterly (includes Lloyds of London insurance)

Storage fees are billed quarterly based on the average daily balance of your holdings multiplied by the (%) each location charges. Storage fees may vary by product and location. Minimum account level storage fee of $5 per quarter. Example: $100k holding of gold would cost $120 per year for storage. Read OneGold's page about how they calculate their Storage Fees here. Read OneGold's Storage Fee Calculator here. |

Buying and Selling

Fees

Buying Fees

Transactions....Purchases....Commission On the first.....$75,000/equivalent....0.50% On the next....$750,000/equivalent...0.10% Then...........................................0.05%

Read Bullion Vault's Buying and Selling Commission Rates here. |

Read OneGold's information about Withdrawing money through each funding source here. |

Selling Fees

Transactions....Purchases....Commission On the first....$75,000/equivalent.....0.50% On the next....$750,000/equivalent...0.10% Then...........................................0.05%

Read Bullion Vault's Buying and Selling Commission Rates here. |

Read more about OneGold's Selling process and other selling questions here. |

Cash & Physical Bullion

Withdraws

Cash Withdraws

|

Only Validated Accounts with cleared funds can withdraw cash. Validated Accounts can withdraw cash at anytime. Learn about Bullion Vault's process of Account Validation here. Withdrawals must be over $100 (USD) or other-currency equivalent. Cash Withdraw Charges where applicable

Common withdrawal fees are:

A small currency holding fee may also apply where Bullion Vault's bank charges negative interest rates. This does not currently apply. Read Bullion Vault's full page on "Getting Paid" here. |

|

OneGold states that your account does not need to be verified to withdraw cash from your account. For those who fund their account via

Credit/Debit Card, PayPal, or ACH, OneGold has some exceptions for you concerning withdraws...Read them here. Read more about OneGold's Cash Withdraws in their FAQs section here. |

Physical Bullion Withdraws

|

Only Validated Accounts can withdraw physical bullion. Learn about Bullion Vault's process of Account Validation here. Bullion Vault has three ways you can withdraw bullion. (50grams of Gold Minimum)

|

|

OneGold offers physical bullion through APMEX, a leading precious metals dealer in the United States. OneGold has two requirements to place a successful physical redemption order.

1.) Verification - Forms of Identification Required to Verify a OneGold Account:

Read more about OneGold's account verification process here. 2.)

Eligible Funds

Read more about OneGold's Physical Redemption here. |

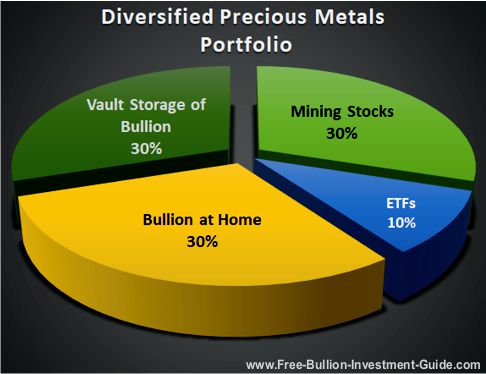

Precious Metals Portfolio

Diversification

Regardless of how much you own in precious metals in comparison to your total investment or savings portfolio, the question that many ask is:

How should I diversify my precious metals investments?

Ultimately, you know what works for you, what you can afford, and what form of precious metals works best for you.

There are several choices:

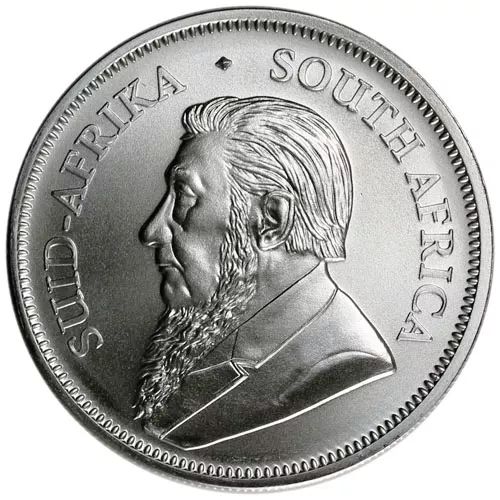

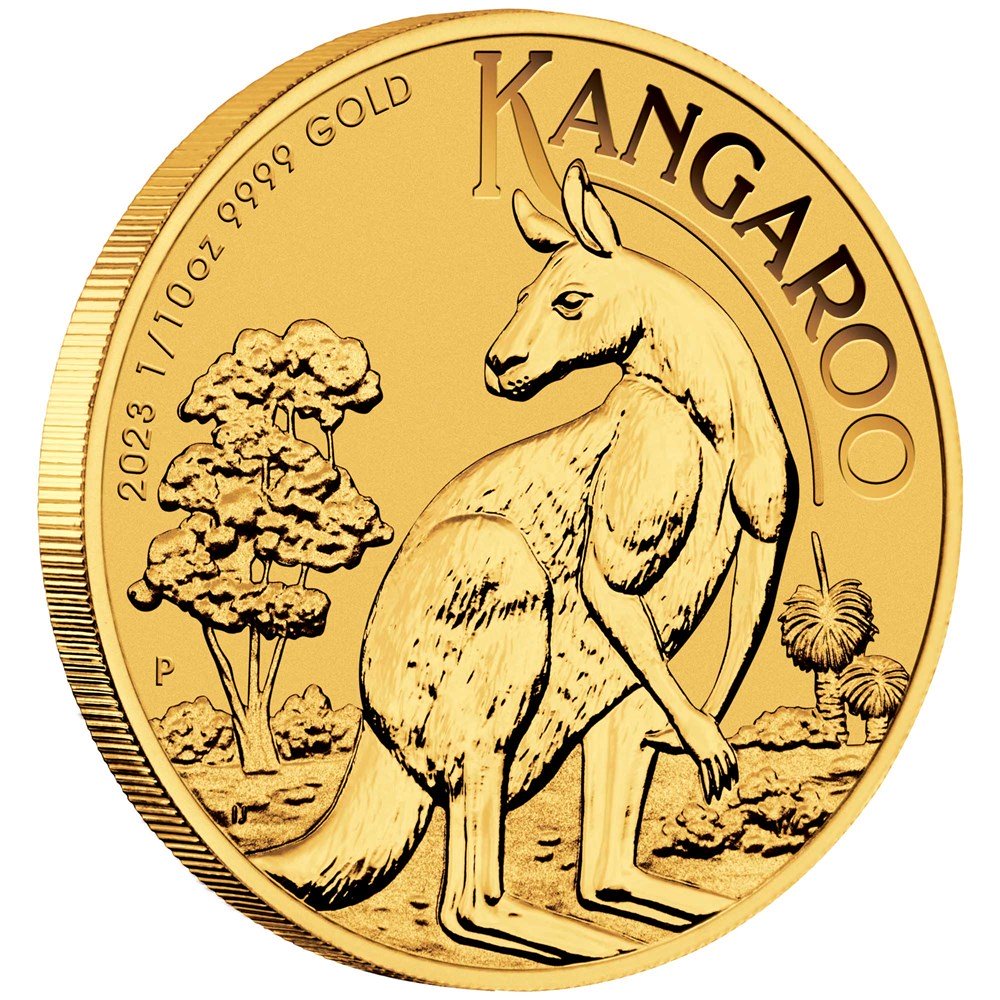

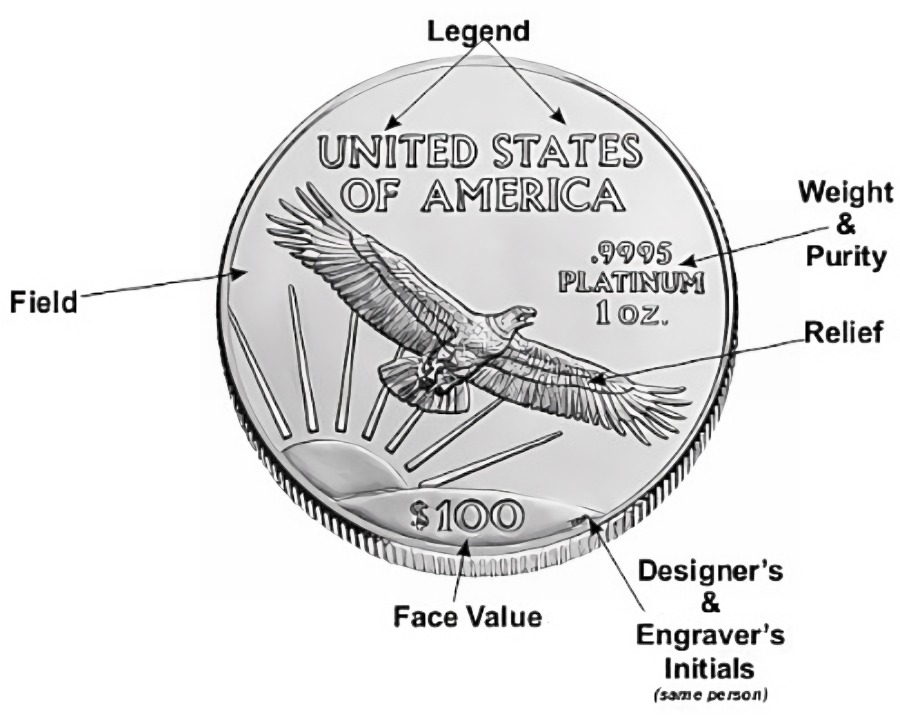

- Owning Physical Bullion at Home - ex: Coins, Bars, Rounds

- Owning Physical Bullion through a Vault Storage Bullion Company or Brokerage.

- Gold IRA

- Mining/Royalty Stocks - ex: WMP, NEM, RGLD, AG

- ETFs - e.g., GLD, SLV - metal is non-allocated and annual storage fees.

The chart below is a sample portfolio of how an individual may diversify 20% of their money in precious metals.

Other pages, on this Guide, that you

may like...

Vault Storage Brokerages

For Bullion Market News...

|

| |||||

Free Bullion Investment Guide

Search the Guide

| search engine by freefind | advanced |

Daily

Updated

Updated

Numismatic & Bullion Auctions page

3/21/2024

Updated

03/07/2024

Blog Post

Updated

Update

Update

New Page

Mintage Figures

2023

Mintage Figures

Archangel Raphael

~

The Angel of Healing

Help Us Expand our Audience by forwarding our link

www.free-bullion-investment-guide.com.

Thank You!

March's

pages

Bullion Refiner

Bullion Refiner

ExpressGoldCash - 4.9 star Customer Reviews